Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 10, 2016

Consumers services feel the January cold

Consumer spending has remained relatively downbeat, with consumer services firms coming at the bottom of the inaugural Markit US Sector PMI.

- Consumer discretionary firms reported a fall in output in the January US Sector PMI survey

- Short interest in consumer discretionary firms is up by 60% over the last year

- Retailers top the list of sector's most shorted, with Discovery and Wynn also targeted

Consumer spending represented two thirds of US GDP as of latest count and with other sectors of the economy coming unstuck by global volatility, market watchers have increasingly looked to US consumers to pick up the growth slack. But this faith in US consumers is looking increasingly misplaced, as overall consumer spending over the crucial December holiday shopping window was flat on the previous month.

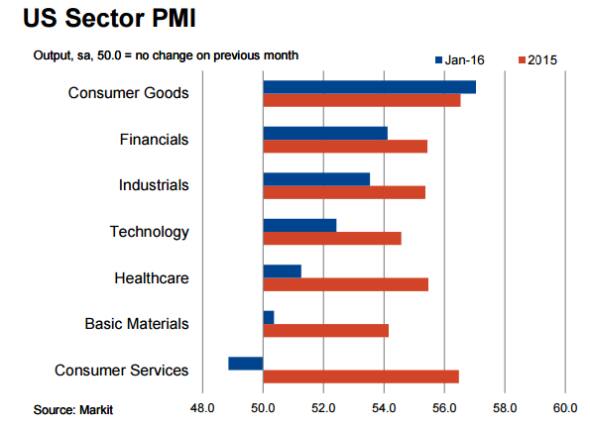

The new year has brought a further wave of negative indicators regarding the health of US consumers. Consumer services firms came in at the bottom of the pile of the newly released Markit Economics US Sector PMI. These firms had previously led all sectors in terms of output growth over last year, but momentum has faltered over the last two months and firms reported a slowdown in output over January for the first time in over two years.

In fact the consumer services sector was the only sector to see a slowdown in output over the month; putting it even behind even basic materials firms, which have been the vanguard of the recent market slowdown.

Investors shifting positions

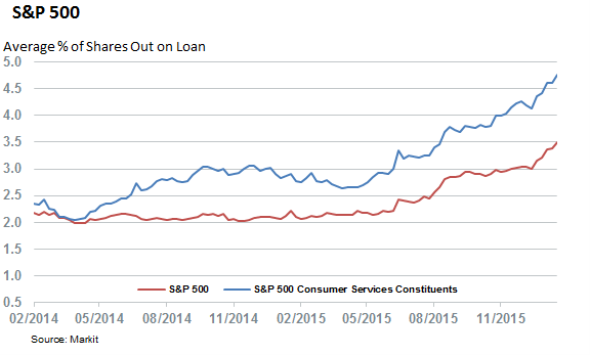

The recent weakness looks to have been seized upon by short sellers as demand to borrow consumer services' shares has increased to new highs in recent weeks. The current average demand to borrow shares in the sector has crossed the 4.5%, making it the third most shorted sector behind oil & gas and basic materials firms.

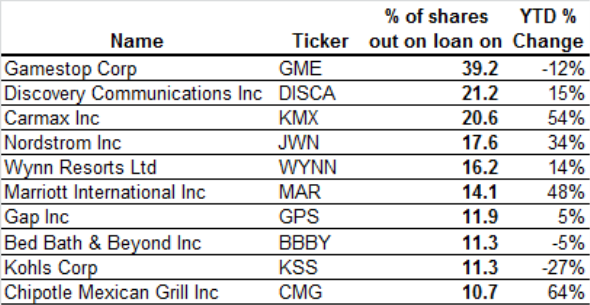

Retailers, which stand to feel the brunt of the anaemic consumer spending, have been the most targeted by short sellers as the industry makes up six of the ten most shorted S&P 500 retail constituents.

Video game retailer Gamestop comes in as the most shorted of the lot with 40% of the firm's shares now on loan as its stocks hit new multi-year lows after its earnings came in below analyst estimates.

Other retailers favoured by short sellers are Carmax, Nordstrom and Gap, all of whom see more than 12% of their shares now out on loan.

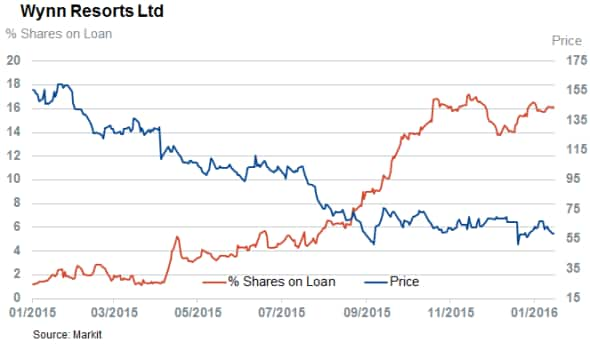

Outside of retailers, short sellers have been loading up on Discovery Communication and casino operator Wynn Resort. The latter of the two has seen short sellers circle as its shares tumbled by over 80% from their highs in 2014.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-Equities-Consumers-services-feel-the-January-cold.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-Equities-Consumers-services-feel-the-January-cold.html&text=Consumers+services+feel+the+January+cold","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-Equities-Consumers-services-feel-the-January-cold.html","enabled":true},{"name":"email","url":"?subject=Consumers services feel the January cold&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-Equities-Consumers-services-feel-the-January-cold.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Consumers+services+feel+the+January+cold http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10022016-Equities-Consumers-services-feel-the-January-cold.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}