Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 09, 2016

UK exports lift higher in October after weak third quarter

Official UK data contrast with business surveys in showing few signs of trade benefitting from the weakened sterling exchange rate, but there are perhaps some signs of the export trend improving in October. More up to date survey evidence suggest, however, that rising import costs are already starting to erode some of the benefits of a deprecating currency for exporters.

The trade deficit, including both goods and services, meanwhile narrowed more than expected in October, down to "1.971bn from "5.812bn in September, according to the Office for National Statistics, its lowest since May. The deficit in goods shrank from "13.832bn to "9.711bn. However, the big disappointment was news that goods export volumes fell by 2.1% in the three months to October, while imports rose by 4.4%. Given the steep fall in sterling, one would have expected this to be the other way round, with exports rising and imports falling.

Errors in the trade data supplied to the ONS mean that prior numbers have had to be restated significantly, once again raising question marks over how much emphasis we should place on the official trade figures.

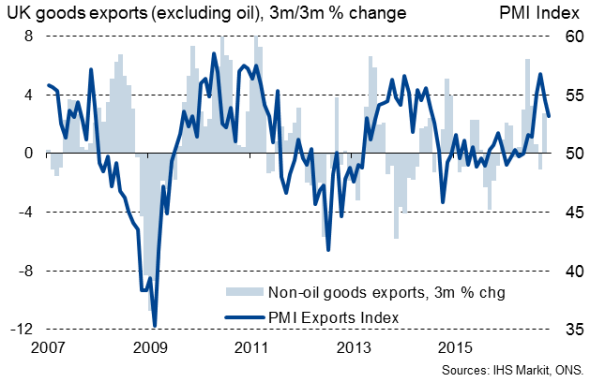

Our scepticism is raised further by the fact that the ONS trade data also sit in stark contrast to the business surveys, which seem to paint a more reasonable-looking picture of exports, given recent events. The manufacturing PMI survey has shown that goods exports have risen since the pound's dramatic fall that followed the EU referendum, with companies seeing the exchange rate as a key driver of improved export performance, alongside rising demand in key markets such as the US and continental Europe, both of which are showing signs of stronger economic growth.

The one ray of light in the official data was a "2bn (8.7%) rise in goods exports in October alone, suggesting the official data may be starting to also show signs of the weaker pound have some beneficial effect. However, the surveys also indicate that companies are already having to pass higher costs for imported components on to customers in the form of increased selling prices, therefore eroding some of the benefits of the weaker pound in terms of export competitiveness. The November PMI survey showed that export orders growth has consequently already slowed sharply from a peak in September.

UK goods exports

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-UK-exports-lift-higher-in-October-after-weak-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-UK-exports-lift-higher-in-October-after-weak-third-quarter.html&text=UK+exports+lift+higher+in+October+after+weak+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-UK-exports-lift-higher-in-October-after-weak-third-quarter.html","enabled":true},{"name":"email","url":"?subject=UK exports lift higher in October after weak third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-UK-exports-lift-higher-in-October-after-weak-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+exports+lift+higher+in+October+after+weak+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09122016-Economics-UK-exports-lift-higher-in-October-after-weak-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}