Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 09, 2014

Week Ahead Economic Overview

A vast amount of economic data are published during the week, including updates on inflation, the labour market and households' financial situations in the UK. Industrial production numbers are released across Europe and the US, with the eurozone also seeing updated inflation figures.

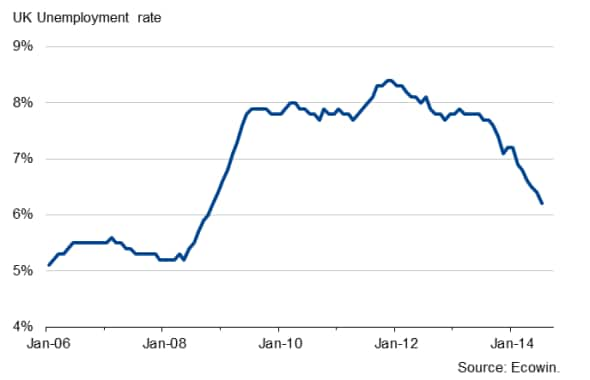

UK policymakers will be keeping their eyes keenly focused on the latest labour market update after voting to keep rates on hold in September. Recent data have been confusing, with unemployment dropping but pay growth slowing. Survey data suggest that unemployment should continue to fall from the 6.2% rate recorded for the three months to July. A jobless rate below 6% is achievable by the end of the year if anything like the current pace of job creation is sustained in coming months. However, weak pay growth remains the Achilles Heel of the economic recovery and policymakers have made it clear they want to be sure that pay growth is picking up substantially from the current record low before making the first move in tightening policy.

UK unemployment rate

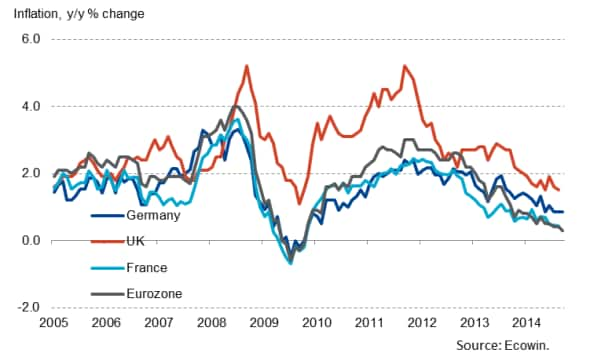

Inflation numbers will also add to the policy debate at the Bank of England. In August, consumer prices rose at 1.5%, the joint-lowest rate for five years and dropping further below the Bank's 2% target. The downturn in inflation provides policymakers with greater leeway to keep interest rates on hold for longer while the economy continues to recover. Moreover, the first insight into UK households' financial situations and consumer confidence in October will be provided by Markit's Household Finance Index.

Inflation in the UK and the eurozone

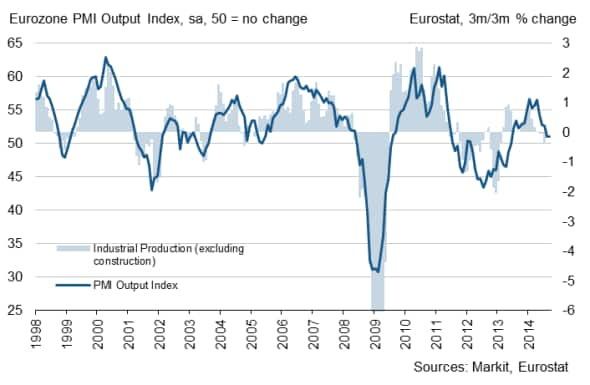

Industrial production numbers and inflation figures are meanwhile released in the eurozone. A downturn in factory output in August is expected after production increased 1.0% in July. Data for Germany have already shown industrial output falling in August at the sharpest rate since the financial crisis, adding to recession worries in the eurozone's largest economy.

Eurozone industrial production and the PMI

Official data for Spain also disappointed. Survey data suggest that the currency union's goods-producing sector has lost further momentum in September, with manufacturing downturns reported in Germany, Austria, Greece and France.

An update on consumer prices is also out for the euro area. A 'flash' estimate from Eurostat showed that consumer price inflation fell to 0.3% in September, the lowest in nearly five years. At its September meeting, the European Central Bank decided to take further steps to bolster the faltering eurozone economic recovery. The ECB is especially concerned that inflation expectations in the euro area are turning down alongside the surprising weakness of the economy so far this year.

Industrial production numbers and retail sales data are meanwhile released in the US. It's likely that the underlying production trend remains healthy, after September's PMI results showed business conditions in the US goods-producing sector continuing to improve markedly. The survey data bode well for another quarter of solid GDP growth after GDP rose at an annualised rate of 4.6% in the second quarter. Despite a surprise fall in manufacturing output in August, industrial production is running 0.5% higher so far in the third quarter compared to the second quarter, while manufacturing output is running 1.0% higher, adding to signs of further solid GDP growth in the third quarter.

US industrial production and the PMI

Monday 13 October

The UK regional PMI results and the Irish construction PMI are released by Markit.

Trade data are meanwhile out in China.

In Brazil, payroll job growth data are issued.

Tuesday 14 October

The National Australia Bank releases its business confidence survey results.

Inflation numbers are published in Spain, Italy, the UK and France, with the latter also seeing the release of current account data.

Wholesale price figures are issued in Germany alongside ZEW economic sentiment data.

The euro area sees the publication of industrial production numbers.

The National Federation of Independent Business publishes its latest business optimism results for the US.

The OECD publishes a statistics release on employment in the second quarter.

Wednesday 15 October

The latest UK Household Finance Index is published by Markit.

Consumer confidence figures for Australia are released by the Faculty of Economics and Commerce Melbourne Institute.

Inflation numbers are out in China and Germany.

In Japan, industrial production data for August are released.

The European Central Bank's Governing Council meet, but no interest rate decision is scheduled.

Spain sees the release of current account numbers, while information on the public deficit to GDP ratio are out in Italy.

A labour market update is released in the UK, including the ILO unemployment rate, earnings data and claimant count numbers.

Retail sales figures are meanwhile issued in Brazil.

In the US, producer price figures, retail sales numbers and business inventories data are released.

Thursday 16 October

The quarterly IPA Bellwether Report is released by Markit.

Trade balance data and inflation numbers are highlights for the Eurozone economy.

Manufacturing sales numbers are meanwhile issued in Canada.

In the US, initial jobless claims, the NAHB Housing Market Index and industrial production numbers are out.

Friday 17 October

The UK House Price Sentiment Index is released by Markit.

Production in construction data are published by Eurostat for the currency union.

In Canada, inflation numbers are released.

Housing starts data are meanwhile issued for the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}