Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 09, 2015

Covered bonds outperform in volatility

European covered bonds are the sole corporate bond sector still in positive total return territory for the year so far, encouraging ETF investors to return to the asset class.

- Markit iBoxx € Covered index is up by 60bps for 2015 to date

- Euro denominated covered bonds are now outperforming corporate bonds by 1.5%

- Covered bonds ETFs saw large inflows wake of the recent market volatility

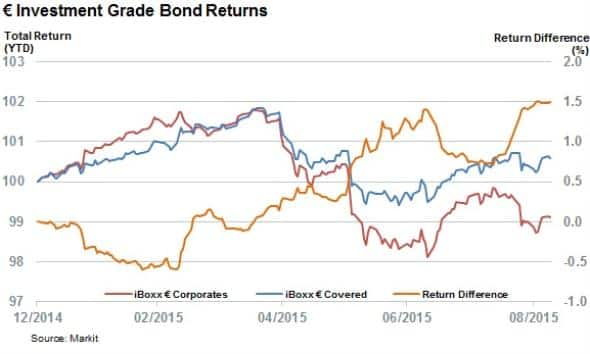

European investment grade corporate bonds have had a turbulent ride over the last nine months. The Markit iBoxx € Corporates index returned 1.9% in the opening four and a half months of the year, only to relinquish all these gains in a subsequent 3.7% selloff triggered by fears of a possible Grexit. While the asset class has regained some of its lost ground, the index's total returns are still negative for the year, to the tune of 89bps.

Covered bonds buck the trend

Covered bonds have been a relative success story however as the asset class is the only subset of the bond market to post positive total returns in the opening eight months of the year, according to the Markit iBoxx monthly bond report.

The asset class, as measured by the Markit iBoxx € covered index, briefly dipped into negative total return territory for the year during the worst of the recent volatility but returned to positive territory since the closing week of July. The corresponding corporate bond index has so far been unable to match this achievement.

Covered bonds have traded in positive territory ever since July and the recent commodities slump saw the year to date total return differential between conventional and covered investment grade bonds surge to new highs with the latter now 1.5% ahead of its less secure peer.

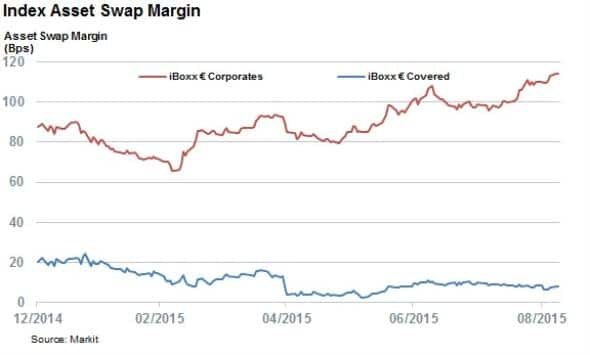

This trend looks to have been driven by increased credit risks priced into conventional euro denominated bonds as the asset swap margin of theMarkit iBoxx € Corporates index, which measures the extra yield demanded by investors to hold the asset class over benchmark securities, has surged to a new yearly high of 114 bps as of latest count.

But covered bonds, which still benefit from their inclusion in the ECB's asset purchase program, have not seen the same trend as their asset swap rate stands at a very low 8bps, down from 20bps at the start of the year.

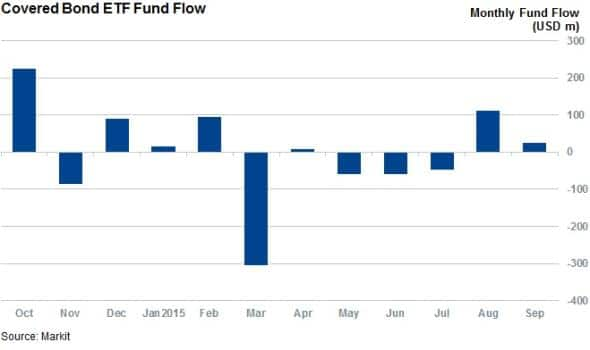

ETF investors pile in

The return differential between the two asset classes looks to have been noticed by ETF investors as covered bond ETFs have reversed the outflows which they experienced earlier in the year. This change in fortunes, which saw investors pull $300m in the opening six months of the year, means that the 16 covered bond ETFs have are on track for their first quarterly inflow of the year in the third quarter after investors bought $74m of exposure so far in the third quarter.

Investor demand to gain exposure to the relatively safer asset class has accelerated in the wake of the recent market volatility as last three weeks has seen investors pile over $100m of assets into these ETFs.

Simon Colvin, Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092015-Credit-Covered-bonds-outperform-in-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092015-Credit-Covered-bonds-outperform-in-volatility.html&text=Covered+bonds+outperform+in+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092015-Credit-Covered-bonds-outperform-in-volatility.html","enabled":true},{"name":"email","url":"?subject=Covered bonds outperform in volatility&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092015-Credit-Covered-bonds-outperform-in-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Covered+bonds+outperform+in+volatility http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09092015-Credit-Covered-bonds-outperform-in-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}