Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 09, 2015

Week Ahead Economic Overview

The future of Greece remains the hot topic in the coming week, with all 28 members of the European Union due to meet on Sunday to decide Greece's fate. Other policy highlights include a monetary policy announcement from the European Central Bank. Chinese second quarter GDP, US industrial production and worldwide inflation numbers are the data highlights.

All eyes will remain firmly fixed on Greece. Sunday will be an historic day, with all 28 European Union leaders meeting to decide Greece's fate a week after the "No" referendum, in which the country voted against a bailout that carried austerity measures.

It is expected that the European Central Bank will meanwhile keep its foot firmly on the stimulus pedal at its June Governing Council meeting on Thursday. With the ECB's policy of quantitative easing now well under way, the eurozone's economy has been showing signs of improvement, with survey data showing the region's economy enjoying its strongest growth for four years in June.

The week also sees important data releases for the currency bloc, including updates on industrial production, inflation and employment numbers. Survey data point to industrial production growth picking up after a mere 0.1% rise in April, and inflation is also likely to have revived further, not least due to the weakened euro. Consumer prices rose at an annual rate of 0.2% in June according to flash data, in what is a strong turnaround from the 0.6% rate of decline seen at the start of the year, while unemployment held steady at 11.1%. However, it is likely that the jobless rate will start falling again, with the PMI measure for job creation running at its highest for four years in June.

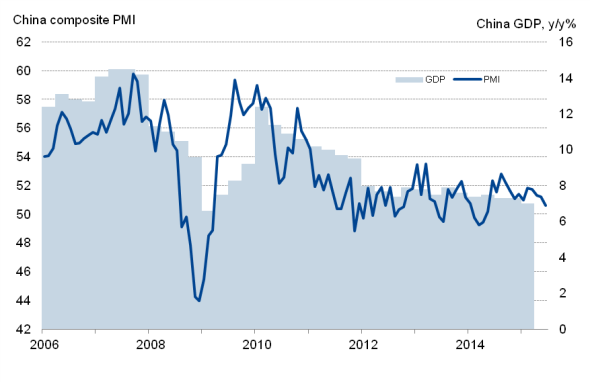

China's slumping equity markets could see further volatility as second quarter GDP numbers are released. Recent PMI data raise the possibility of economic growth having slowed further from the 7.0% annual pace seen in the first three months of the year. If GDP growth slows further, the Chinese government could fail to meet its growth target of 7.0% for 2015, which would be the slowest expansion for a quarter of a century. ETF data meanwhile point to investors having taken a wary approach to Chinese equity-exposed exchange-traded funds, which most likely reflects a combination concerns about equity markets being overvalued and weak economic growth.

Chinese GDP and the PMI

Sources: Markit, Ecowin.

UK data watchers will focus on latest inflation and labour market data. In April, the UK fell into deflation for the first time since data were first compiled in 1989, but consumer prices rebounded in May. Inflation is likely to have remained in positive territory in June but there remains uncertainty as to the extent to which it might take off later this year, with important implications for both economic growth and interest rates.

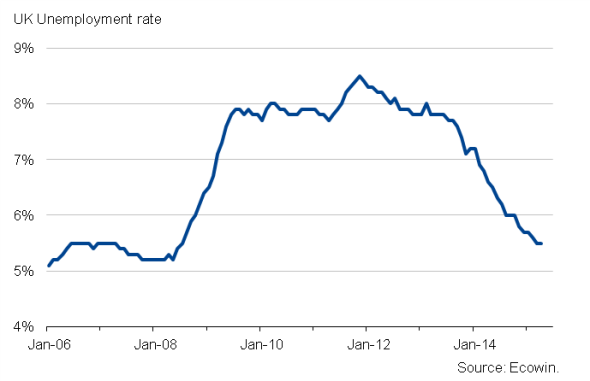

Wage data, also updated during the week, will therefore also be important in gauging the future path of UK interest rates, with past data having showed signs of pay picking up to its highest since 2009. There's also a strong chance that the UK unemployment rate will fall to 5.4% from 5.5%, adding to signs of a tightening labour market. While business survey data signalled a further slight slowing of employment growth in June, the data continued to signal historically robust job gains.

UK unemployment

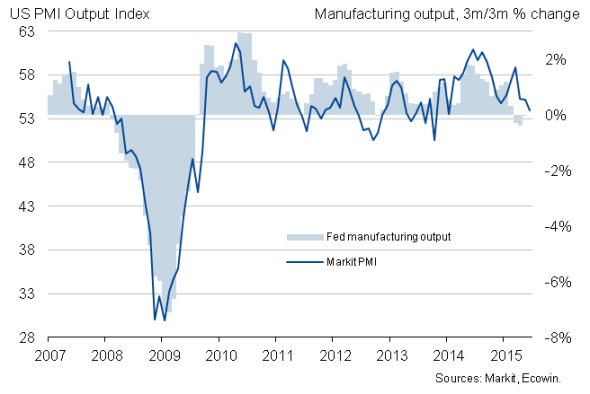

Inflation data in the US will also provide an important steer to US policymaking. Core inflation dipped to 1.7% but any renewed shift towards 2% raises the chance of the FOMC hiking rates later this year. Industrial output numbers in the US will also be eyed for signs that the manufacturing sector has recovered from the downturn seen over the past three months. However, US factories reported a disappointing end to the second quarter, with factory output growing at the slowest rate for one-and-a-half years, according to survey data. The slowdown is being led by weak export performance, which many producers in turn linked to a loss of competitiveness caused by the strong dollar. The survey results will therefore add to further worries about the damaging impact of the strong dollar, and will encourage the Fed to be cautious in terms of the timing the first interest rate hike. Retail sales numbers will also provide policy makers with additional information on the health of the US economy, after sales surged 1.2% in May.

US industrial production and the PMI

Monday 13 July

Revised industrial production figures for May are issued in Japan.

China and India see the release of trade data.

The Lloyds Bank Commercial Banking England & Wales Regional PMI results are released.

Tuesday 14 July

Business conditions data are updated in Australia.

In India, wholesale price figures are issued.

Latest inflation data are released in Italy, Spain and Germany, with the latter also seeing the publication of the ZEW Economic Sentiment Index.

Eurostat meanwhile publishes industrial production numbers for the currency bloc.

The Office for National Statistics issues latest inflation data for the UK.

The latest Ulster Bank Northern Ireland PMI is out.

Retail sales numbers are also updated in Brazil.

In the US, the latest NFIB Business Optimism Index is released alongside retail sales and business inventory data. Export and import prices are also updated.

Wednesday 15 July

In Australia, the Melbourne/Westpac Consumer Sentiment index and new motor vehicle sales numbers are released.

The Bank of Japan issues a statement on monetary policy.

Second quarter GDP data are published in China.

Meanwhile, Russia sees the release of industrial output figures.

Retail sales numbers are issued in South Africa.

In France, consumer price data are out.

Unemployment and wages information are updated in the UK.

In Canada, manufacturing sales numbers are out and the Bank of Canada announces its latest interest rate decision.

Industrial production figures are out in the US.

Thursday 16 July

Inflation and trade data are updated in the eurozone and the European Central Bank announces its latest monetary policy decision.

Initial jobless claims numbers and the NAHB Housing Market Index are released in the US.

The OECD publishes a statistics release on employment.

Friday 17 July

Inflation, retail sales and unemployment data are out in Russia.

Canada and the US see the release of consumer price numbers, with the latter also releasing the latest University of Michigan Consumer Sentiment index.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}