Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 09, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the upcoming week.

- Uncertainty for heavily shorted US homebuilders, despite a strong 2015 expected

- German food producer Suedzucker most shorted in Europe with 8% short interest

- Japanese automaker U-Shin most shorted in APAC with 7.8% shares outstanding on loan

North America

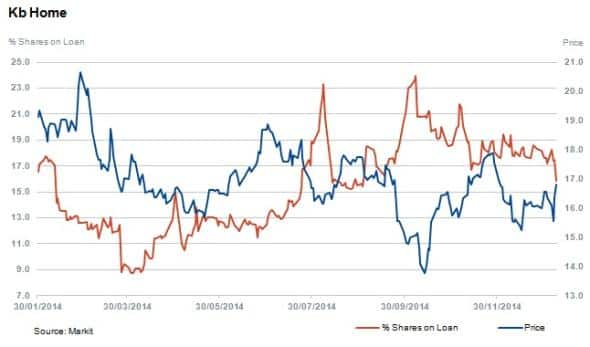

US homebuilder KB Home is the most shorted this week ahead of announcing earnings. KB Home currently has 15.8% of shares outstanding, and is joined by fellow homebuilder Lennar Corp which is sixth most shorted with 9% of shares outstanding on loan. KB Home's shares have decreased 6% over the last 12 months in contrast with Lennar Corp's increasing by 22%.

Both KB Homes and Lennar construct and sell single-family styled housing, primarily aimed at first time buyers across the US.

New house sales numbers in the US dropped unexpectedly in November to the lowest levels since July 2014. The outlook for housing in the US for 2015 however is strong but the rapid decline in oil prices and possible future effects on homebuilder's remains uncertain. US Homebuilders, who have significant exposure to states where recent economic activity is underpinned by alternative oil production, could come under pressure if low oil prices are sustained.

Overall, the US housing market rallied over the last quarter of 2014 after seeing a disappointing first three quarters. The Spdr S&P Homebuilders ETF's price rose by 20% in the last quarter of 2014. (Lennar is one of the top ten constituents of the ETF).

Short interest in the Homebuilder ETF has shrunk from almost 12% of shares outstanding on loan in October to 4.3% currently.

Another popular short sale in the US ahead of earnings is People's United Financial. The savings, loan and wealth services company currently has 14% of shares outstanding on loan. Short sellers timed the previous large price decline of 10%, which occurred in July, well. Since then the share price has recovered and is actually up 3.8% over the last year, attracting renewed interest from short sellers in the last few weeks.

Europe

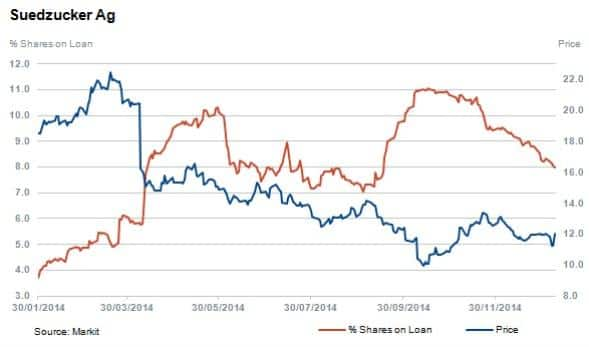

The company in Europe seeing most significant short interest ahead of earnings this week is German sugar and food producer Suedzucker. The company lowered its dividend payments in 2014 and was removed from the MSCI Germany Index earlier in the year.

Suedzucker's share price has declined 39% over the last 12 months and short sellers have continued to cover, with short interest decreasing month on month by 13% to 8% of shares outstanding on loan.

Asia Pacific

Japanese auto component manufacturer U-Shin tops this week's most shorted in the APAC region, with 7.8% of shares outstanding on loan.

The next most shorted in the region is Singapore Press with 7.6% of shares outstanding on loan. The printer, publisher and multimedia company is the Singapore's largest newspaper publisher and was recently included in a joint venture announcement with Schibsted, Naspers and Telenor regarding classified websites.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09012015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}