Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 08, 2015

Markit economic overview

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

Global growth weakens amid deepening emerging market downturn

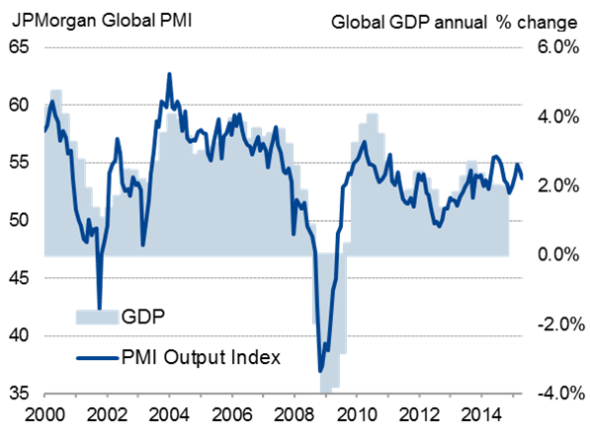

A deepening emerging market downturn led global economic growth lower in September. The JPMorgan Global PMI", compiled by Markit, fell from 53.9 in August to 52.8 in September, its weakest for nine months and signalling a rate of worldwide GDP growth of just 2% per annum. The divergence between robust developed markets and deteriorating emerging markets widened to the greatest on record in Q3.

Global economic growth (GDP v PMI)

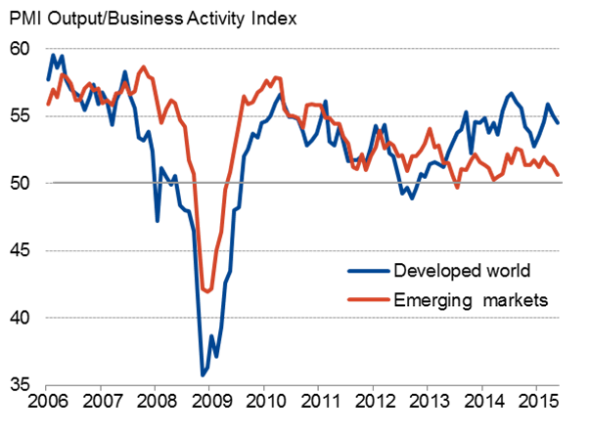

Developed v emerging markets

Emerging markets see weakest performance since 2009

At 49.0, the emerging market PMI fell to its lowest since March 2009, indicating a deterioration in business conditions across manufacturing and services for the third time in the past four months. The developed world PMI also fell but, at 54.0, remained in expansion territory. The developed world PMI translates to 1.5% annual GDP expansion, while the emerging market equivalent is broadly consistent with just 3% growth.

Developed world

Emerging markets

China in steepest downturn since start of 2009 as weakness spreads to services

The Caixin (Markit-compiled) PMI surveys indicated that China's economy contracted at the fastest rate since January 2009 in September . The downturn is most pronounced in the manufacturing economy, where the survey data are pointing to the steepest falls in factory output and export orders since March 2009. However, the industrial sector slump is now being joined by a near-stalling of growth in the service sector.

China economic growth (GDP v PMI)

China sectors

Use the download link below to access a full overview of the September PMI surveys, including details of all major economies, policy implications and the market impact.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Economics-Markit-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Economics-Markit-economic-overview.html&text=Markit+economic+overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Economics-Markit-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Markit economic overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Economics-Markit-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markit+economic+overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08102015-Economics-Markit-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}