Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Sep 08, 2015

US financials continue to outperform non-financials

US financials have proven to be the bright spot in the US corporate bond market so far this year as their respective credit position diverges.

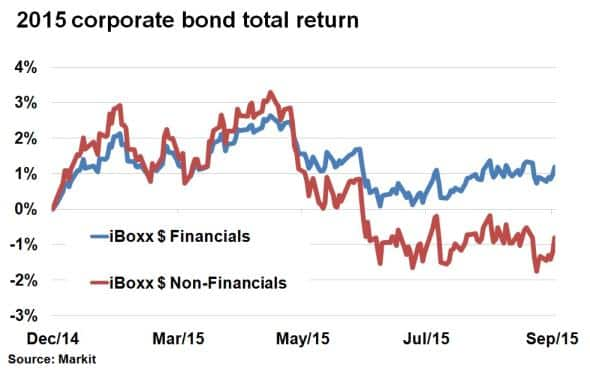

- Markit iBoxx $ Financials index has outperformed non-financials by 2% this year

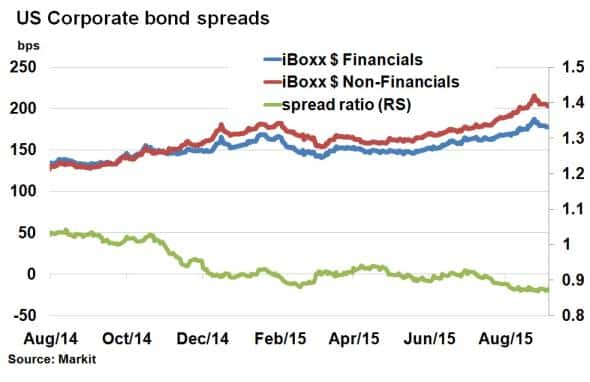

- Spread ratio of financials to non-financials has been compressing since July

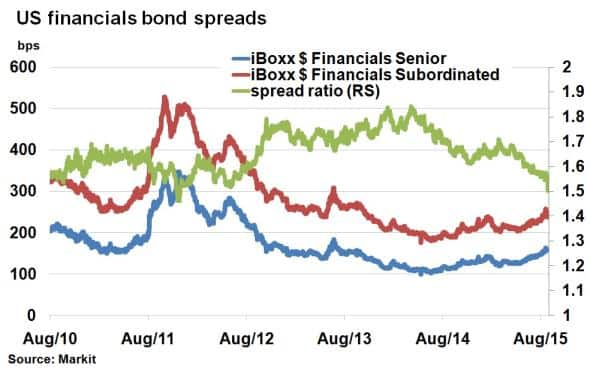

- Spread ratio of senior to subordinated US financials is at lowest since December 2011

In the US corporate bond market, financials was the best performing sector in August. Last month's volatility in financial markets caused credit spreads to widen, yet financials even outperformed defensive sectors such as healthcare and utilities, according to Markit's iBoxx indices. Banks in particular stood out among financials, returning 46bps more than the broader dollar corporate bond market.

So far in 2015, the Markit iBoxx $ Financials index has outperformed the Markit iBoxx $ Non-Financials index by 2% on a total return basis. This year actually started with non-financials beating its financials peers, outperforming by as much as 0.87% in January. The trend switched towards the end of April and performance has since diverged further.

The start of 2015 saw headwinds for financials. Heavy litigation costs and reduced trading revenues saw CDS spreads spike. Stress testing of the banks also caused frayed nerves among market participants. Non-financials, on the other hand, enjoyed the transitory effects of European QE, which reduced credit risk more broadly. Mid-April then saw a shift towards a more risk off environment as once again, matters in Europe and the Greek debt crisis unsettled investors. As primary market issuance seized up, financials held up better than non-financials over the summer. This trend was further exacerbated over the last few months due to financials' lower direct exposure to commodities and Chinese demand compared to non-financials.

The outlook

The last few months have seen the spread ratio of the Markit iBoxx $ Financials index to the Markit iBoxx $ Non-Financials index compress to new five year lows. The ratio had been hovering around the 0.9 mark from December 2014 till July this year, before moving lower.

Further compression of this ratio depends on the outlook for both sectors. Uncertainty around Chinese and emerging market demand remains a concern for non-financials with foreign exposure, while corporates' exposed to oil and commodities remain wary about further downside risk.

Conversely, US financials are generally less exposed to global macro concerns (seen by the recent spread outperformance) and continue to strengthen their balance sheets while being monitored by a strong regulatory backdrop. The Markit iBoxx $ Financials index spread over treasuries currently stands at 177bps, approximately 50bps wider than in mid-2014; suggesting there is room for potential further tightening.

Senior vs. subordinate

The fundamental credit strengthening of the US financial sector is evident by looking at the spread relationship between the highest quality financial debt and the lowest quality (subordinated). The spread ratio between the Markit iBoxx $ Financials Senior and iBoxx $ Financials Subordinated has been in steadily decline since April, and is now at its lowest level since 2011.

Most interestingly, spreads of treasuries have been widening since April which suggests technical rather than fundamental factors. With the US economy improving, this can only bode well for the US financial sector.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092015-Credit-US-financials-continue-to-outperform-non-financials.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092015-Credit-US-financials-continue-to-outperform-non-financials.html&text=US+financials+continue+to+outperform+non-financials","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092015-Credit-US-financials-continue-to-outperform-non-financials.html","enabled":true},{"name":"email","url":"?subject=US financials continue to outperform non-financials&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092015-Credit-US-financials-continue-to-outperform-non-financials.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+financials+continue+to+outperform+non-financials http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08092015-Credit-US-financials-continue-to-outperform-non-financials.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}