Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 07, 2015

Shorts increase metal exposure

Weak demand for base metals and resources continues to depress commodity prices, pressuring producers and traders, while forcing aggressive cost reductions and attracting short sellers.

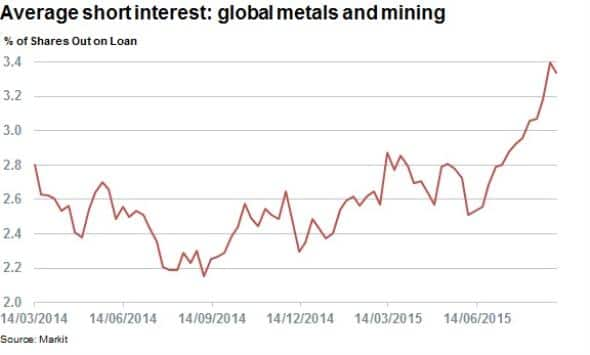

- Average short interest in metals and mining firms increases by a third

- Glencore shares react positively to debt restructuring ,sending short sellers covering

- Teck Resources, United States Steel and Fortescue attracting high levels of short interest

Commodity trader derisks

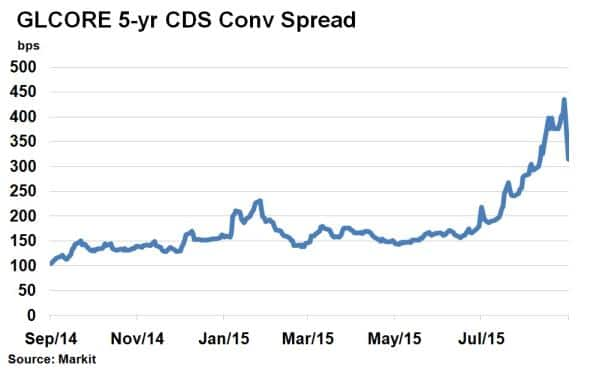

Miner and commodities trader Glencore has announced multiple measures to restructure its debt by 2016 in an effort to restore investor confidence and protect its investment grade credit rating. CDS spreads for the stock have risen over the past few months, indicating that the market had started to price in uncertainty surrounding the company's ability to service higher cost debt.

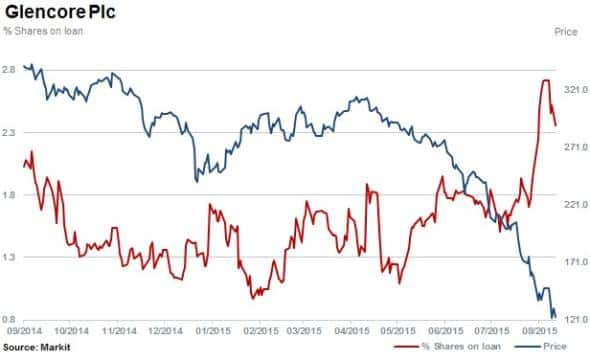

The company has committed to reducing its $30bn dollar debt burden issuing $2.5bn in shares, suspending dividend payments totalling $2.4bn and reducing working capital and expenditure. Initial market reaction was positive as shares rebounded more than 10% on September 7th 2015.

The bounce is of little respite to long term who have seen Glencore shares retreat 77% since floating in 2011.

Short interest had risen sharply in Glencore in the three months prior to Monday's announcement, with shares outstanding on loan increasing by 69% to 2.7%, while shares fell by 55%. Short sellers however began to cover positions in the first days of September 2015, with short interest decreasing by 13% to 2.4%.

Assisting Dr Copper

Glencore plans to take out 400k tonnes of global copper production by suspending operations at Zambian and DRC mines in an effort to boost the metal's price through reduced supply.

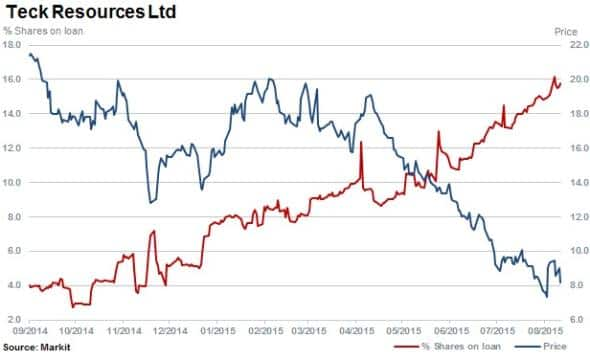

This should also assist copper, zinc and coal producer Teck Resources which has been targeted by short sellers in the last 12 months with shares outstanding on loan increasing threefold to 15.6% as shares declined 63%.

The Vancouver based Teck's operating profits are 60% exposed to copper and zinc production, with the balance exposed to coal production.

Oil and iron ore markets continue to suffer from low prices and supply gluts as major producers in both segments continue to leverage stronger balance sheets, maintaining production levels and squeezing higher cost producers, attracting short sellers.

Across metals and mining firms worldwide average short interest has increased by a third in the last three months to 3.3%.

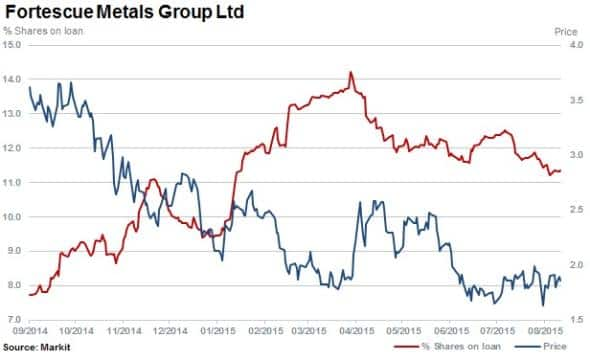

Australian majors maintaining production, Rio Tinto and BHP have pushed smaller companies down the cost curve. One small but still relatively large producer, Fortescue Metals is one of the largest suppliers of iron ore to China and currently one of the most shorted.

Shares outstanding are at 11.3% with short sellers taking profits over the last year as the stock has fallen by 51%.

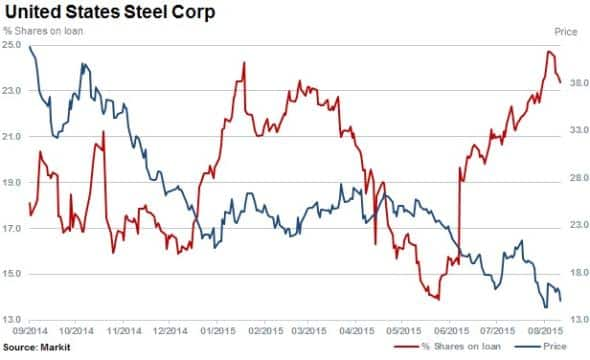

The most short sold company in metals and mining is United States Steel with 23.4% of shares outstanding on loan. The stock has fallen by 39% in the last three months, while short interest has risen by 62%.

The company supplies processed (rolled) steel products to industry and have been impacted by not only weak demand and low steel spot prices but also high levels of imports exasperated by a strong dollar, oil industry capex reduction and a rebalancing of inventory levels.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092015-Equities-Shorts-increase-metal-exposure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092015-Equities-Shorts-increase-metal-exposure.html&text=Shorts+increase+metal+exposure","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092015-Equities-Shorts-increase-metal-exposure.html","enabled":true},{"name":"email","url":"?subject=Shorts increase metal exposure&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092015-Equities-Shorts-increase-metal-exposure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+increase+metal+exposure http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07092015-Equities-Shorts-increase-metal-exposure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}