Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 08, 2016

Global growth lifted by emerging market upturn

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article

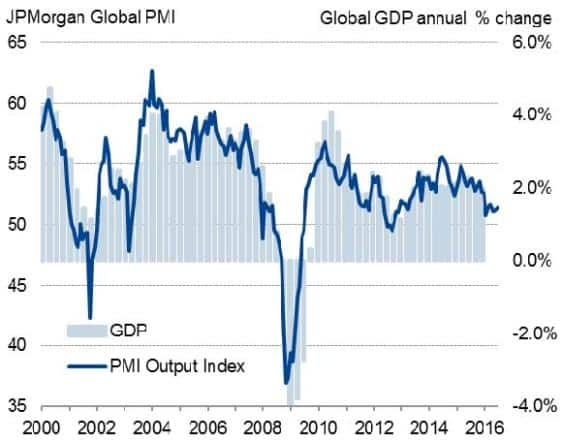

Global economic growth edged higher at the start of the third quarter, but failed to break out of the rut of sluggish expansion that has been evident since February. The JPMorgan Global PMI, compiled by Markit from its various national surveys, rose from 51.2 in June to a three-month high of 51.4. The PMI continues to signal a modest annual global GDP growth rate of only 1.5%, though manufacturing showed renewed signs of life.

Global PMI and economic growth

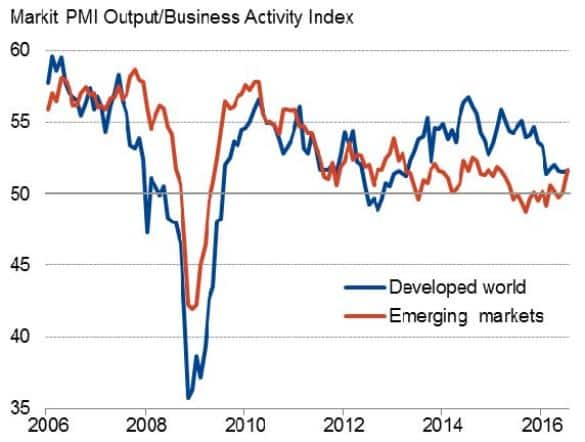

Most encouraging was an upturn in the rate of growth signalled by the emerging markets PMI to the highest since February of last year. The emerging market PMI rose above the equivalent developed world index for the first time since April 2013. The latter continued to show one of the weakest growth rates seen for three-and-a-half years.

At 51.6, the developed world PMI for July rounded off the worst three-month growth spell for over three years, albeit inching higher from 51.5 in June. The surveys showed developed world growth moving down a gear in February and have since been stuck in a range consistent with just under 1% GDP (at market prices).

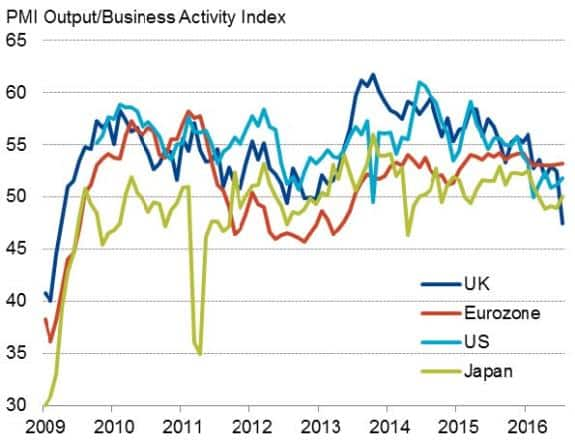

There were more encouraging signs when digging deeper into national performance, with the July PMI mainly dragged down by a record Brexit-related fall in the UK surveys. Looking at the other largest developed world economies, growth picked up across the board, rising in the US, Japan and the eurozone, with the latter leading the pack for a fourth successive month.

Developed v emerging markets

Major developed markets

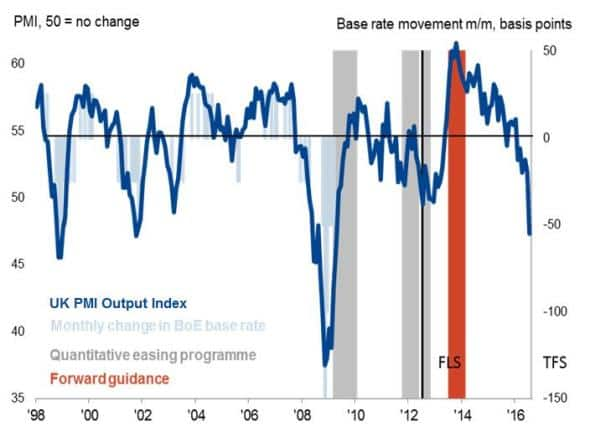

The Bank of England unveiled an aggressive new stimulus package to ward off the threat of recession, including record low interest rates, more QE and a new scheme to help pass low rates on to borrowers. The decision placed emphasis on a record fall in the UK PMI since the EU referendum. The PMI signalled the largest drop in output since April 2009, suggesting GDP could drop 0.4% in Q3. However, the Bank expects its stimulus to help avert recession.

Despite the stimulus the Bank is expecting the economy to take a 2.5% hit to GDP due to Brexit over coming years, and for the jobless rate to rise from 5.0% to 5.6% in two years' time. An immediate impact on the job market has already been signalled, as recruiters reported the largest drop in permanent placements since 2009 in July.

UK PMI and monetary policy

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-Economics-Global-growth-lifted-by-emerging-market-upturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-Economics-Global-growth-lifted-by-emerging-market-upturn.html&text=Global+growth+lifted+by+emerging+market+upturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-Economics-Global-growth-lifted-by-emerging-market-upturn.html","enabled":true},{"name":"email","url":"?subject=Global growth lifted by emerging market upturn&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-Economics-Global-growth-lifted-by-emerging-market-upturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+growth+lifted+by+emerging+market+upturn http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082016-Economics-Global-growth-lifted-by-emerging-market-upturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}