Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 08, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to the companies due to announce earnings in the week to come.

- Myriad Genetics is the most shorted firm ahead of earnings this week, with 42.7% of its shares out on loan

- Construction and machinery sectors dominate heavily shorted firms in Europe, holding three of the top four places

- Japanese internet software firm Gree sees the highest short interest in Asia, with over a fifth of its shares out on loan

North American earnings

Second quarter earnings announcements continue this week, and there are 18 firms in the US with over 6.1% of shares out on loan; over three times the average short interest in across S&P 500.

The most shorted US company this week is molecular diagnostic firm, Myriad Genetics Inc with a hefty 42.7% of its shares outstanding on loan ahead of reporting earnings. While shorts clearly continue to target the firm, demand to borrow fell by 1% compared to last month. Analysts have articulated fears over emerging competitors and negative pricing pressure.

US retailer J C Penney continues to see heavy short interest ahead of earnings, with nearly two fifths of its shares out on loan. Although shares remain heavily borrowed, some short sellers have been covering, with total short interest down 8% month on month. The retailer seems to have stabilised its business for now, after cutting expenditures and growing sales, but is still struggling to find a ceo to help implement a turnaround.

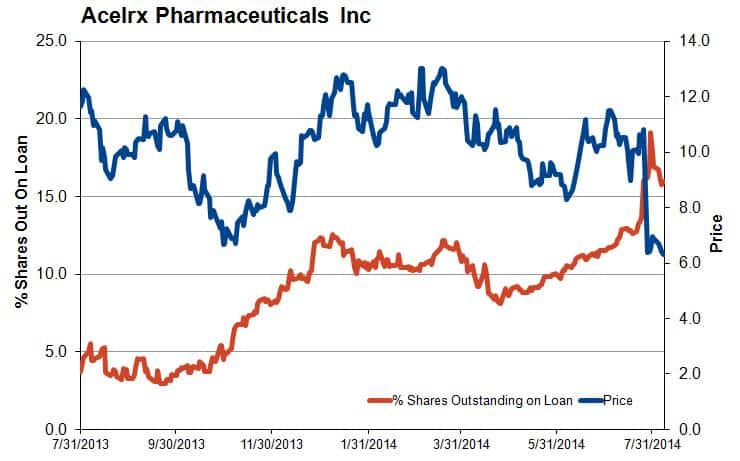

Acelrx Pharmaceuticals has seen short interest jump by 29% over the past month to 15.9% of shares outstanding on loan. This is on the back of the firm's stock diving by 40% at the end of July after the FDA rejected Acelrx's drug dispensing devise due to a potential component error.

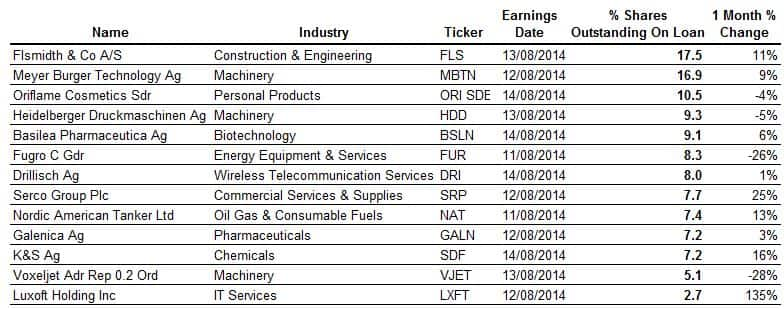

European earnings

Construction and machinery firms dominate the list of most shorted companies announcing results in Europe this week, comprising three of the four most shorted stocks.

Perennial short favourite FLSmidth tops the list, after the construction firm saw an 11% month on month rise in its shares out on loan. Swiss machinery firm, Meyer Burger Technology is hot on Flsmidth's heels with 16.9% of shares out on loan.

In the UK, Serco Group has seen its short interest jump by a quarter over the past month, after consensus analyst forecasts were reported predicting the company to report a 57% slump in earnings due to less work central government and fewer BPO wins. As a result, Markit's dividend forecasting team expect the firm to cut its dividend by 40% to GBP(p) 2.11 (gross), representing a dividend cover of 2.8% earnings in line with their policy.

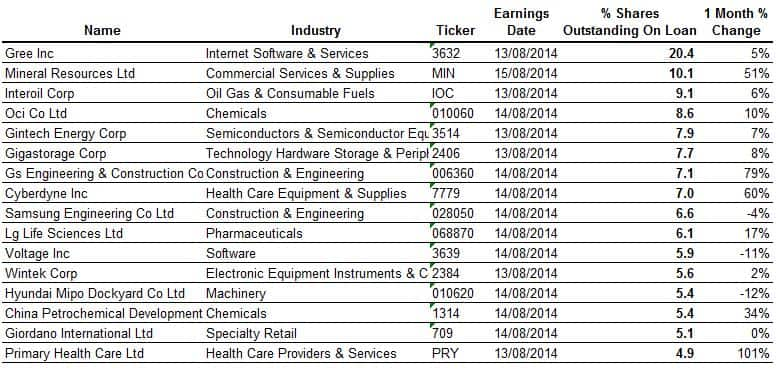

Asian earnings

Turning to the Asian markets, Japanese internet software firm Gree is the most heavily shorted firm ahead of reporting earnings with 20.4% of its shares out on loan. The mobile game developer is hoping a move into the hotel booking business can help turnaround its declining revenues, after investing $4.5m in Hong Kong-based app HotelQuickly last month.

Australian mining services firm, Mineral Resources is in second place after seeing a 51% increase in short interest over the last month resulting in 10.1% of its shares out on loan.

Also noteworthy are South Korea-based Samsung Engineering and Gs Engineering & Construction, which have both seen short interest jump by 60% and 79% respectively in the lead up to earnings.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082014120000Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082014120000Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08082014120000Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}