Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 08, 2016

Global economy sees worst quarter since 2012

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

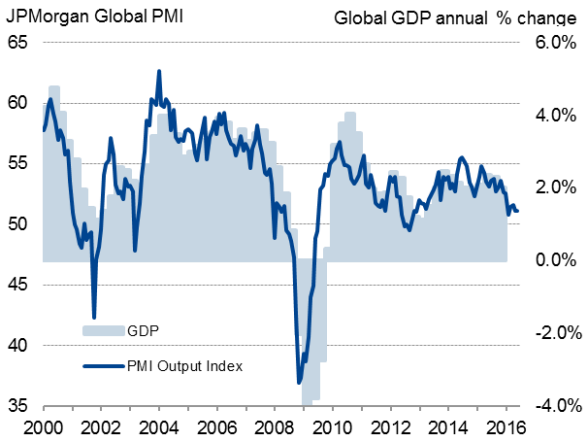

Global economic growth lowest since 2012 in second quarter

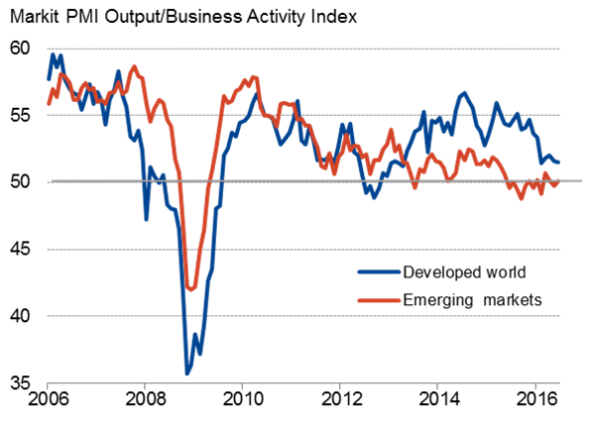

The JPMorgan Global PMI", compiled by Markit from its worldwide business surveys, held steady at 51.1 in June, rounding off the weakest quarter since the fourth quarter of 2012. The data point to global GDP rising at market prices at an annual rate of just 1.5%, below the long-run average of 2.3%. Emerging markets remained in an overall state of stagnation, continuing the trend seen over much of the past year. Developed world growth meanwhile slipped to the second-lowest in just over three years, maintaining the sluggish growth profile seen since February.

Global economic growth (GDP v PMI)

Developed v emerging markets

Charts show GDP-weighted PMI output indices covering both manufacturing and services

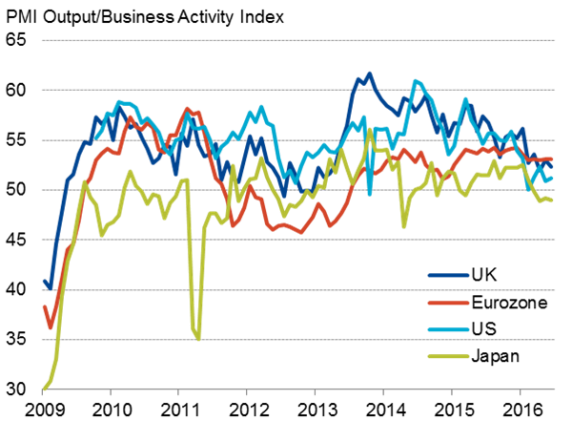

Global economy lacking growth drivers

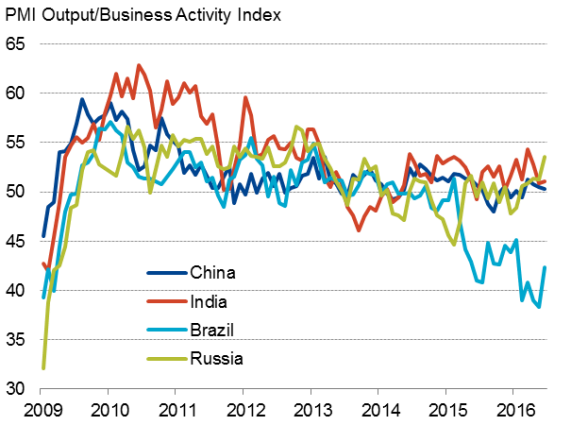

The PMI surveys again showed the lack of any global growth drivers in June. Rising political uncertainty has played a key role in subduing rates of expansion in the US and UK compared to earlier in the year, the latter hit in particular by uncertainty regarding the country's EU referendum. A struggling recovery in the eurozone and renewed downturn in Japan meanwhile coincided with an ongoing near-stagnation of the emerging markets. Brighter news came out of Russia and Brazil, however, where stronger growth and a slower rate of decline were seen respectively.

Developed world

Emerging markets

PMI shown above is a GDP weighted average of the survey output indices

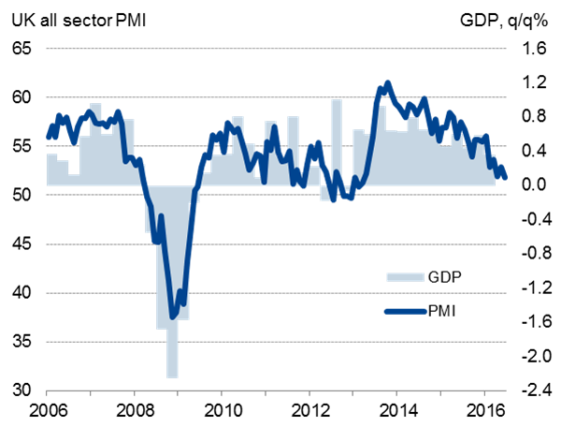

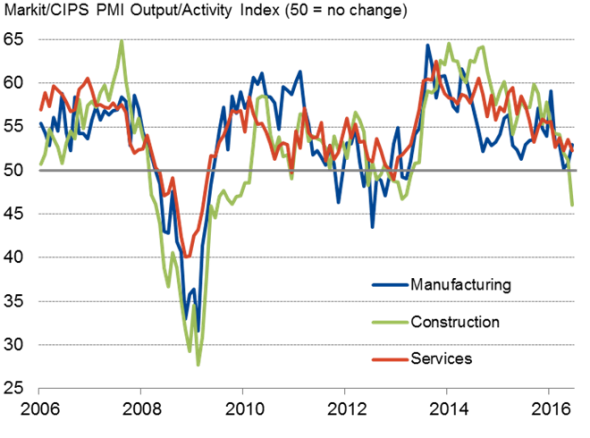

UK surveys signal growth slowdown and pull-back in hiring as Brexit worries intensify

The UK PMI data for June, mainly collected prior to the vote to leave the EU, showed that uncertainty regarding the referendum has been a major factor bringing the PMI series down to a level that signal just 0.2% GDP growth in Q2. Growth in June was the weakest since March 2013, led by construction output falling at the fastest rate for seven years. The PMI surveys also showed employment growth slipping to the lowest for three years. A separate recruitment industry survey registered the first drop in permanent staff placements since September 2012.

UK economic growth (GDP v PMI)

Output by sector

All sector PMI shown above is a GDP weighted average of the survey output indices.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-economics-global-economy-sees-worst-quarter-since-2012.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-economics-global-economy-sees-worst-quarter-since-2012.html&text=Global+economy+sees+worst+quarter+since+2012","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-economics-global-economy-sees-worst-quarter-since-2012.html","enabled":true},{"name":"email","url":"?subject=Global economy sees worst quarter since 2012&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-economics-global-economy-sees-worst-quarter-since-2012.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+sees+worst+quarter+since+2012 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072016-economics-global-economy-sees-worst-quarter-since-2012.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}