Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 08, 2017

Global economy set for robust Q2 growth

The following is an extract from IHS Markit's monthly economic overview. For the full report, please click the link at the bottom of the article.

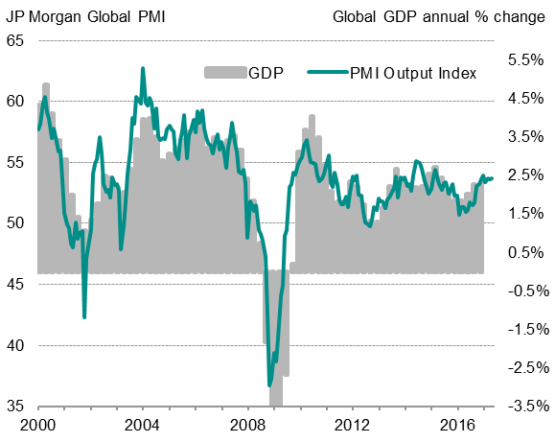

PMI indicates robust global growth in Q2

The global economy is on course for a robust second quarter, according to PMI survey data. The JPMorgan Global PMI", compiled by IHS Markit from its various national surveys, edged up from 53.6 in April to 53.7 in May. The latest reading is in line with the average seen so far this year and a level which is broadly consistent with global GDP growing at an annual rate of 2.5%.

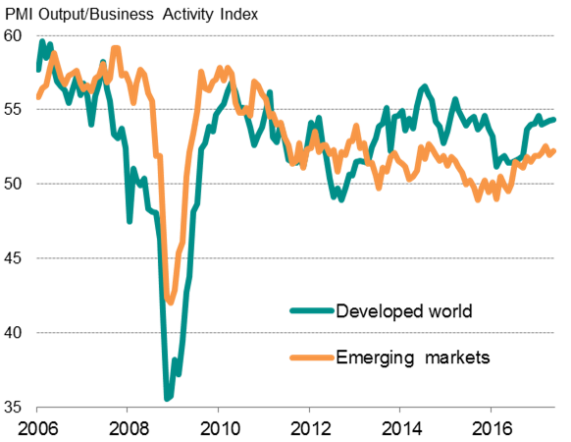

Robust rates of economic growth were signalled across both the emerging markets and the developed world, though the former remained somewhat "decoupled", with the pace of expansion remaining below that seen in the rich world, continuing the trend evident since 2013. While the Emerging Market PMI rose to 52.2 in May, its second highest in 32 months, the Developed World PMI held steady at 54.3.

Global PMI* & economic growth

Sources: IHS Markit, JPMorgan.

Developed & emerging market output

Source: IHS Markit. * PMI shown above is a GDP weighted average of the survey output indices.

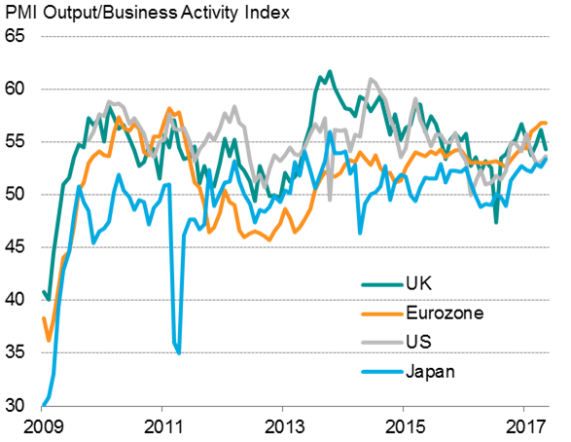

Europe powers ahead in developed world expansion

Europe continued to dominate the PMI rankings in May. Of the four largest developed world economies, growth was once again led by the eurozone, which has now led the pack for four successive months, followed by the UK. Slower, but still relatively robust, expansions were meanwhile seen in the US and Japan, with both reporting faster rates of growth than April.

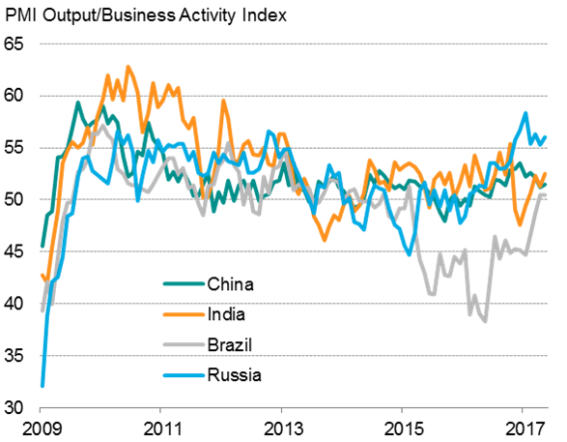

Turning to the largest emerging markets, the biggest disappointment was the on-going meagre growth rate signalled by the Caixin PMI surveys for China. Although Brazil recorded the weakest PMI, registering only a marginal expansion, the surveys nevertheless add to indications of an end to the country's recession. India continued to revive from the de-monetisation related downturn, but Russia remained the strongest performer.

Major developed markets*

Source: IHS Markit, CIPS, Nikkei.

Major emerging markets*

Sources: IHS Markit, Caixin, Nikkei.

* PMI shown above is a GDP weighted average of the survey output indices.

Europe leads manufacturing rankings, Asia struggles

Worldwide manufacturing activity continued to rise at a solid pace in May, according to global PMI data, but the surveys underscored the recent dominance of European producers and the malaise in Asia.

Europe accounted for all top eight countries in the May worldwide PMI rankings. The fastest growth was seen in Germany, followed by neighbouring Austria and the Netherlands. The UK was the fourth-fastest growing.

Of the 28 countries covered by the PMIs, only five saw manufacturing conditions deteriorate, four of which were Asian.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-economics-global-economy-set-for-robust-q2-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-economics-global-economy-set-for-robust-q2-growth.html&text=Global+economy+set+for+robust+Q2+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-economics-global-economy-set-for-robust-q2-growth.html","enabled":true},{"name":"email","url":"?subject=Global economy set for robust Q2 growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-economics-global-economy-set-for-robust-q2-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+set+for+robust+Q2+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062017-economics-global-economy-set-for-robust-q2-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}