Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 08, 2016

Long live the UK high street

Despite recent high street icons falling into administration, short sellers have covered positions across UK retailers which have pulled average short interest of the FTSE 350 lower. However key discretionary names have seen sharp increases in shorting levels this past month.

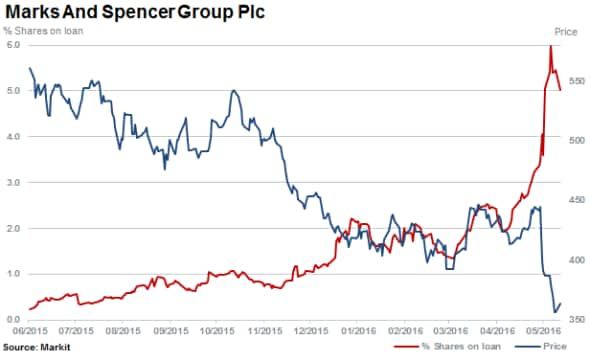

- Shorts sellers change habits and pivot into Marks & Spencer's as its clothing business hangs

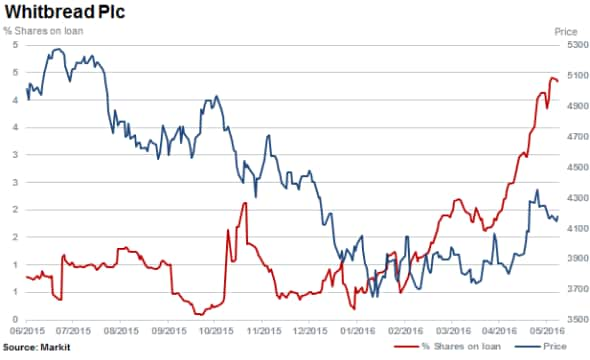

- Costa coffee chain owner Whitbread sees a sharp jump in shorts as sales cool

- ASDA owner Walmart sees value of short positions surge to $1.3bn

Previously lifting average short interest across UK stocks, retailers have seen short sellers cover recently, taking profits and shifting into key consumer discretionary names as stock prices slide. This perhaps indicates that the negative sentiment surrounding UK grocers may have a chance to turn.

However, fierce competition in the UK retail sector is not over as the battle for footfall and customer spend has seen the collapse of BHS and Austin Reed. Both of these have gone into administration with a potential business saving deal at BHS scuppered by pension liability issues.

Pension risks had previously been a concern among 'traditional' UK retailers however most are now unshackled from these obligations with even employee owned John Lewis ditching its salary based pension scheme. Shifting away, pension risks should increase future operational effectiveness and enable retailers to compete better - particularly against the German discounters.

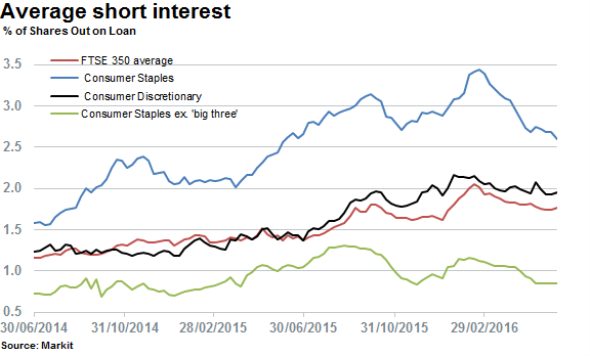

Average short interest of the FTSE 350 has declined 14% from 2016 highs to reach 1.7% currently. Heavily Influencing the decrease has been cuts to positions in the 'big three' staple retailers; Morrisons, Sainsbury's and Tesco.

Average short interest of UK consumer staples has overall, declined by a quarter from recent highs. Excluding the above 'big three', the decline in short sentiment is more evident across the industry with average short interest declining by a third.

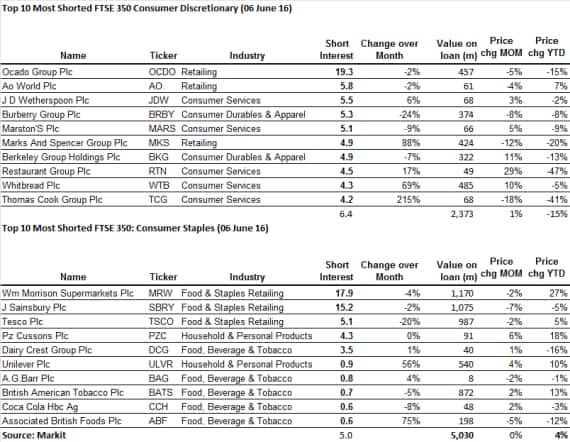

Short interest in Sainsbury's has fallen back down below 16% but the largest change in the past month though has been in Tesco, with short sellers closing a fifth of positions while the stock has declined 22% since mid-March.

Consumer staple stocks, led by the above grocers have actually performed relatively well year to date compared with discretionary peers. The top 10 most shorted discretionary retail stocks have fallen 15% on average, compared to a 4% gain for the staples stocks.

With an 88% increase in short interest in the past month rising to 4.9%, Marks and Spencer has the highest level of short interest seen in almost four years. The stock has fallen 20% year to date amid profit warnings as the firm's clothing department continues to struggle.

Online retailers Ocado and AO World lead short interest among consumer discretionary names with the former losing out to Morrisons in an Amazon tie-up and its shares down 15% year to date. Short sellers shave moderately covered in these two firms with a fifth of Ocado shares currently outstanding on loan, almost four times that of AO World.

Shorts have increased positions in the owner high street coffee chain Costa, Whitbread, with short interest spiking nine fold in the past six months to 4.3%. Whitbread which also owns Premier Inns (and now a 49% stake in Pure Food), has seen sales growth start to cool in the past year.

Lastly, Walmart, owner of UK supermarket chain ASDA has seen a marked increase in short interest while the relative percentage of shares outstanding on loan is small, only at 0.79%, the value short sold of the US retailing giant has surged year to date, with currently $1.46bn on loan.

ASDA reported sales declines amid strong competition in the first quarter with the UK CEO departing this week amid owner Walmart's disappointment.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-equities-long-live-the-uk-high-street.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-equities-long-live-the-uk-high-street.html&text=Long+live+the+UK+high+street","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-equities-long-live-the-uk-high-street.html","enabled":true},{"name":"email","url":"?subject=Long live the UK high street&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-equities-long-live-the-uk-high-street.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Long+live+the+UK+high+street http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062016-equities-long-live-the-uk-high-street.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}