Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 09, 2016

Markets react to ECB's corporate bond buying

The recent rally seen across euro denominated bonds has taken their yields near all-time low levels; however the developments have as much to do with benchmark rates as spreads are still off the lows seen last year.

- Markit iBoxx " Corporates benchmark spreads are 50bps wider than last year's lows

- Idiosyncratic credit risk has fallen across euro denominated investment grade sectors

- Euro denominated investment grade ETFs manage a record "25bn of AUM after strong inflows

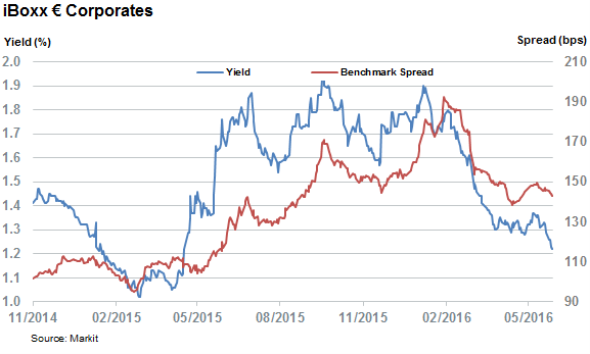

The expansion of the European Central Bank's (ECB) quantitative easing (QE) programme to include certain euro denominated bonds has been well received by the market, if the plunging yields delivered by the asset class are any indicators. While the current 1.2% yield delivered by the euro denominated investment grade bonds tracked by the Markit iBoxx " Corporates is within 20bps of the all-time lows registered last year, a large part of the recent yield collapse has been driven by the underlying benchmark risk free rates.

The current benchmark spread of 143bps, which measures the extra yield required by investors to hold the asset class, is still 50bps higher than the all-time lows seen early last year when investors required less than 100bps of extra yield in order to hold euro denominated investment grade bonds. This shows that the current spread contraction has as much to do with the negative rate policy, and its knock on effect on benchmark rates, as the decision to include corporate bonds in the QE program.

This holds true even after the ECB started buying bonds as the current Markit iBoxx " Corporates benchmark spread is still 3bps off the yearly lows seen at the end of April.

But investors don't seem to be turned off by the recent plunge in yields, as euro denominated investment grade ETFs have seen strong inflows in each of the weeks since Mario Draghi's announcement in March. This has taken the AUM managed by these ETFs past the "25bn mark for the first time ever.

Sector spreads converge

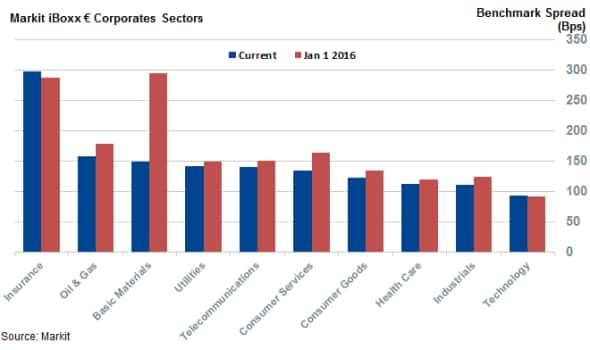

While spreads have not tightened to new lows, the recent action have taken a lot of the idiosyncratic risk away from the euro investment grade corporate bond market according to the sector benchmark spreads of the component indices that make up the Markit iBoxx " Corporates index. Nine of the ten non-bank component subsectors in the index have seen a fall in benchmark spreads from the levels seen at the start of the year, which shows the universal impact of the recent policy steps across the spectrum of euro investment grade corporates.

This universal tightening means that the levels of extra yield required to across the component sectors which make up the Euro investment grade universe has converged since the start of the year. In fact the standard deviation of benchmark spreads across the ten Markit iBoxx " Corporates sector indices is now roughly one fifth lower than at the start of the year, at 56bps currently. This trend indicates that investors are less worried about the individual sector risk since they were included into the basket of eligible securities.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-Credit-Markets-react-to-ECB-s-corporate-bond-buying.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-Credit-Markets-react-to-ECB-s-corporate-bond-buying.html&text=Markets+react+to+ECB%27s+corporate+bond+buying","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-Credit-Markets-react-to-ECB-s-corporate-bond-buying.html","enabled":true},{"name":"email","url":"?subject=Markets react to ECB's corporate bond buying&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-Credit-Markets-react-to-ECB-s-corporate-bond-buying.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markets+react+to+ECB%27s+corporate+bond+buying http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062016-Credit-Markets-react-to-ECB-s-corporate-bond-buying.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}