Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 08, 2015

Prospect of higher rates bodes well for US banks

With healthier economic data coming out the US and a rise in long term treasury yields, US banks stand to benefit through lending revenue.

- In the US, banks were the only sector to produce a positive total return in May

- The US yield curve has steepened 60bps since January; positive for bank lending margins

- Over the past month, the CDX has widened while US banks' CDS has tightened

Last week's nonfarm payrolls report indicated that the US economy added 280,000 jobs in May, beating expectations and increasing the likelihood of an interest rate hike later this year.

US treasury yields reacted by widening across the curve. The 10-yr rate shifted up 10bps to 2.4%, the highest since October 6th last year.

Treasury yields have been on the rise recently, partly led by better growth expectations in Europe. The latest positive US economic data has further catalysed the imminent arrival of higher short term rates and subsequently long term rates.

US banking sector on the up

In May, banks were the best performing sector on a total return basis as represented by the Markit iBoxx $ Banks index. Led by lower duration, it was the only sector not to post a negative return in May amid market volatility which pushed treasury yields higher, exaggerated on the long end. So far is has been a similar story in June with banks returning -1.1% compared to -1.53% for the broader dollar corporate market.

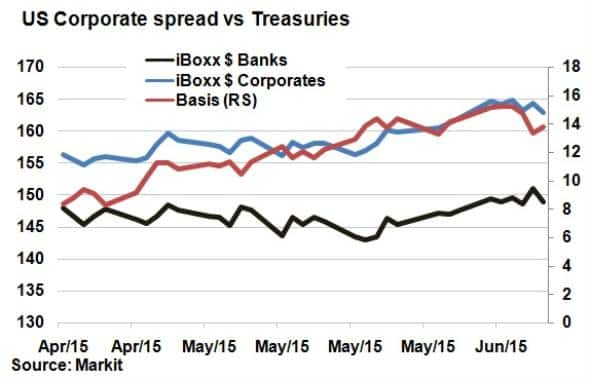

The recent outperformance in banks can be seen in a review of bond spreads over treasuries. A widening spread usually indicates a worsening credit outlook, but can also incorporate idiosyncratic factors such as liquidity. On April 20th, the 10-yr US treasury yield hit 1.89% and has since widened a further 50bps. During that period the iBoxx $ Corporates index spread over benchmark widened from 156bps to 163bps, while the iBoxx $ Banks index spread over benchmark remained flat.

The banks' outperformance over the broader market comes as no surprise. Banks benefit from higher interest rates and heightened market volatility. Higher rates equals higher profit margins on lending - being able to exploit the spread between the rate in which they borrow (short term) and the rate in which they lend (long term); the net interest margin.

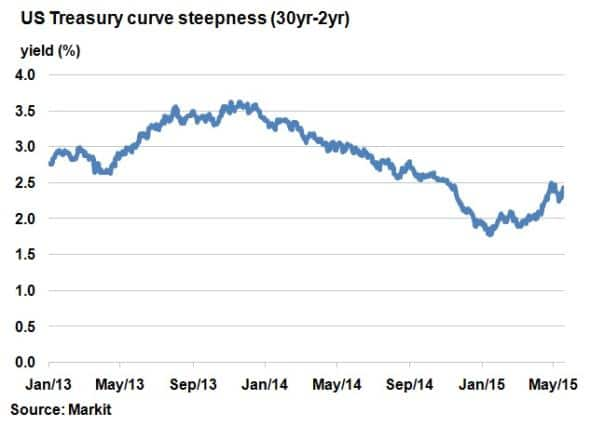

The steepness can be best represented by looking at the steepness of the US treasury curve, which can be calculated by subtracting the 2-yr yield from the 30-yr. Having reached a bottom in January at 1.78%, the curve has since steepened and reached 2.4%. Expectations are for the curve to steepen further, which currently remains below the five year average of 3%.

Credit markets react

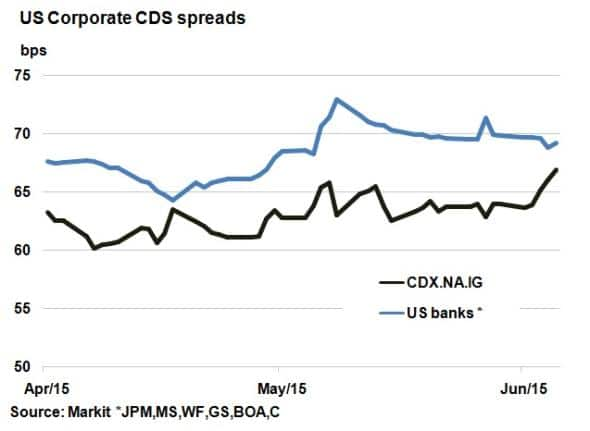

It has been a similar story in credit markets where the basis between the CDX.NA.IG index, which compromises of 100 investment grade single name CDS, and the average CDS spread of the six largest US banks has tightened in recent weeks. Since May 7th, Citigroup, Bank of America and J.P. Morgan have all seen their credit spreads tighten, whereas the CDX.NA.IG index has seen its spread widen 3bps. Trading heavy banks such as Goldman Sachs and Morgan Stanley have also outperformed the general corporate sector, with market volatility viewed as a positive.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Credit-Prospect-of-higher-rates-bodes-well-for-US-banks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Credit-Prospect-of-higher-rates-bodes-well-for-US-banks.html&text=Prospect+of+higher+rates+bodes+well+for+US+banks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Credit-Prospect-of-higher-rates-bodes-well-for-US-banks.html","enabled":true},{"name":"email","url":"?subject=Prospect of higher rates bodes well for US banks&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Credit-Prospect-of-higher-rates-bodes-well-for-US-banks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Prospect+of+higher+rates+bodes+well+for+US+banks http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08062015-Credit-Prospect-of-higher-rates-bodes-well-for-US-banks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}