Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 08, 2015

Japan PMI data signal renewed economic downturn in March

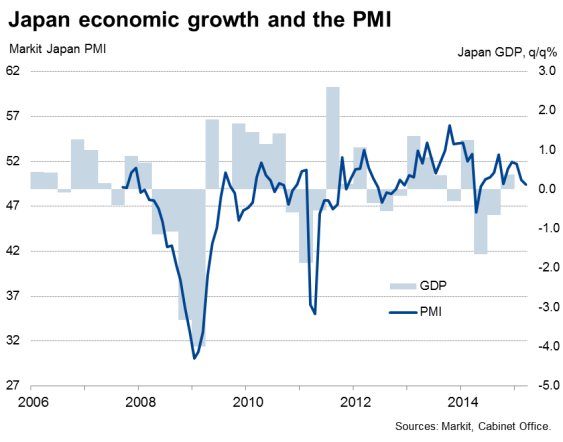

Japan's economic recovery is faltering again, according to survey data, calling into question the Bank of Japan's recent upbeat analysis of the economy and upping the likelihood of the authorities seeking new ways to revive consumer and business spending.

At 49.4, the PMI survey measure of business activity across the manufacturing and service sectors hit a ten-month low. By falling below 50, the index also signalled the first monthly drop in activity since last October.

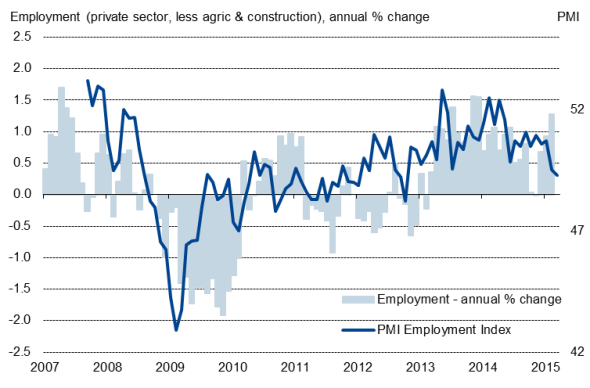

A lack of demand prompted firms to trim staffing levels for a second successive month, leading to largest (albeit still only modest) drop in employment since October 2012. However, although only minor, the drop in employment is a major setback for the economic recovery.

Employment falls for second month

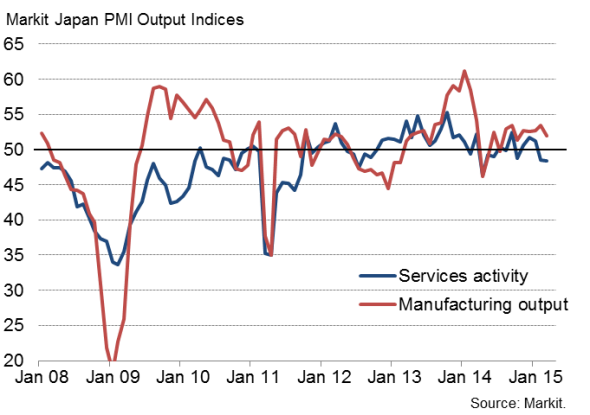

At the heart of the deterioration is a weakening of domestic demand. Service sector activity fell for a second successive month in March, attributed by survey respondents mainly to weak inflows of new business in home markets.

Service sector leads the downturn

Manufacturing output grew at a slower pace, showing the smallest monthly increase since October as factory orders fell for the first time since May of last year, despite rising export orders. With factory hiring falling, the overall manufacturing PMI survey is painting the bleakest picture for ten months.

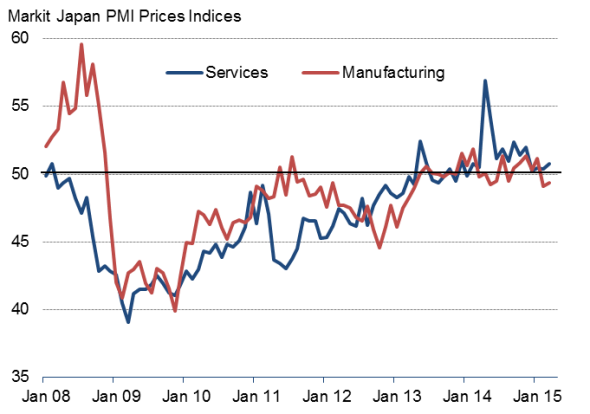

A further worry is the lack of price pressures, with prices charged by manufacturers falling for a second successive month while service sector charges showed only a modest rise.

Price pressures wane

Investors bet on stimulus

The downturn in the PMI surveys is a disappointment after the survey data around the turn of the year had provided signs of the economy reviving from last year's mini-recession.

The data call into question the Bank of Japan's assessment of the economy. In a statement following its April 8 meeting, the BoJ considered Japan's economy to have "continued its moderate recovery trend" amid "resilient" private consumption, encouraging policymakers to make no changes to their QE programme of "80tn per annum.

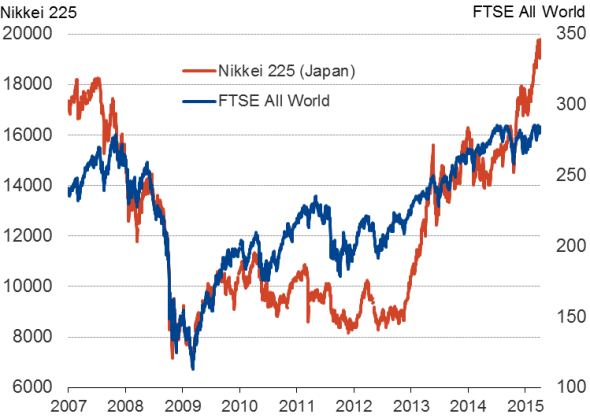

The continued stimulus pushed Japanese equities higher, with the Nikkei 225 benchmark index rising to a 15-year peak as investors perceived further solid corporate earnings.

Stock markets

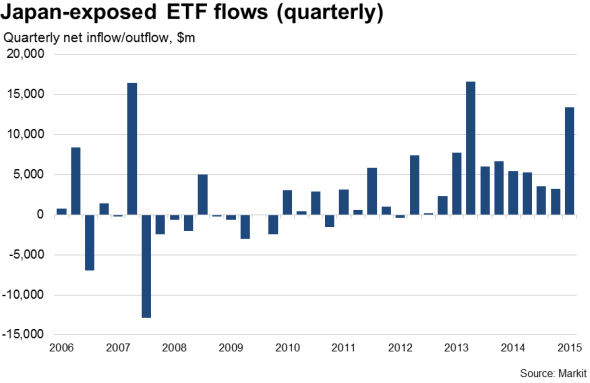

Data compiled by Markit have also shown a sharp increase in inflows into exchange traded funds with an exposure to Japan so far this year, the vast majority of which are equity funds. The first quarter has seen the biggest inflow since the second quarter of 2013

.

The PMI survey data suggest that business conditions clearly need to improve in coming months if the Bank of Japan's current positive assessments of the economy and equity valuations are justified.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042015-economics-japan-pmi-data-signal-renewed-economic-downturn-in-march.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042015-economics-japan-pmi-data-signal-renewed-economic-downturn-in-march.html&text=Japan+PMI+data+signal+renewed+economic+downturn+in+March","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042015-economics-japan-pmi-data-signal-renewed-economic-downturn-in-march.html","enabled":true},{"name":"email","url":"?subject=Japan PMI data signal renewed economic downturn in March&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042015-economics-japan-pmi-data-signal-renewed-economic-downturn-in-march.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+PMI+data+signal+renewed+economic+downturn+in+March http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042015-economics-japan-pmi-data-signal-renewed-economic-downturn-in-march.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}