Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 08, 2016

Banks send European corporate credit risk soaring

Troubles in Europe's banking sector have led to widespread risk aversion among European corporate credit.

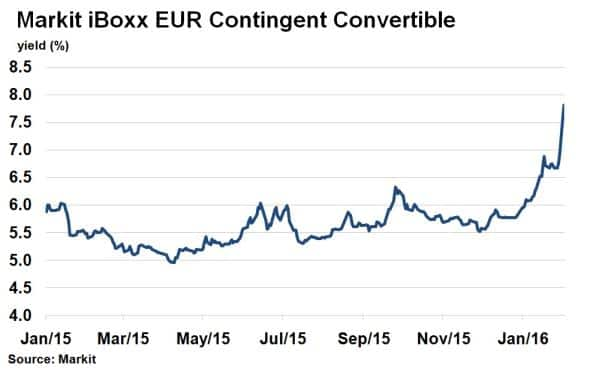

- Markit iBoxx EUR Contingent Convertible index yields 2% more than at the start of 2016

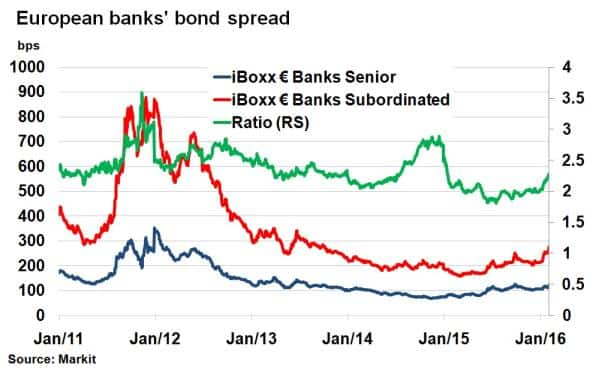

- Spread ratio between Markit iBoxx " Banks Subordinated/Senior indices has climbed to a 12 month high, but remains below 2011's level

- Markit iTraxx Europe main index has surpassed 118bps for the first time since June 2013

Despite having managed to remain relatively calm to date, the recent volatility in global financial markets has finally started to engulf European credit markets. The Markit iTraxx Europe main index, made up of 125 investment grade single name credits, has widened 25bps so far this month; surpassing 118bps for the first time since June 2013.

Europe's banking sector has been seen as a catalyst, with recent worries over bad loans among peripheral banks and, more broadly, a downbeat earning season driving negative sentiment in region.

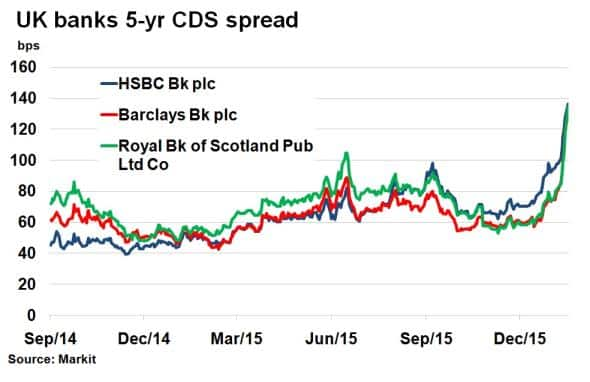

UK banks for example have seen their 5-yr CDS spreads widen in tandem, with HSBC's, once the safest among UK banks, now seeing its 5-yr CDS spread wider than its peers. Emerging market exposure, the threat of a 'Brexit' and a longer period of zero interest rates (which have hurt bank margins) have all culminated in the market readjusting risk expectations.

Coco selloff

The selloff in European bank equity and credit has also seen prices on contingent convertible (Coco) bonds fall sharply.

Used by banks since 2009 as a cheap way to shore up capital buffers, Cocos demonstrate the current risk off mood. Deutsche Bank's 6% Coco has seen its mid-price fall to 76.8 (cash basis to par), according to Markit's bond pricing service. The bond had been valued at 91.5 just two weeks ago. The troubled German bank has seen its 5-yr CDS spread widen to 217bps, now wider than peripheral European banks such as Intesa Sanpaolo and BBVA, as it struggles to deal with regulatory, litigation and profitability issues.

Across the Coco universe, the Markit iBoxx EUR Contingent Convertible index now yields 2% more than at the start of 2016, with yields topping 7.5%.

Not quite 2011

The selloff has seen the basis between the Markit iTraxx Europe Senior Financials and the Markit iTraxx Europe Sub Financials widen to the highest level since July 2012, with the subordinated bank credit seeing spreads widen above 300bps for the first time since 2013.

The disparity among senior and subordinated bank debt is however less evident among cash bonds. The ratio between Markit iBoxx " Banks Senior index and the Markit iBoxx " Banks Subordinated index has climbed to only a 12 month high.

But despite all the turmoil, the spreads in both cash and synthetic credit are well below those seen in 2011's European banking crisis - the basis between the Markit iTraxx Senior/Sub-indices is 89bps tighter at present. Peripheral sovereign spreads also remain somewhat subdued; with knowledge the ECB will remain accommodative.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022016-credit-banks-send-european-corporate-credit-risk-soaring.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022016-credit-banks-send-european-corporate-credit-risk-soaring.html&text=Banks+send+European+corporate+credit+risk+soaring","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022016-credit-banks-send-european-corporate-credit-risk-soaring.html","enabled":true},{"name":"email","url":"?subject=Banks send European corporate credit risk soaring&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022016-credit-banks-send-european-corporate-credit-risk-soaring.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banks+send+European+corporate+credit+risk+soaring http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022016-credit-banks-send-european-corporate-credit-risk-soaring.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}