Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 08, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- US industrial supplies firm Fastenal, trading in a tough environment as short interest grows

- Suedzucker shares recover as sugar prices rebound after a respite from years of declines

- Japanese game developer Cave Interactive most short sold stock in Apac

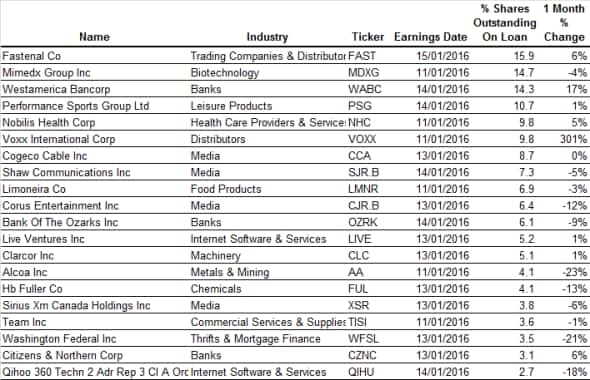

North America

Most shorted ahead of earnings this week in North America is Fastenal with 15.9% of shares outstanding on loan. Shares for the industrial and construction supplies firm hit a year low at the beginning of October 2015 but have subsequently rallied 12%. This has however attracted short sellers ahead of earnings who have increased positions by as much as 24%.

Fatenal's CEO last year stated that despite the "industrial environment" being in recessionary mode, the company continued to add customers and maintain momentum.

Second most shorted is biotech firm Mimedx Group with 14.9% of shares outstanding on loan. The company focuses on tissue regeneration products and medicines. Shares have faltered since July 2015, falling 26% in the last six months along with a general selloff in US biotech stocks but shares have recently rebounded on positive earnings guidance released by the firm.

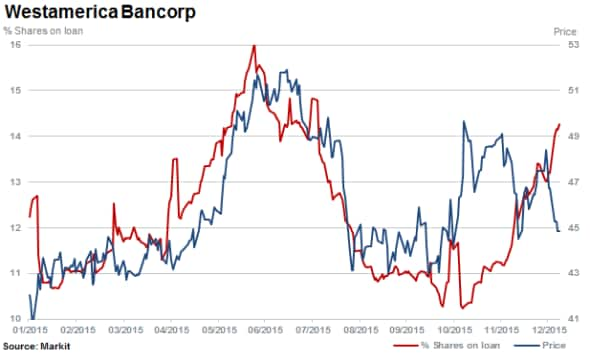

Short sellers continue to track Westamerica Bancorp shares closely ahead of earnings with short interest spiking by a third in the last three months, while volatile movements during the year has seen the stock move sideways.

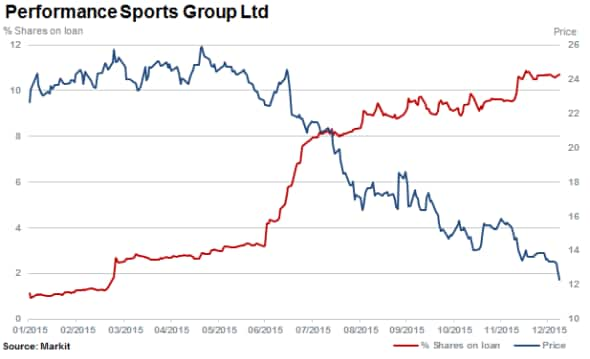

Owner of sports brands Bauer and Easton, Performance Sports group remains the target of short sellers ahead of earnings with 10.7% and shares falling a quarter in the last three months. Shares in the company have fallen 49% in the last 12 months.

Western Europe

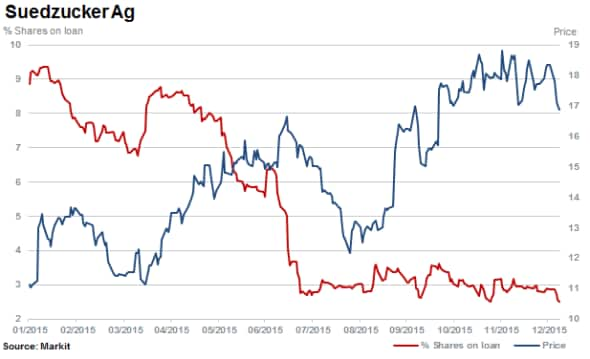

Once again the most shorted in Europe ahead of earnings at the start of the year is Suedzucker with a relatively low amount of shares outstanding on loan at 2.5%. Shares have risen 12% in the last three months as sugar prices seemed to have finally bottomed out in 2015. After several years of declining prices a slight recovery was seen in the final months of the year despite the company recently guided earnings expectations lower.

Apac

Most shorted ahead of earnings this week in Apac with short interest jumping a third in the last week is Japanese app and game developer Cave Interactive. Currently there are 10.8% of shares outstanding on loan with the stock moving higher by 68% in the last three months alone.

U-shin and Singapore Press feature once again in the top most shorted ahead of earnings for the first week of the year. Japanese auto component manufacturer U-Shin APAC region, with 9.0% of shares outstanding on loan has seen shares end flat after 12 months.

Third most shorted in the region is Singapore Press with 8.6% of shares outstanding on loan. Singapore's largest newspaper publisher has seen shares slide 10% in the last six months with shorts adding to positions since July 2015.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08012016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}