Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 07, 2014

German industrial sector falls into technical recession, but underlying trend improves

German industrial production returned to growth in September, buoyed by rising factory orders and a rebound in exports. The September numbers allay some of the worries about the health of the German economy that had been induced by the weakness of the official data earlier in the summer.

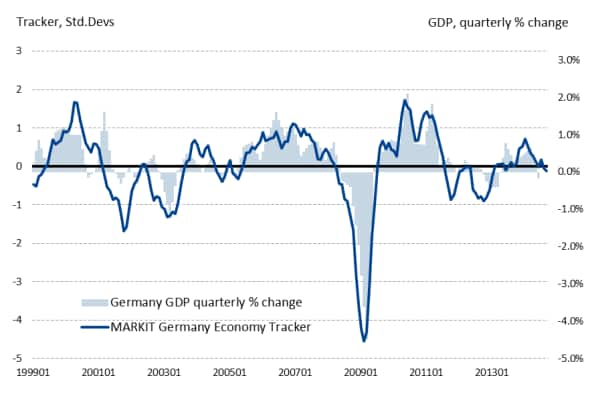

Importantly, although the weakness of the industrial sector means it is likely to act as a major drag on third quarter GDP, the economy looks set to skirt recession with GDP rising 0.2%, reversing the 0.2% decline seen in the second quarter. However, a further easing in private sector growth in October signalled by the PMI surveys suggests a renewed downturn in the fourth quarter should not be ruled out.

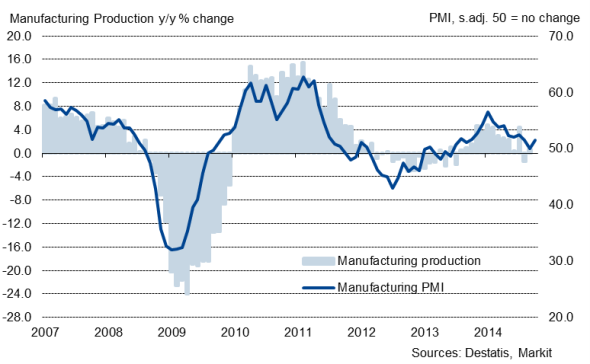

Production returns to growth

Industrial production rose 1.4% in September, according to the Federal Statistical Office (Destatis). Economists polled by Reuters had expected a stronger, 2.0%, increase. The rise in industrial production follows a revised 3.1% decline in July (previously reported as -4.0%). However, even with September's rebound, industrial production will act as a drag on third quarter GDP, with output down 0.3%. Some comfort can nevertheless be gleaned from the fact that this represents an easing compared to the 1.1% drop seen in the second quarter.

Destatis reported that capital goods manufacturers saw the steepest increase in September, with production up some 4.5%. Intermediate goods output meanwhile fell 0.2% and the production of consumer goods decreased 1.4%. Energy production was up by 2.4% on the month, but construction was down 1.2%.

With the exclusion of construction and energy, manufacturing output was up 1.7%, following a 3.4% decline in August.

Manufacturing production and the PMI

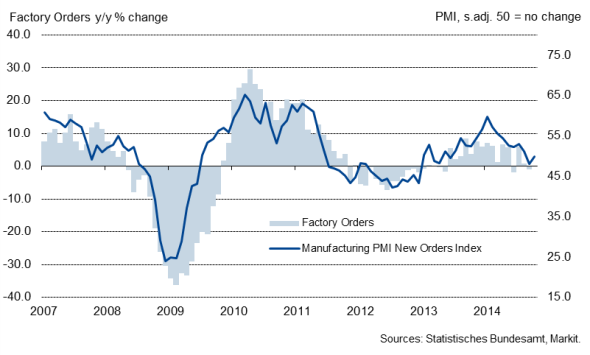

Factory orders up slightly in September

The production data followed official data released on Thursday which had shown factory orders rising 0.8% in September, having fallen a substantial 4.2% (revised up from an initial 5.7% fall) in August. Domestic orders fell 2.8%, while new export work rose 3.7%. Factory orders rose 0.1% in the third quarter, following a 0.2% contraction in Q2. PMI data had signalled sluggish new order growth in recent months and suggest that order intakes may fail to show any meaningful increase at the start of the fourth quarter.

Factory orders and the PMI

A separate data release showed exports rebounding in September. A stronger than expected 5.5% rise in goods exports in the latest month effectively reversed a 5.8% decline seen in August, so that the third quarter as a whole saw exports rising.

Manufacturing sector continues to struggle

While the industry data in particular have been difficult to read over the summer as the removal of seasonality has proven especially difficult due to the shifting nature of the regional school holidays, there can be little doubt that Germany's mighty industrial sector (which accounts for more than 20% of the economy) has lost considerable momentum since the start of the year.

After slipping slightly into contraction territory in September, the Manufacturing PMI recovered in October. However, a closer look at the data highlights the fragility of Germany's goods-producing sector, as new orders fell for a second successive month, suggesting that production growth is likely to remain sluggish in the near-term. Furthermore, companies were reported to have often increased their production levels merely to build stock, and not in response to higher current demand.

Marginal growth for third quarter likely

Both the release of the orders and industrial production data for September confirmed our thinking that industry will act as a drag on third quarter GDP, and any economic growth will be determined by the performance of the service sector. Although the business surveys have suggested the services economy continued to expand over the quarter, some weakness in September's retail sales numbers places some doubt on underlying performance.

While our nowcasting model for Germany is currently predicting an expansion in the region of 0.2%-0.3%, the official data flow for Q3 suggests that GDP growth at the bottom of this range is probably the best we can hope for and, in line with recent Bundesbank thinking. We therefore look for only a marginal expansion of the German economy when the official data are released next week and currently expect this weakness to persist into the fourth quarter.

German GDP Model

Paul Smith | Economics Director, IHS Markit

Tel: +44 149 146 1038

paul.smith@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-German-industrial-sector-falls-into-technical-recession-but-underlying-trend-improves.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-German-industrial-sector-falls-into-technical-recession-but-underlying-trend-improves.html&text=German+industrial+sector+falls+into+technical+recession%2c+but+underlying+trend+improves","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-German-industrial-sector-falls-into-technical-recession-but-underlying-trend-improves.html","enabled":true},{"name":"email","url":"?subject=German industrial sector falls into technical recession, but underlying trend improves&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-German-industrial-sector-falls-into-technical-recession-but-underlying-trend-improves.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+industrial+sector+falls+into+technical+recession%2c+but+underlying+trend+improves http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-Economics-German-industrial-sector-falls-into-technical-recession-but-underlying-trend-improves.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}