Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 07, 2015

UK manufacturing output falls for second month running

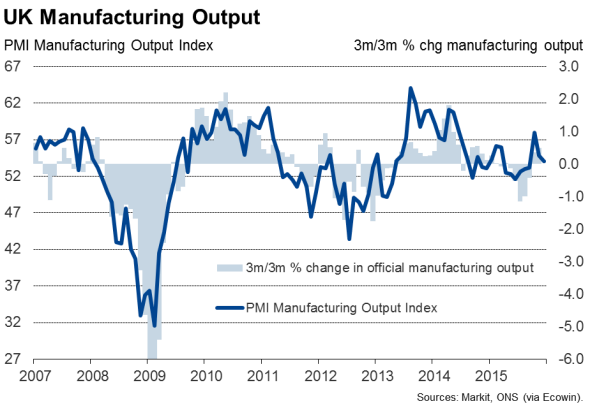

A second successive monthly fall in manufacturing output means the goods-producing sector will act as a drag on the economy in the second quarter, leaving the upturn reliant once again on the service sector. The disappointing performance of the country's factories, linked in part to competitiveness being hit by the strong pound, will no doubt act as a deterrent to any imminent hike in interest rates.

Industrial production rose a stronger than expected 0.4% in May, but the encouraging headline number once again masked worrying weakness in the goods-producing sector.

The upturn was fuelled by a 7.3% surge in oil and gas output, according to data from the Office for National Statistics, but manufacturing output slumped 0.6%, following a 0.4% decline in April.

Although industrial production is on course for a 0.9% rise over the second quarter as a whole, up from 0.2% in the first quarter, manufacturing output is set to fall by 0.3%, representing a further deterioration in the sector's performance after the meagre 0.1% rise seen in the first quarter.

The disappointing trend in the goods-producing sector looks to have persisted into June. The PMI surveys saw the weakest manufacturing output trend for over two years, attributable in part to a faster rate of decline in export orders, which was in turn commonly linked by producers to the strong pound. In recent months, sterling has been running at its highest level since 2008 on a trade-weighted basis.

However, the survey data suggest that the slowdown in the economy is largely limited to the manufacturing sector at present. Both construction and the vast services economy enjoyed rebounds in June, having seen growth slow due mainly to the general election. The Markit/CIPS PMI surveys indicate that the economy looks to have grown 0.5% in the second quarter, up from 0.4% in the first three months of the year.

Policymakers will be reassured that the important service sector continues to drive robust economic growth, especially as there are signs that the upturn is now being accompanied by accelerating wage growth. However, the Monetary Policy Committee will be in no rush to raise interest rates given the signs of weakness in the manufacturing sector and the uncertainty being caused by the Greek debt crisis.

A rate hike later this year remains a possibility, but requires a swift and successful resolution to the crisis in Greece, as well as further sustained growth of the domestic economy and a continued upturn in wages, all of which are by no means guaranteed.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072015-Economics-UK-manufacturing-output-falls-for-second-month-running.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072015-Economics-UK-manufacturing-output-falls-for-second-month-running.html&text=UK+manufacturing+output+falls+for+second+month+running","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072015-Economics-UK-manufacturing-output-falls-for-second-month-running.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing output falls for second month running&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072015-Economics-UK-manufacturing-output-falls-for-second-month-running.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+output+falls+for+second+month+running http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07072015-Economics-UK-manufacturing-output-falls-for-second-month-running.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}