Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 07, 2016

Yield sprouting from dividend stumps

Dividend cuts have surged in the last fiscal year, but many firms slashing their payments have seen their shares fall by a greater amount than their dividend cut, meaning the "dividend stump" - what remains of the dividend after its cut - means that their forward dividend yield is actually higher than the pre-cut level.

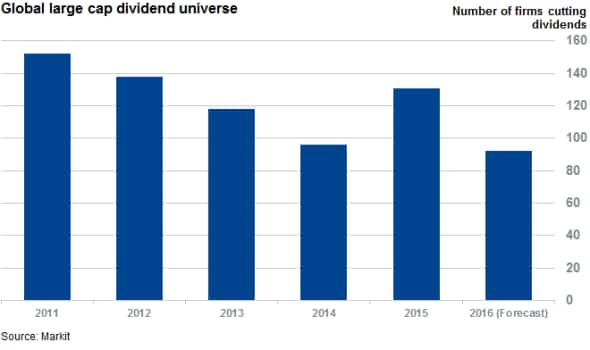

- Over 130 large cap firms have cut their dividends for fiscal 2015, most since 2012

- Over a third of those firms now trade with a more attractive yield, despite cutting payments

- French utility EDF is the most attractive stump with a 12% forecasted forward yield, albeit at high risk

The lacklustre dividend environment has opened up the door for canny yield investors to take advantage of the fact that many of the companies cutting dividends have cut payments by a smaller margin than the fall in their share price. While dividends cuts among the ~1,500 global names which make up the Markit large cap dividend universe are running at a multiyear high, over a third of the 130+ companies in that universe that trimmed their dividend payments in 2015 fiscal year have seen their shares fall by a greater margin.

This means that the trailing dividend yield offered by these shares has increased over when both sides of the yield equation are factored in.

Yield hungry investors looking to take advantage of these attractive looking stumps need to beware however, as dividend cuts often precede further bad news for future payments. This is forecasted to be the case in 21 of the 49 shares in the Markit large cap universe which currently meet the dividend stump criteria.

In fact all seven US listed shares which have cut their dividend payments in fiscal 2015 and currently trade with a more attractive dividend yield than 12 months ago are set for further cuts, according to the latest forecast from Markit's dividend forecasting team. The most extreme case is seen in pipeline company Kinder Morgan which is forecast to cut its payment by two thirds in fiscal 2016, compounding a 7.8% fall in per share payment in the last fiscal year. This means that the firm's forecasted 12 month dividend yield stands 2.8%, less than a third of its trailing 12 month yield of 9.1%.

While dividends can fluctuate widely with firms cutting their payment, Markit is forecasting flat or increase per share payments in 28 of the 49 current dividend stumps.

These include French utility firm EDF. The company has cut its dividend payment by 12% in fiscal 2015, the latest dividend forecast is for the company to maintain its "1.1Eur per share payment for the next 15 years, which makes its 11.6% forward yield sustainable on an ongoing basis. However, the French government is currently involved in a recapitalisation; so the juicy yield comes with a high risk.

Other firms with high forecasted yields which meet the dividend stump criteria include Italian insurer Unipol and Swedish bank Swedbank, which are both forecast to yield more than 7% in the coming 12 months.

Asia provides the majority of dividend stumps with five Taiwan firms among the ten dividend stumps set to yield more than 5% in the coming 12 months. This list is led by Radiant Opto-Electronics which is forecast to yield 7% in the next 12 months. The firm is set to increase its dividend payment by a quarter in fiscal 2016. However like many other dividend stumps the projected yield comes with risk, in this case due to the slowing demand for Apple devices

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042016-Equities-Yield-sprouting-from-dividend-stumps.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042016-Equities-Yield-sprouting-from-dividend-stumps.html&text=Yield+sprouting+from+dividend+stumps","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042016-Equities-Yield-sprouting-from-dividend-stumps.html","enabled":true},{"name":"email","url":"?subject=Yield sprouting from dividend stumps&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042016-Equities-Yield-sprouting-from-dividend-stumps.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Yield+sprouting+from+dividend+stumps http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042016-Equities-Yield-sprouting-from-dividend-stumps.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}