Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 06, 2016

UK leads meagre Q2 dividend haul

Global dividend growth is set to continue cooling in the second quarter as the commodities slump feeds through to firms' dividend policies.

- Russian dividend woes mean European yoy Q2 dividends payments will be 7.5% lower

- The pace of US large caps dividend growth has halved in the last 12 months with c

- UK bucks the trend with FTSE 350 payments made in Q2 forecast to grow by 11%

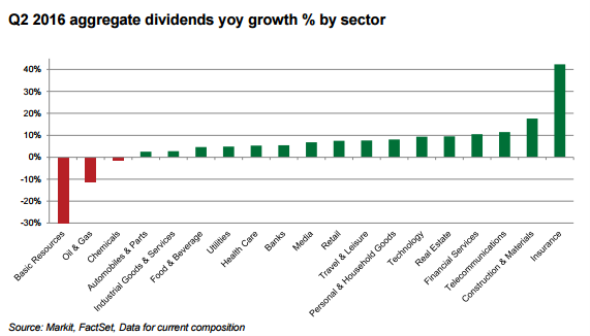

The global commodities slump and the woes faced by firms forced to address this new reality have filtered through to dividend policies. This means that payments made by firms in basic resources and oil and gas sector across world are set to cloud dividend payment in the second quarter, with firms in both the US and Europe feeling this trend according to the Markit's latest dividend forecast.

In the US, both basic resources and oil firms are set to trim their aggregate dividend payments by double digits in percentage terms, with a 30% and 11% fall in aggregate Q2 dividends payments respectively.

The large fall in the basic materials sector is driven by the Freeport-McMoRan dividend suspension as the firm was responsible for a third of the sector's dividend haul.

The falling dividend total from oil firms is of great significance given that the sector is the fourth largest contributor to the aggregate dividend haul in the second quarter.

While the 16 remaining non-commodities exposed sectors are still set to grow dividends in the coming quarter, the aggregate dividend payments made by large cap US firms in the second quarter, $104.7bn, will mark 5.2% growth on the same period last year. This marks a halving of the growth rate seen in Q2 of last year when dividends grew by 11.7%.

The commodities-driven upheaval is also set to make a dent in Europe's second quarter dividends as payments made across the region are actually set to fall by 7.5% to "27bn in the coming quarter.

Russian firms are set to be the main protagonists of the disappointing second quarter dividend haul as the country's economy struggles to deal with the demise of its biggest economic driver and the impact on the ruble. This is of particular importance for the coming quarter as Russian firms are the largest source of European dividends in the second quarter. Russian firms are forecast to pay around 20% less dividends in euro terms than at the same time last year.

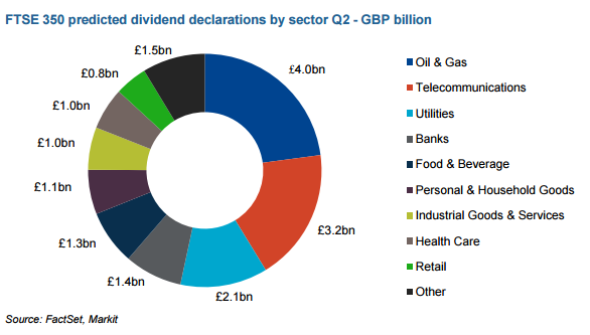

The one relative bright spot in second quarter dividends is the UK where constituents of the FTSE 350 index are set to pay "17.2bn of dividends in the second quarter, 11% higher than in the same period 12 months ago.

While this trend may look encouraging at first glance it's worth noting that the increase is largely technical only. Many of the index's constituents set dividend payments in US dollars and at least a third of the increase in payments is driven by the falling value of the pound over recent months.

Another large contributor to the increase in payments has been the fact that Royal Dutch Shell makes a larger part of the index after its purchase of BG Group closed in February. This could be a double-edged blessing however as over a quarter of all FTSE 350 payments will now be paid by oil and gas firms which could be forced to reassess their dividend policies should the oil slump continue.

The other commodities reliant sector, basic resources, will not contribute to the index's dividend haul as Vedanta Resources is not forecasted to pay a dividend in the coming quarter. The company suspended its dividend payments in the closing weeks of last year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Equities-UK-leads-meagre-Q2-dividend-haul.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Equities-UK-leads-meagre-Q2-dividend-haul.html&text=UK+leads+meagre+Q2+dividend+haul","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Equities-UK-leads-meagre-Q2-dividend-haul.html","enabled":true},{"name":"email","url":"?subject=UK leads meagre Q2 dividend haul&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Equities-UK-leads-meagre-Q2-dividend-haul.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+leads+meagre+Q2+dividend+haul http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Equities-UK-leads-meagre-Q2-dividend-haul.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}