Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 06, 2015

Credit markets shudder but firm after referendum

After a resounding "no' vote from the Greek public over the weekend, European sovereign credit trembled but remained resilient while European financials continue to weaken amid the uncertainty.

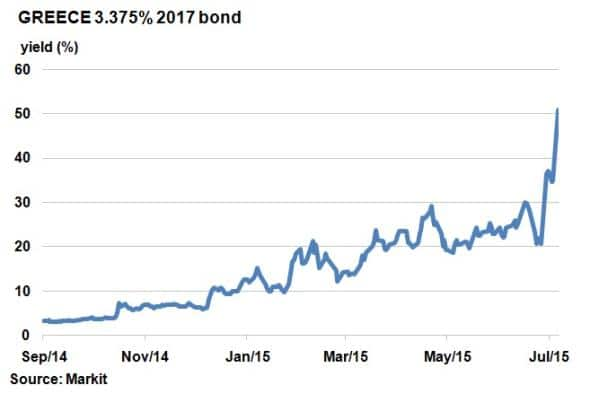

- Greece's 2-yr government bond yield has widened 16%; surpassing 50%

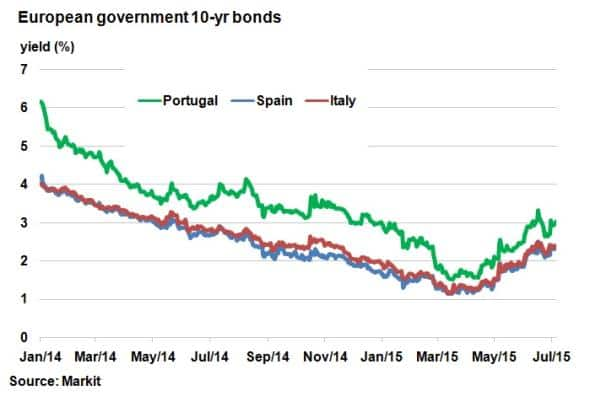

- European periphery sovereign bond spreads are up 3-9bps, signalling a muted reaction

- Markit iTraxx Europe Senior Financials has widened 7bps, highest since March 2014

The Greek referendum concluded with a decisive victory for the Syriza-backed "no' camp, which won over 61% of the vote.

The hope now for Greece's leaders is to go back to the negotiating table with the public behind them. The government has reiterated that it does not want a Grexit, but a swift resolution to the crisis. To ease negotiations, hard-line leftist finance minister Yannis Varoufakis resigned this morning.

But time is running out. Banks remain shut and are running out of money fast as the ECB remains defiant on its Emergency Liquidity Assistance cap. Eurozone leaders will meet on Tuesday to try and thrash out a deal; in the meantime, emergency meetings between the various institutions will be held.

Credit markets muted

Despite the majority of market participants expecting a narrow win for the "yes' camp, credit markets have now settled after an initial negative reaction.

Much of the negative reaction has concentrated on Greek credit. The price on Greece's two year 2017 bond has plummeted. Its yield has now surpassed 50%, according to Markit's bond pricing service; more than double the level seen seven days ago as the market prices in the heightened Grexit risk.

Just as seen last week, European periphery sovereign bond spreads have widened, but nowhere near the levels seen during the contagion in 2011. Portugal's 10-yr bond yield has widened 9bps on the back of the "no' victory, but is actually lower than last Monday's level of 3.06%. A similar trend can be observed in the other two most Grexit sensitive peripheral nations, Spain and Italy.

The diverging economic success of Europe's periphery and Greece since 2011 has had a large part to play in the muted contagion. Portugal, Italy and Spain have enjoyed a pickup in growth and prosperity in recent years which will only help pro-eurozone sentiment among voters. Even if risk among the periphery was to escalate, signals from the market suggest that the eurozone is better armed to handle the situation this time around.

While contagion among European sovereigns remains muted, corporate credit risk has heightened. European high yield credit, as represented by the Markit iTraxx Europe Crossover index, has widened 19bps from last Friday's close of 325bps; the highest level since January 2015.

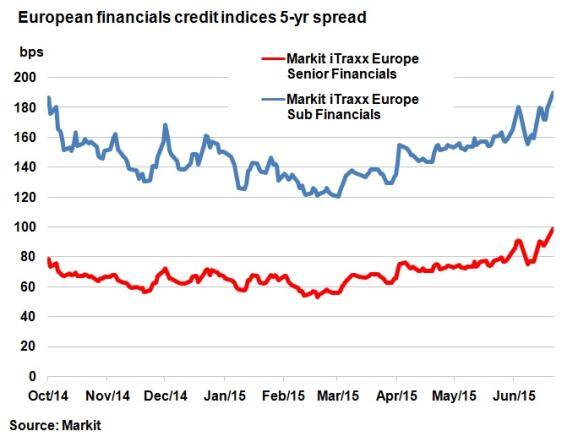

Unsurprisingly, banks' credit was among the biggest deteriorations seen. The Markit iTraxx Europe Senior Financials is at its widest level since March 2014 at 99bps, while the Markit iTraxx Europe Sub Financials is 11bps wider, the widest since October 2014.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-credit-credit-markets-shudder-but-firm-after-referendum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-credit-credit-markets-shudder-but-firm-after-referendum.html&text=Credit+markets+shudder+but+firm+after+referendum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-credit-credit-markets-shudder-but-firm-after-referendum.html","enabled":true},{"name":"email","url":"?subject=Credit markets shudder but firm after referendum&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-credit-credit-markets-shudder-but-firm-after-referendum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+markets+shudder+but+firm+after+referendum http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-credit-credit-markets-shudder-but-firm-after-referendum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}