Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 06, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Over two thirds of timeshare and property group Interval Leisure's shares are short sold

- Stroeer is the most shorted as activist campaign continues ahead of earnings

- Japanese tech giants see short sellers cover as Nikon's dividend expected to be cut

North America

Most shorted ahead of earnings this week in North America is Interval Leisure Group with 38% of its shares currently outstanding on loan. Seeing a significant spike in short interest and the cost to borrow surge in recent weeks, short sellers have been attracted to the non-traditional property and timeshare manager since late 2015. Shares have plummeted by over 43% in the last 12 months.

Featuring again among the most shorted stocks in North America is Lumber Liquidators with over a third of its shares outstanding on loan. While shares have recovered from all-time lows, recent gains have been lost with the stock remaining heavily short sold.

Short sellers have ceased covering of positions in specialist consumer debt recovery firm, Encore Capital Group. A 60% surge in the firm's shares since the end of January seems to have now lost momentum but despite the recent covering, a third of the company's shares remain short sold.

Shorts have continued to target Badger Daylighting since making an appearance in the most shorted last March. Shares outstanding on loan have increased by threefold since then; reaching 30% currently and shares have fallen by a quarter in the last 12 months.

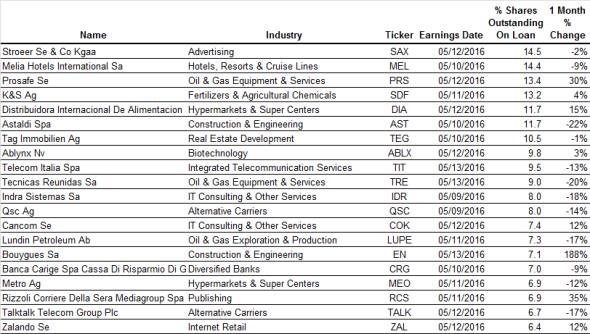

Europe

Most shorted ahead of earnings in Europe is Stroeer with 14.5% of shares outstanding on loan. Shares in the company plummeted by 18% on a single day in April 2016 after activist short seller Muddy Waters published a report outlining their campaign against the firm. Since then short interest and the company's shares have remained stagnant, with the company releasing a press release highlighting that Stroeer's business outlook is in fact "excellent".

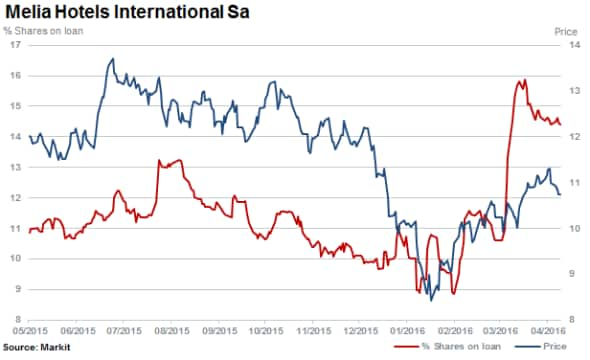

Second most shorted in Europe is Melia Hotels International with 14.4% of shares outstanding on loan. Short sellers have tracked Melia's rallying share price since January but accelerated their build up in positions towards the end of March with short interest levels surging by a third.

Oslo listed owner/operator of semi-submersible accommodation vessels used in offshore energy operations Prosafe, is the third most shorted company ahead of earnings this week in Europe. Shares of the firm have tumbled in the past 12 months falling almost 90% with short interest climbing fivefold to 13.4%.

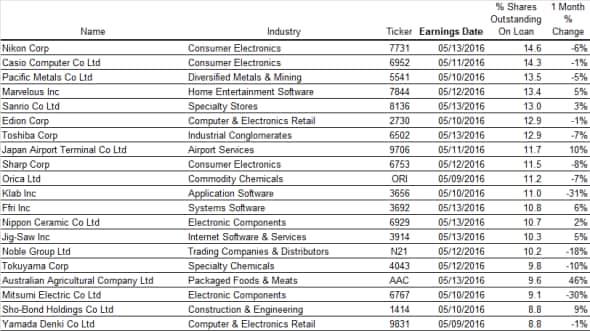

Apac

Most shorted ahead of earnings in Apac is Japanese consumer electronics giant Nikon, with 14.6% of its shares outstanding on loan. Shares have fallen by 5% year to date while short sellers have covered almost 40% of positions.

Markit Dividend forecasting currently expects a 63.6% cut in the upcoming dividend for Nikon (as guided) which would cut the FY16 full year dividend in half. This is after the company guided for a maintained dividend last year but subsequently earnings slumped as a result of poor operating results and impairment losses.

Joining Nikon is iconic electronics manufacturer Casio with 14.2% of its shares outstanding on loan. Short interest spiked in February, reaching 19% of shares outstanding on loan however in a similar trend to Nikon, after seeing resurgent short interest in 2015 short sellers have covered large proportions of their positions with Casio shares falling 30% year to date.

Lastly featuring as the most shorted in Apac in November 2015 and taking third place ahead of earnings in Apac this week is Pacific Metals with 13.5% of shares outstanding on loan. On a 12 month basis, short interest has risen over 50% with the stock price moving sideways in the nickel and stainless steel producer.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}