Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 06, 2016

Keep on TruPin

The Trust Preferred CDO market is showing signs of life following eight years of dormancy post financial crisis.

- Spreads remain elevated but have tightened in April

- Fitch & Moody’s have upgraded the ratings on numerous outstanding tranches

- TruPS new issuance sparks to life with the first deals since 2008

The pronounced sell off in high yield credit witnessed over the past several months was also keenly felt in the securitized credit market, with broad-based widening across all sectors as investors fled to safe harbour assets.

Trust Preferred Collateralised Debt Obligations (TruPS CDOs), a securitized product backed by the preferred trust securities of banks, insurance companies and Real Estate Investment Trusts (REITs), have been equally impacted by the risk-off sentiment of market participants. However, despite the recent fallout, TruPS CDO activity has begun to rebound due a marked improvement in underlying collateral performance and an uptick in primary issuance.

Spreads widen

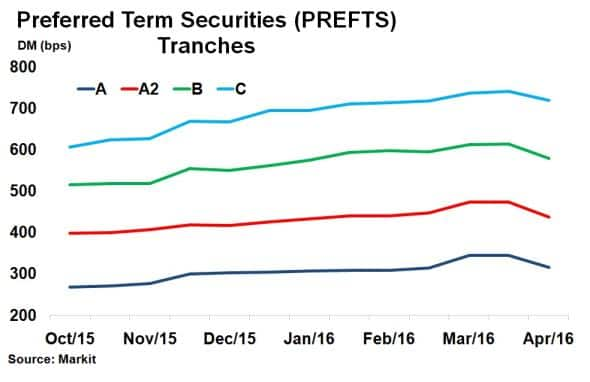

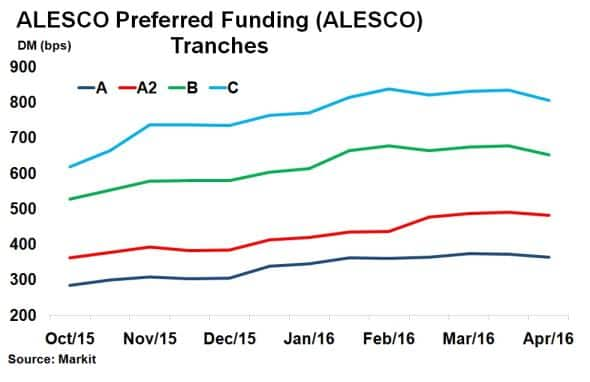

TruPS CDO trading volume fell sharply in late-2015, as money managers shifted their focus from the space amid global capital market volatility. Such aversion to the asset class resulted in material widening, as exemplified by activity seen in specific TruPS CDOs.

Market colour collected by Markit’s Parsing service found PRETSL 10-B3 to have covered in the mid-40s price range in late-April 2016 – six points off its low-50s cover in October 2015. Furthermore, PRETSL 22-A1, an Aa2-rated front-pay bond, covered in low/mid-70s this past week – notably below its mid-70s cover a year previously.

Such spread movements have, consequently, resulted in dealers lowering their offer levels. ALESCO 8-A1B is currently being offered in mid-70s, having been offered in the low-80s just a year earlier. Similarly, TRAP 2006-11A-A3 saw its offer price reduced from mid-50s to high-40s over the same period. There have, however, been some bright spots in the market, KDIAK 2006-1A A1 traded in the high-90s last month, up from its low-90s cover in June 2015.

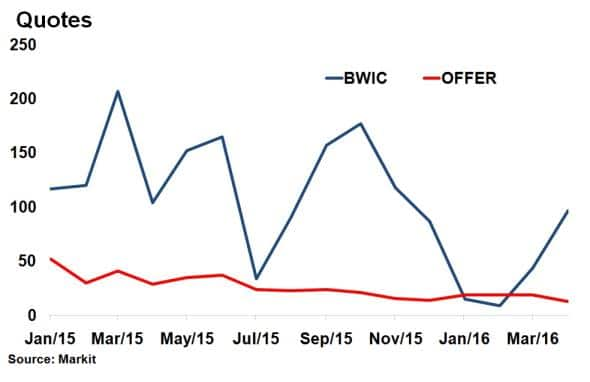

Bid Wanted in Competition (BWIC) lists, which are submitted to dealers via investors, have seen lacklustre activity so far this year. Despite sporadic trading, notably in late-April, BWIC volume in 2016 has remained sparse.

Improved outlook

Still, despite the recent selloff, the underlying collateral performance of TruPS CDOs has generally, improved. According to analysis from Markit’s Securitized Products Pricing service, Moody’s and Fitch have taken ratings action on 158 tranches since the beginning of the year; affirming 96, upgrading 48, downgrading ten and withdrawing four.

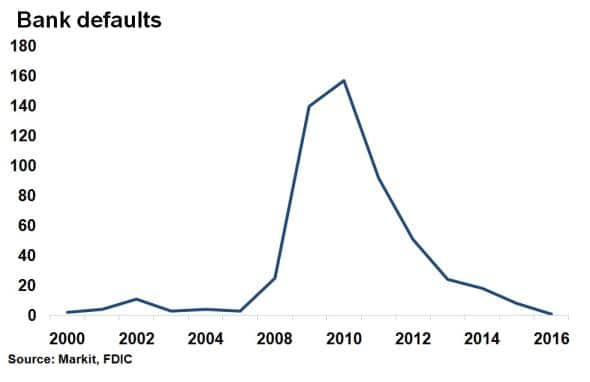

This surge in rating upgrades can be directly attributed to banks’ performance following the financial crisis. US bank defaults have recently returned to historic lows after a period of high defaults since 2008. This has helped to improve the speed at which underlying payment deferrals have cured, which has outpaced those which are defaulting or deferring. Collateral prepayments, default recoveries, along with the increase in cures, and corresponding decrease in deferrals, have resulted in larger principal payments to senior tranches. The payments have helped cure failing triggers, which previously diverted cash flows scheduled for tranches lower in the capital structure.

Recently, deals ALESCO 13 and ALESCO 17 cured their respective Class B OC triggers, which in turn resumed payments to the their C1 and C2 tranches for the first time in over six years. While this has been viewed in a positive light, it can lead to adverse concentrations in the remaining underlying securities which may comprise the deal’s collateral.

So far through 2016, we’ve observed a 5-part deal liquidation for SOLOSO CDO 2005-1. As well as scheduled collateral auctions, notably for ICONS, IPRETSL 4, and Dekania 1 which are due in May.

Issuance comes to life

While performance has improved since the financial crisis, the TruPS market has experienced muted issuance since 2008. However, since late 2015, three new TruPS deals have come to market.

StoneCastle issued the first new deal; Community Funding CLO, a $250m deal fully backed by trust preferred notes comprised of 38 notes from various US community banks. EJF Capital’s affiliates have also had two new issuances. Financial Institution Note Securitization 2015-1, a $229m deal backed by 30 notes from 22 regional banks. Trust Preferred Insurance Note Securitization 2016-1, a $354m deal which is backed by 46 loans from 41 insurance companies. Both 2015 issued deals offered fixed rate tranches, TruPS CDOs have historically been floating rate.

The new deals provide improved transparency compared to their predecessors, offering full details of the bond’s collateral makeup. Legacy issued deals kept the makeup of underlying securities private, with only bond holders having access to the collateral details.

Industry chatter over the past few months has increased, with participants expecting more new issuance throughout 2016. This is due to the positive market reaction of the three deals mentioned above, along with the encouraging rating actions and improved collateral performance.

TruPS CDOs offer investors attractive yields, while also providing additional benefits to issuing community banks and bond holders. Securitization of these assets allows regional banks to access tier 2 capital. TruPS CDOs also have regulatory advantages, since bonds issued prior to May 2010 for bank holding companies with less than $15bn are considered as Tier 1 capital under BASEL III (limited to 25%, with the remainder being considered as tier 2 capital).

Markit’s Securitized Products Pricing service provides independent evaluated pricing, sector level time series and transparency metrics across agency pass through, agency CMO, non-agency RMBS, consumer ABS, European ABS, CMBS, TruPS, CDO and CLO asset classes. For further information please email:

usabspricing@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Structured-Finance-Keep-on-TruPin.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Structured-Finance-Keep-on-TruPin.html&text=Keep+on+TruPin%27","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Structured-Finance-Keep-on-TruPin.html","enabled":true},{"name":"email","url":"?subject=Keep on TruPin'&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Structured-Finance-Keep-on-TruPin.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Keep+on+TruPin%27 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-Structured-Finance-Keep-on-TruPin.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}