Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 06, 2016

Scandinavians lead European airline shorts

Shielded by declining oil prices, traditional European airlines join Scandinavian carriers being targeted by short sellers while short haul budget carriers are ignored.

- Scandinavian carrier SAS currently the most shorted airline in Europe

- Norwegian Air's long haul ambitions attract short sellers despite shares and business gains

- Shorts abandoned bulk of Air France KLM positions prior to CEO departure

SAS and Norwegian Air Shuttle lead European airline shorts as the benefit of lower oil prices on earnings fades, rewarding short sellers staying the course.

The lowest fuel costs seen in almost two years have provided a bump in airline earnings. Sustained lower oil prices have seen now seen airlines once again actively hedging their energy exposure.

Established long haul airlines have for some time been squeezed by larger legacy cost bases, less efficient fleets, labour issues and fierce competition (in particular from long haul - Middle East carriers). Combined with the success of short haul budget airlines in past decades, revenue and earnings growth at traditional airlines has remained mostly grounded.

Low cost budget airlines Easyjet and Ryanair are for now flying below short seller's radars but ambitious low cost long haul carrier Norwegian Air has been targeted as of late. The most shorted European airline however is Norwegian Air's rival SAS with 13.4% of its shares currently sold short.

SAS shares have fallen 7% thus far this year after posting a strong rally in 2015 which saw short sellers double down and increase positions by almost two fold. SAS recently released earnings for the company's first and "seasonally weakest quarter" for 2016. Figures were improved on a year-on-year basis however, were boosted by lower jet-fuel costs and cost cutting measures.

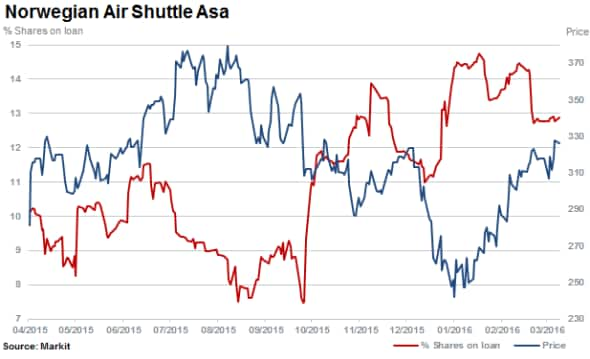

The second most shorted European airline is Norwegian Air with 12.9% of its shares outstanding on loan. Short sellers have however again covered positions in the stock since the end of January, reducing positions by almost a third as shares rallied 30%. The company posted strong overall earnings for 2015, benefiting from market share gains and lower fuel costs.

With 10.7% the third most shorted airline in Europe is Deutsche Lufthansa whose shares have come under recent pressure after an impressive recovery staged in late 2015. Shares have fallen as the company reported higher than expected costs caused by labour issues, including strikes and a cabin modernisation programme.

Unable to improve Air France-KLM's competitive outlook, the firm's CEO just stepped down after three years battling trade unions and declining profitability. Shares have tumbled in reaction to the news but short sellers had already abandoned more than half of their positions in the stock since late 2015.

Short sellers retreated as Air France KLM shares (like Deutsche Lufthansa) benefited from rising earnings with shares rising almost 40% since October 2015. These movements were driven by improved earnings, which were predominantly driven by lower fuel costs.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-equities-scandinavians-lead-european-airline-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-equities-scandinavians-lead-european-airline-shorts.html&text=Scandinavians+lead+European+airline+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-equities-scandinavians-lead-european-airline-shorts.html","enabled":true},{"name":"email","url":"?subject=Scandinavians lead European airline shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-equities-scandinavians-lead-european-airline-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Scandinavians+lead+European+airline+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-equities-scandinavians-lead-european-airline-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}