Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 06, 2016

German economic growth remains sluggish amid near stagnation of manufacturing

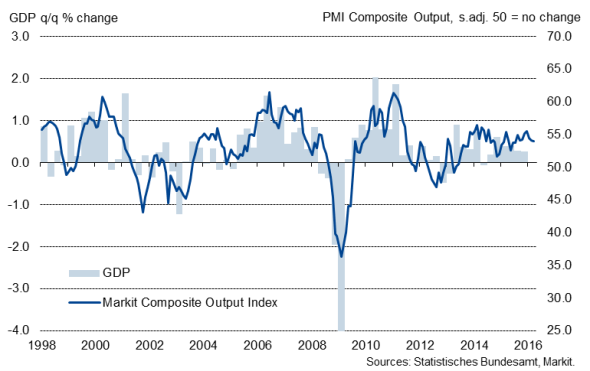

Germany's composite Output Index (produced by Markit from its manufacturing and service sector surveys) fell to an eight-month low of 54.0 in March, pointing to a slowdown in economic activity at the end of the first quarter. The survey data are nevertheless still signalling modest, albeit unspectacular, GDP growth of approximately 0.4% in the opening quarter of 2016.

Modest GDP growth signalled

Worryingly, the forward-looking indicators suggest that growth could slow even further in coming months. The amount of new work received by businesses rose at the weakest rate since last August, which in turn resulted in a more cautious approach with regards to hiring. Although employment continued to rise during the month, the rate of job creation equalled February's near one-year low, with goods-producers cutting payroll numbers for a second consecutive month. Moreover, levels of work outstanding rose only marginally, which could lead to a further slowdown of jobs growth in coming months.

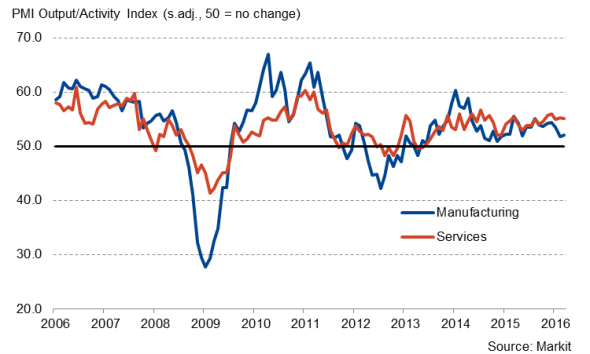

Service sector grows solidly, manufacturing stuck in low gear

Germany's mighty service sector continued to grow at a steady pace throughout the first quarter, leading the economy's expansion, although failed to gain traction from prior months. There have been reports recently from survey participants that the large inflow of refugees led to increased activity, especially with regards to building new shelters. This development was also reflected in recently strong construction PMI numbers, with the index reaching its highest level since the first quarter of 2011 in February, before slowing in March.

Meanwhile, the manufacturing sector grew at a snail's pace during the past two months, thereby highlighting how the sector is struggling in an uncertain global economic environment. Despite ticking higher from February's 15-month low, at 50.7, the PMI signalled a near-stalling of manufacturing.

Steady services growth contrasts with weak manufacturing

Although the announcement of more aggressive ECB stimulus temporarily weakened the euro against the dollar, a euro now buys $1.13, up around 7 cents since December.

The strong euro clearly has some negative side effects. First, it makes imports from overseas cheaper, which will add additional downward pressure on inflation and lead to 'import substitution'. Second, exports will be more expensive. This is particularly bad news for Germany's more export-oriented manufacturers, who are already struggling in the current global economic environment. Markit's PMI New Export Orders Index fell to an eight-month low in March, signalling a near-stagnation of foreign sales. With the exception of the marginal decline in July 2015, it was the lowest reading in over a year.

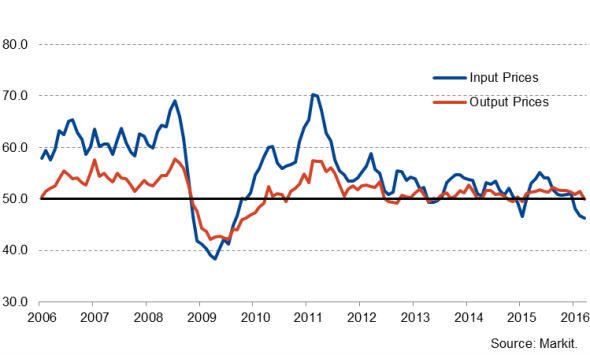

Inflation likely to remain low in coming months

The data highlight a strong likelihood that deflationary pressures may persist for some time. Input prices faced by German companies fell at the fastest pace since the financial crisis, with the low interest rate environment, salary cuts and low prices for energy and raw materials all exerting downward pressure on inflation. Moreover, companies left their selling prices unchanged during March, following a 13-month period of increases.

Although the official CPI measure rose to 0.3% in March, part of this can be attributed to an early Easter date this year, with hotels and retailers raising their prices for the holiday period.

PMI input and output prices

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-german-economic-growth-remains-sluggish-amid-near-stagnation-of-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-german-economic-growth-remains-sluggish-amid-near-stagnation-of-manufacturing.html&text=German+economic+growth+remains+sluggish+amid+near+stagnation+of+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-german-economic-growth-remains-sluggish-amid-near-stagnation-of-manufacturing.html","enabled":true},{"name":"email","url":"?subject=German economic growth remains sluggish amid near stagnation of manufacturing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-german-economic-growth-remains-sluggish-amid-near-stagnation-of-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+economic+growth+remains+sluggish+amid+near+stagnation+of+manufacturing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-german-economic-growth-remains-sluggish-amid-near-stagnation-of-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}