Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 06, 2016

Global manufacturers see worst quarter for almost three years

Global factory growth remained near-stagnant in March, according to PMI survey data. The JPMorgan Global PMI, compiled by Markit from its worldwide business surveys, rose from the no-change level of 50.0 seen in February, but at just 50.5 signalled only a marginal improvement in overall conditions.

The surveys also pointed to falling global trade flows, declining factory headcounts and an ongoing lack of inflationary pressures, albeit with some signs that deflationary pressures may be easing.

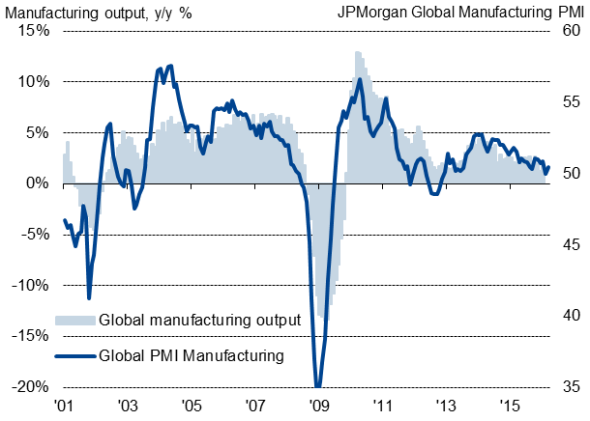

Global factory output growth

Trade-led weakness

Indices measuring output and new orders both rose in March but remained indicative of weak growth. Historical comparisons suggest the latest PMI Output Index reading points to just 1.5% annual global manufacturing production growth.

The export orders index remained especially subdued, pointing to a marginal decline in worldwide trade volumes for a second successive month.

Factory headcounts also fell for a second consecutive month, adding to the downbeat survey picture, often due to companies seeking to cut costs in the face of weak demand and a lack of pricing power. Average factory gate prices fell for a ninth straight month, albeit only marginally.

Some of the drop in prices reflected firms passing on lower costs, as average purchase prices dropped for a seventh month in a row. However, with oil prices edging higher during the month, the drop in costs was the smallest seen over this period.

With suppliers' delivery times - a key gauge of demand and supply imbalances - largely unchanged once again during the month, the surveys meanwhile indicated a lack of demand-pull inflationary pressures in global supply chains.

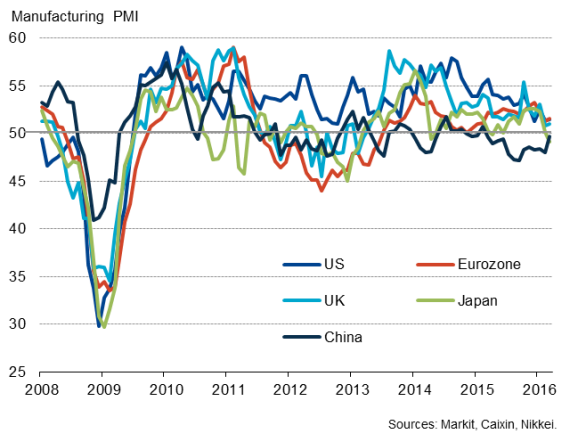

The recent bout of weakness has been led by emerging markets, though the Emerging Market PMI at least showed a stabilisation of manufacturing for the first time in a year in March, aided in particular by a welcome easing in the rate of decline in China to the weakest for just over a year.

In the developed world, manufacturing growth meanwhile remained close to stagnation on the whole, unchanged on the 32-month low seen in February.

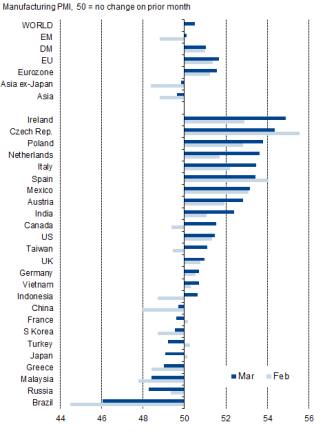

Worldwide manufacturing PMI rankings

Manufacturing contracts in nine countries

Drilling down further, of the 25 countries covered, only nine saw a deterioration of manufacturing conditions in March (as signalled by a sub-50 PMI reading), unchanged on February.

The steepest downturn was again seen in Brazil, where an ongoing severe decline continued to be recorded despite the PMI rising from February's low, followed by Russia.

In fact, six of the nine deteriorating manufacturing economies were emerging markets. The only developed world nations seeing a decline were Japan - where the stronger yen combined with weak demand to push the PMI to its lowest for just over three years - and eurozone stragglers France and Greece.

The divergent trends within the eurozone were highlighted by Ireland taking top spot at the head of the rankings from the Czech Republic, the former being one of four eurozone countries featuring in the top six places.

Manufacturing growth over the whole of the eurozone remained disappointingly modest, however, dragged down in particular by poor performances in Germany and France. Similarly, only weak growth was recorded in both the US and the UK, with both countries also showing signs of malaise spreading from manufacturing to services.

Key economies

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Economics-Global-manufacturers-see-worst-quarter-for-almost-three-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Economics-Global-manufacturers-see-worst-quarter-for-almost-three-years.html&text=Global+manufacturers+see+worst+quarter+for+almost+three+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Economics-Global-manufacturers-see-worst-quarter-for-almost-three-years.html","enabled":true},{"name":"email","url":"?subject=Global manufacturers see worst quarter for almost three years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Economics-Global-manufacturers-see-worst-quarter-for-almost-three-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturers+see+worst+quarter+for+almost+three+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-Economics-Global-manufacturers-see-worst-quarter-for-almost-three-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}