Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 06, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Oil hedging no saviour to Comstock as short interest hovers above 40%

- World's oldest bank BMPS sees 175% increase in shorting as capital adequacy ratios force equity issuance

- Hello Kitty maker and iron ore recycler most shorted in APAC

North America

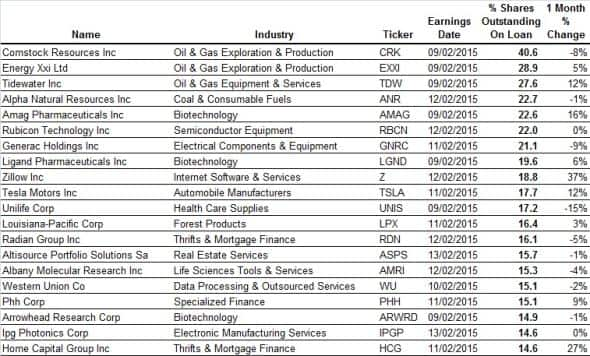

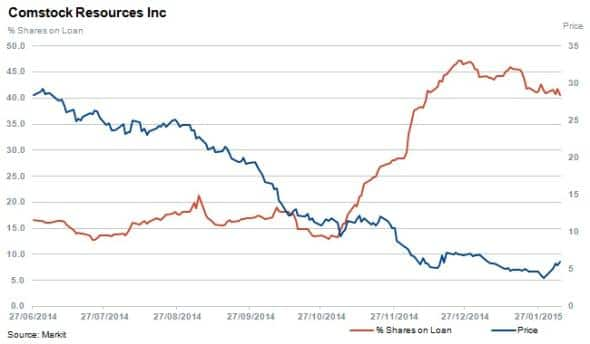

Oil & Gas firms feature prominently among short sellers' favourites this week within companies reporting earnings. Leading the pack is Comstock Resources with 40.6% of shares outstanding on loan.

The stock is down 80% compared to 12 months previously. The company's results, like others in the sector, have been impacted by sustained low oil prices over the last quarter. Comstock's Q3 results for 2014, which cumulated in a net loss, reveal that 56% of oil production was hedged at $95 per barrel. The hedging policy if continued though Q4 may have cushioned the blow as oil plummeted below $50, but consensus forecasts point to a fourfold increase in losses for the fourth quarter.

Other Oil & Gas companies with significant short interest include Energy Xi and Tidewater with 28% and 27.6% of shares outstanding on loan respectively. Both firms have seen significant increases in short interest in tandem with hefty share price declines over the last six to 12 months.

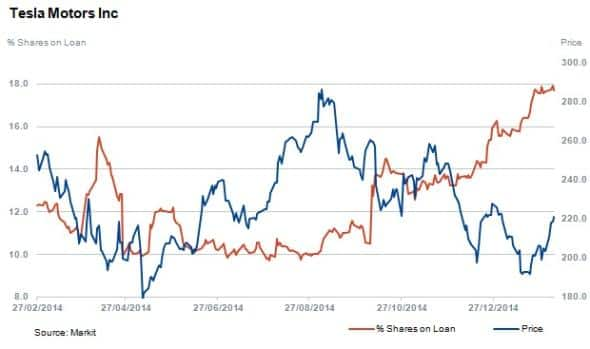

Other notable examples of firms seeing interest in the last month include Zillow and Tesla. Zillow is in a protracted takeover deal with rival Trulia and electric car manufacturer Tesla is tempering investor's expectations as the highest levels of short interest are reached in over 12 months. While full year sales figures for Tesla are expected to almost double, investors had expected more and priced in more growth. Short sellers have increased positions to 17.7% of shares outstanding on loan. The company also faces looming competition as traditional car makers start to make real efforts to enter the electric category.

Western Europe

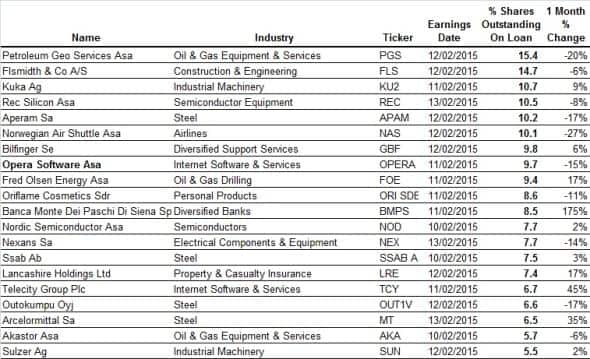

In Europe the world's oldest bank, BMPS, saw a 175% increase in short interest levels. Bets against the firm rose to 8.5% of shares outstanding on loan on news that the company would need to raise €3.5bn, one billion more than previously thought to improve the bank's capital ratios. The bank was one of the 25 lenders that failed ECB stress tests in October 2014 which revealed a capital hole in the Italian financial system.

Nordic firms featuring in the most shorted ahead of earnings include Norwegian Air Shuttle and Rec Silicon. Norwegian Air Shuttle has recently seen short sellers cover as shares outstanding on loan decreased by 43% over the last three months as the share price increased by 32%. The discount airline is benefiting from efficient aircraft and the lower oil prices. Rec silicon has 10% of shares outstanding on loan as the company's solar panel subsidiary is in a pending sale.

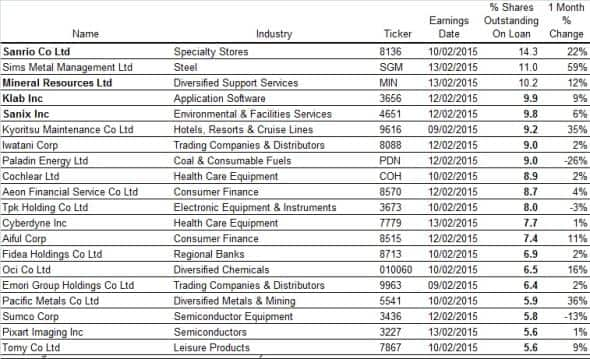

Most shorted in APAC is Tokyo based character goods and merchandise manufacturer Sanrio. Most well-known globally as the Hello Kitty brand, the company saw a 22% increase in short interest over the last month to hit 15.4%.

The company changed strategy last year to manufacture and sell more of its own goods as opposed to selling licences.

Second most short sold in the region is global waste and metals recycling group Simms Metal Management. Based in Australia, Simms has seen a 59% increase in short interest in the last month with 11% of shares outstanding out on loan. Two thirds of the firm's sales are exposed to ferrous metals recycling, whose prices have been falling dramatically. Iron ore prices, like oil prices, are now touching five and half year lows.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}