Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2017

Week Ahead Economic Overview

Updated industrial production and unemployment data in the eurozone will be among the main highlights of next week's economic data releases, providing a steer for ECB policy. Elsewhere, US retail sales data will be eyed for clues as to the timing of the next Fed rate hike and UK construction, trade and industrial output numbers will be closely watched for signs of any Brexit impact. Finally, the Central Bank of Brazil decides upon its latest course of monetary action for South America's largest economy.

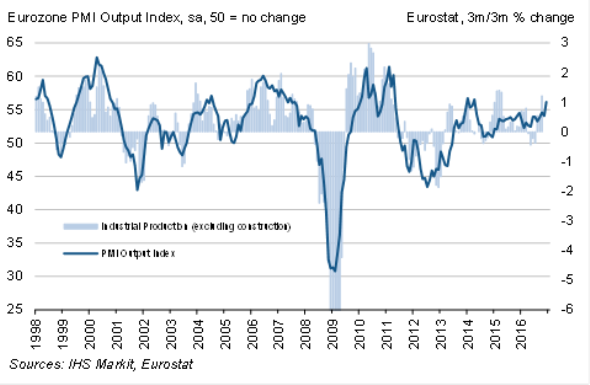

The end of 2016 offered some good news for eurozone policymakers, as PMI survey data signalled the strongest improvement in manufacturing conditions since April 2011. With survey data looking strong, next week's update on the euro area industrial production numbers are expected to pick up from the 0.6% annual growth recorded for October and maintain this momentum throughout the start of the new year.

Industrial Production vs Eurozone PMI

The release of the latest euro area unemployment rate will also provide insight into the health of the eurozone's economy. The labour market has been consistently strengthening in recent years, with October's unemployment rate of 9.8% the lowest since July 2009. The consensus is that this figure will continue to fall when an update is provided next week. This trend is mirrored by survey data, which signalled the fastest rate of job creation for over five years over the fourth quarter of 2016.

Over in the US, the announcement of latest retail sales data will provide important information on consumer spending patterns in the world's largest economy. Retail sales were up only 0.1% on a month-on-month basis in November, weaker than expected as a result of lower motor vehicle sales. Forecasters are pencilling in a 0.4% increase for December, with subdued inflation anticipated to have lifted consumption at the end of 2016.

Meanwhile, the Bureau of Labor Statistics also provides an update on latest US producer prices, with data watchers keeping a close eye on deviations from November's index of 0.4%. Recent survey data has recently shown the steepest rise in prices for goods and services for one-and-a-half years.

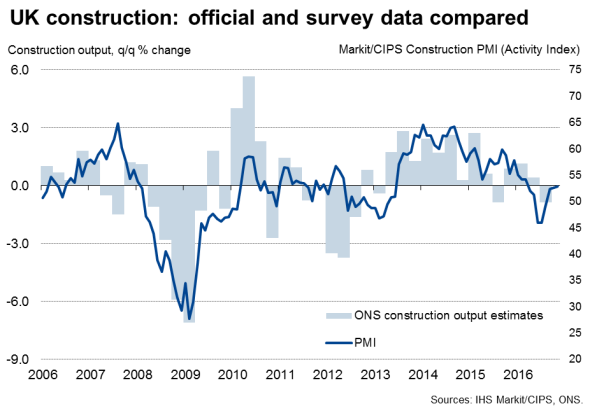

A clearer picture on UK economic performance during the fourth quarter of 2016 will be provided when the Office for National Statistics releases updated construction, trade and industrial output numbers. Signs of the UK construction malaise lifting during the third quarter were evident when revised official data indicated a smaller than previously thought decline in the building sector. Moreover, industrial production is expected to bounce back from October's 1.1% annual decline. The UK manufacturing PMI rose to a 30-month high in December. Eyes will also focus on the trade data for signs that weaker sterling is feeding through to improved export sales.

An update on the landscape of the UK housing market will be available when the latest Halifax House Price Index is issued on Monday. Data watchers will be scrutinizing the release to see if expectations of stalling house price growth comes to fruition.

The Central Bank of Brazil meets next week to determine its latest course of monetary action. Policymakers lowered interest rates to 13.75% at November's meeting, the second successive cut. With inflation at 6.99%, solidly above the bank's benchmark target of 4.5%, and both the manufacturing and services sectors in sustained downturns, another rate reduction could be on the cards.

Other important releases include inflationary figures in China, with the consumer price index expected to stick at the 2.3% annual increase reported for November. Meanwhile, Spanish and Greek inflation data will be analysed for signs of a pick-up in the eurozone inflation rate.

Monday 09 January

The week starts with an update on the Australia-AIG Construction Index.

In Germany, the Netherlands and Greece, the latest industrial production figures are announced, while German trade data are also issued.

The Eurozone unemployment rate will be made available.

In the UK, the latest Halifax House Price Index is issued.

IHS Markit releases Asia, Europe, the US and Global sector PMI data

Tuesday 10 January

Australian retail sales figures are released.

In Japan, the latest consumer confidence index is published.

Inflation data are made available in China as producer and consumer prices indexes are out.

The latest monthly French industrial output numbers are made available.

Brazilian retail sales figures are updated.

Wednesday 11 January

South Africa's business confidence index is issued.

Spanish industrial output numbers are released.

In Greece, an update is provided on its consumer prices index.

The UK sees a number of data releases including construction output, industrial production and the latest goods trade balance.

The Central Bank of Brazil meet to determine future monetary policy, while an update on inflation data is also available.

Thursday 12 January

December bank lending data for Japan is updated, along with latest current account numbers.

An update on Indian industrial output figures are released along with the latest consumer price index.

In South Africa, manufacturing output numbers for November are released.

The release of German GDP figures for 2016 are available.

Monthly and annual updates on Eurozone industrial production data are announced.

Final consumer prices data are issued in France.

The Greek unemployment rate is updated.

Brazilian service sector growth figures are out.

Friday 13 January

Trade data for China and India are made available.

Latest trade figures and retail sales numbers in the Netherlands are issued.

Inflationary figures in Spain are updated with the release of the consumer prices index.

In the US, the Bureau of Labor Statistics issues its latest producer price index, while the latest retail sales figures are also released.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012017-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012017-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}