Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 05, 2016

Most shorted ahead of earnings

A look at how short sellers are positioning themselves in companies announcing earnings in the coming week

- Restoration Hardware has almost a third of its shares shorted ahead of earnings

- Short sellers flee Sports Direct in the lead up to results

- Japanese app designer Morpho sees short sellers triple their bets as its share price halves

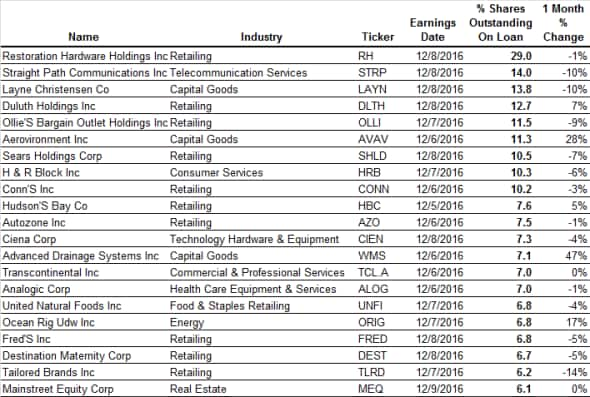

North America

Next week is relatively quiet on the earnings front, but short sellers are still fairly active as this week's relatively small herd of companies announcing results includes 21 firms which see a relatively high 6% or more of their shares out on loan.

Retailers make up the over half of this week's crop of relatively heavily shorted firms, with short sellers holding tight despite the fact that the post-election rally has disproportionally benefited these shares.

Chief among short targets next week is retailer Restoration Hardware, whose current short interest comes in at 29% of shares outstanding, more than twice that of any other firm announcing results this week. Short sellers have zeroed in on Restoration in the wake of a string of disappointing earnings update which have seen the retailer's shares lose two thirds of their value. This strong demand to short Restoration shares has continued unabated despite the fact that its latest earnings update largely outperformed expectations which halted some of their negative momentum.

Other in focus retailers this week include Sears, Saks Fifth Avenue owner Husdon's Bay and Autozone.

The largest jump in short interest leading up to earnings was registered in unmanned drone firm Aerovironment which has seen the demand to borrow its shares surge by a quarter over the last month. Short sellers have more than double their positions in Aero since its last disappointing first quarter earnings update. This trend shows no signs of slowing down despite the fact that the post-election rally, which has boosted defense related shares, has seen Aero recover most of the ground lost in the wake of its last earnings update.

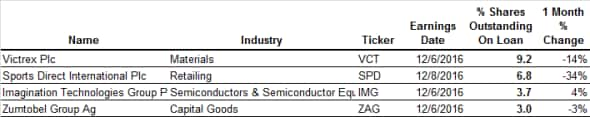

Europe

UK polymer firms Victrex is the highest conviction short target in Europe this week as just over 9% of its shares are out on loan. Victrex whose products serves a diverse range of industry including the energy sector has come to the attention of short sellers over the first quarter volatility and demand to borrow its shares has continued to tick ahead despite the fact that they have recovered most of the ground lost in the opening weeks of the year.

Short sellers haven't shown nearly the same resolve in Sports Direct, the second most shorted company announcing earrings in Europe this week. Short appetite heading in Sports Direct has nearly collapsed in the last four weeks as the proportion of its shares out on loan has fallen by a third.

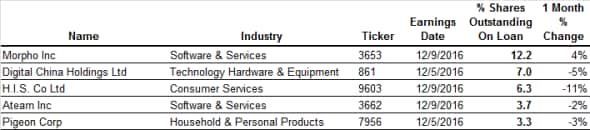

Asia

The only company to see significant short interest out of the company announcing earnings in Asia this week Japanese app developer Morpho. Short sellers have steadily increased their bets in Morpho as its shares lost half their value from their all-time highs set back in April. This poor momentum saw demand to borrow Morpho shares triple in the last six months.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}