Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 05, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the coming week.

- Firms heavily exposed to oil's recent fall comprise two of the three most shorted companies head of earnings

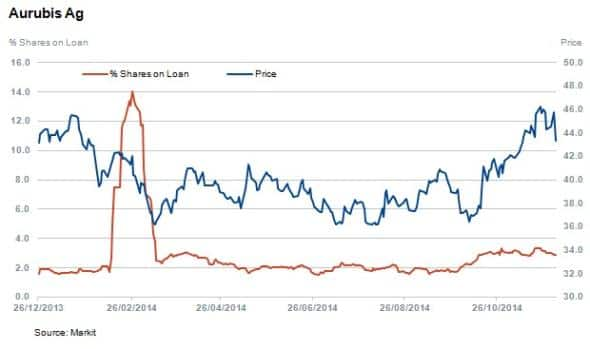

- Steel firm Arubis is the only firm to see more than two per cent of shares on loan ahead of earnings in Europe

- In Asia, two firms see more than 3% of shares outstanding ahead of earnings

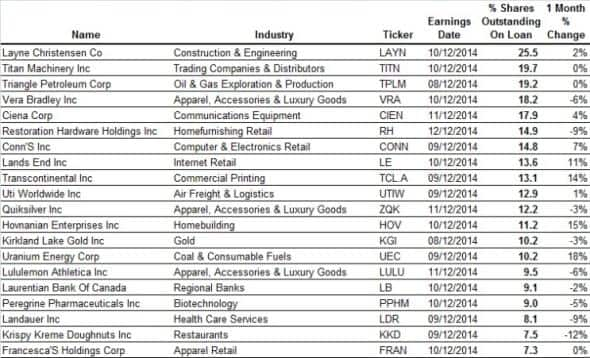

North America

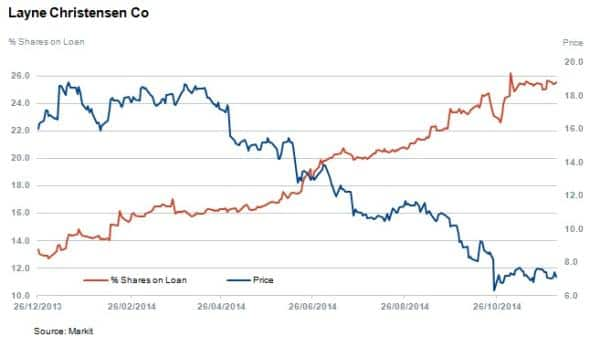

Topping this week's list of heavily shorted shares announcing earnings is US company Layne Christensen. The firm provides water management solutions and other civil engineering related services to the civil, energy and mineral industries.

The increased demand to borrow shares comes as energy and minerals firms, which are vulnerable to low oil prices, reduce their capital spend in the wake of plunging oil prices. This has resulted in a contraction in projected spend, with Layne's shares falling 57% year to date while shares outstanding on loan has increased to a yearly high of 26%.

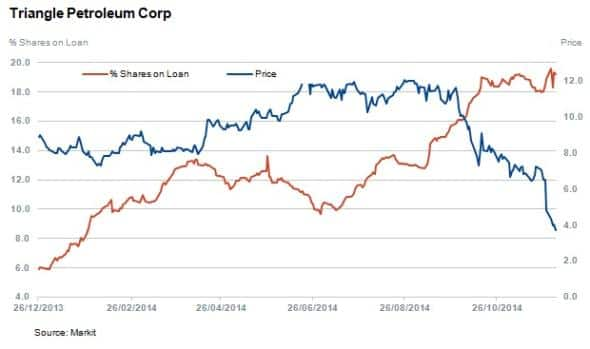

Third most shorted in the US ahead of earnings is Triangle Petroleum, a Nova Scotia based oil and gas exploration company - yet a another "loser' in the oil price wars that continue to play out globally. The share price is down over 50% year to date with shares outstanding on loan at 19%.

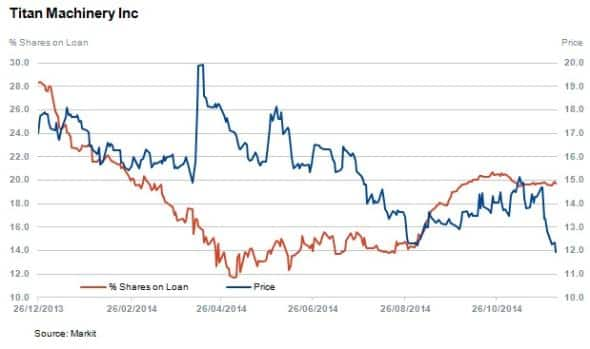

According to the US department of Agriculture, farming profits are expected to fall this year after a record 2013 after buoyant commodities prices.

Titan Machinery supplies products and services to the agricultural and construction sectors, specifically tractors and bulldozers. Titan reported a disappointing second quarter set of results with decreases in pre-tax earnings, dropping by 50% compared to the same quarter last year. There are currently 20% of shares outstanding on loan.

Lower corn and soybean prices compared to last year have impacted farmer's profits and in turn agricultural related sales, with farmers spending less on equipment purchases.

In November Deere & Co (John Deere) revealed similar trends among its farming clients citing a pronounced decrease in demand with fewer machines sold. Deere's currently has 9% of shares outstanding on loan with a relatively flat share performance year to date.

Branded Apparel retailer Quicksilver has 12% of shares outstanding on loan and the stock is down a dramatic 80% year to date. This continues the theme of teenagers changing tastes; shifting from traditional branded retailers to a growing segment of modern competitors.

Other apparel firms and clothing retailers with large amounts of shares outstanding on loan include; Vera Bradley at 18%, Lululemon Athletica at 9.5% and Francesca's with 7.3%.

Europe

European shorting activity looks relatively subdued for companies reporting earnings in the coming weeks as Arubis is the only firm with more than 2% of shares outstanding on loan at 2.9%. The firm is the largest supplier of precision rolled nonferrous alloy products in Europe. Short interest has remained fairly stable in the second half of the year, with the share price flat year to date.

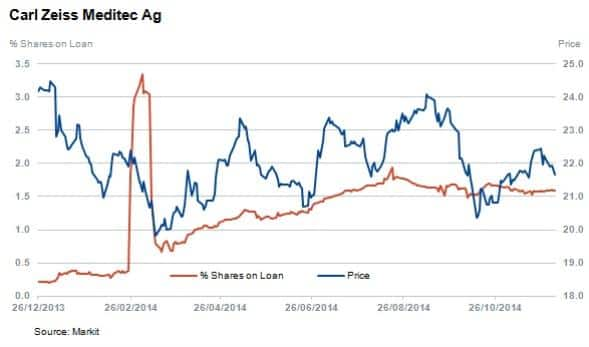

Second most shorted in Europe is Carl Zeiss Meditec, a medical laser and surgery products manufacturer. Short interest is 1.6%, down from 3% highs reached earlier in the year.

Asia Pacific

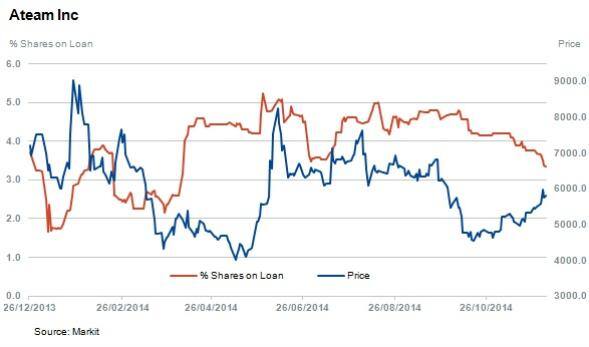

Two Japanese firms, Ateam and 3-D Matrix occupy the top two positions in the region with 3.3% and 3.1% of shares outstanding on loan respectively. Ateam is web and application developer. Short sellers in the stock have covered some 20% their positions in the past few months as the share price recovered.

The third most short in the Asian Pacific region ahead of earnings is Pharmicell with 2.7% of shares outstanding on loan. The South Korean biotech firm is involved in cell therapeutics, stem cell banking and bio-based business and cosmetics.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}