Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 08, 2014

Digging into Canadian ETF outflows

As oil prices continue to decline in the fourth quarter, we assess ETF flows and securities lending data in the region to gauge the impact on equities.

- Canadian ETFs have witnessed $2.5bn of outflows so far this quarter

- Oil slump affecting the region as Brent hits five year lows

- Current growth seen in short interest among oil stocks despite already depressed prices

Using the Markit Canada 500 universe (CAN500) representing the largest 500 companies in the region, two major sectors carry significantly more weight than others. Financials and Energy stocks represent approximately 60% of the Canadian market with the later coming under significant strain in recent months as the price of crude oil plunged and now hovers near $65 a barrel.

Using Markit Research Signals’ Earnings Momentum Model (EMM) for Canada, which is based on the CAN500, reveals that a cumulative return spread of 14.5% could have been achieved shorting companies ranked to underperform the most and accordingly going long those ranked to outperform the most.

The 40% drop in oil prices in the second half of this year to five year lows continues to raises questions on the outlook for energy exposed economies and companies.

ETF flows

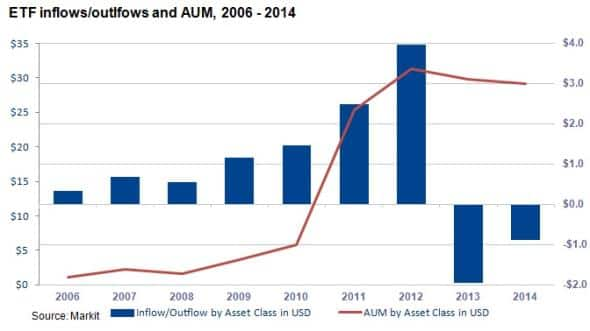

After tremendous ETF inflows into Canadian ETFs occurring between 2010 and 2012, in part due to the doubling of available products, annual AUM in the region peaked at $31bn* in 2012.

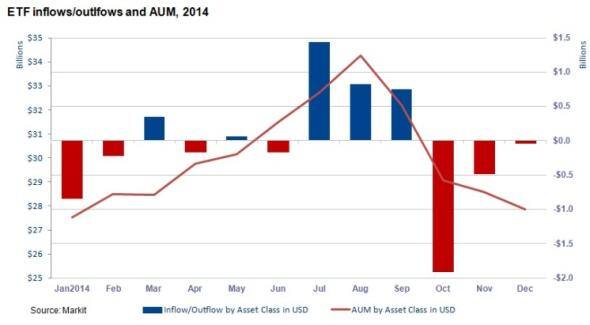

This level was breached briefly during July 2014 as three strong months of inflows occurred and markets rallied. However in the final quarter of 2014 the market has since turned and investors have pulled a cumulative $2.8bn from Canada focused funds to date.

Canadian oil shorts

Canadian oil producers have suffered in a similar vain to that of peers globally against seemingly free falling oil prices. Alternative (high cost) producers, explorers and service providers have been hardest hit as short sellers targeted the most vulnerable front line. We assess increased short interest over the last month in the region as oil price levels continue to touch multiyear record lows.

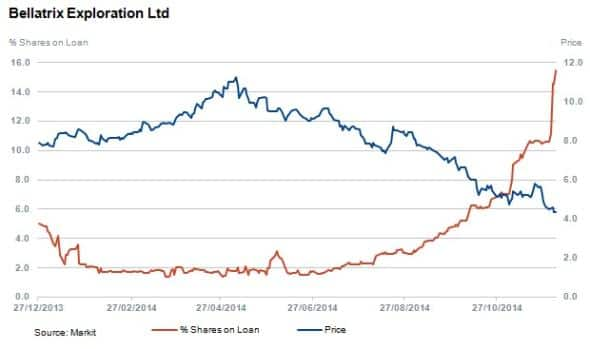

Bellatrix Exploration has seen a 66% increase in shares outstanding on loan in the last month with shares outstanding reaching 15.4%. The share price is down 46% year to date and 10.8% down on the month, which could be either a massive blow, or further opportunity, to the company’s newest and largest shareholder Orange Capital.

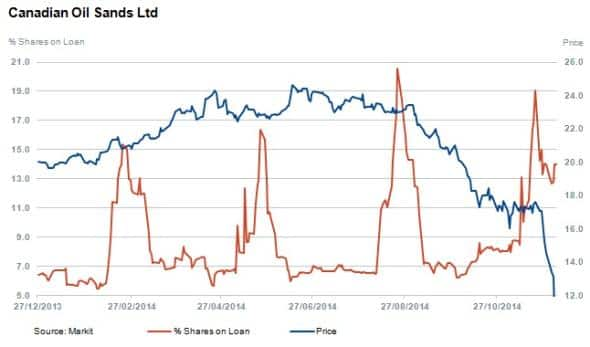

Canadian Oil Sands shares have seen shares outstanding out on loan interest increase by 60% over the last month. The largest among the oil shorts at $4.6bn in market capitalisation, the company is a self-described “pure investment in light, sweet crude oil”. Looking at historical trends, the dramatic increase in short interest could be attributed to dividend related trades taking place however with the corresponding 33% decrease in price over the same period, may indicate short sellers are not confident on short term prospects.

Columbian based Pacific Rubiales Energy is receiving increased attention from short sellers as shares outstanding on loan have increased by 26% over the last month to reach 18.9%. This is the most shorted oil related company listed in the region, and fourth most shorted overall. The share price is down 51% year to date.

The price decline and increased shorting activity follow news that a potential takeover deal from the company’s largest shareholder, Alfa SAB, has most likely been delayed.

*All figures in USD

Relte Stephen Schutte | Analyst, IHS Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Equities-Digging-into-Canadian-ETF-outflows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Equities-Digging-into-Canadian-ETF-outflows.html&text=Digging+into+Canadian+ETF+outflows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Equities-Digging-into-Canadian-ETF-outflows.html","enabled":true},{"name":"email","url":"?subject=Digging into Canadian ETF outflows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Equities-Digging-into-Canadian-ETF-outflows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Digging+into+Canadian+ETF+outflows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Equities-Digging-into-Canadian-ETF-outflows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}