Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2014

Global tech producers lead global growth rankings

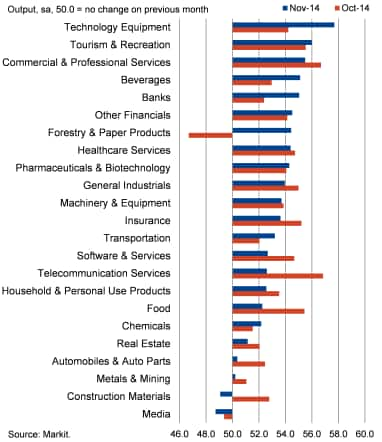

PMI" data from Markit signalled that technology equipment manufacturers topped the growth rankings in November, rising eight places in the sector league table since October. Tourism & recreation occupied second place, while previously top-ranked commercial & professional services was third-fastest of all sectors - its lowest position since June.

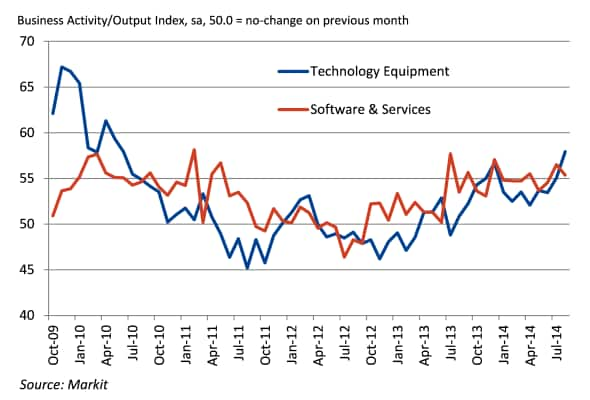

Technology equipment makers registered the fastest rate of output growth since August, and the second-fastest in nearly four-and-a-half years. Moreover, the acceleration was broad-based across North America, Europe and Asia. Employment growth remained modest, suggesting improving productivity in the sector, while output prices remained broadly flat.

Elsewhere, notable climbers in November were forestry & paper products, banks and beverages, which rose 16, 12 and ten places in the sector league table respectively. The former registered a rebound in output growth following October's decline, while drinks makers posted the fastest expansion since January.

Only two sectors registered falling output in November, but a further 12 posted slowing growth. Media was the worst-performing sector, in line with the overall trend shown during 2014 to date. Construction materials posted a fall in output for the first time since August 2013. Among the sectors to record slowing growth, the most pronounced moderations were seen in telecommunication services, food and automobiles & auto parts. Telecommunication services and food were also notable in falling 14 and 12 places in the table respectively.

Global Sector PMI: detailed breakdown

Global Technology PMI: constituent sectors

Momentum and relative growth

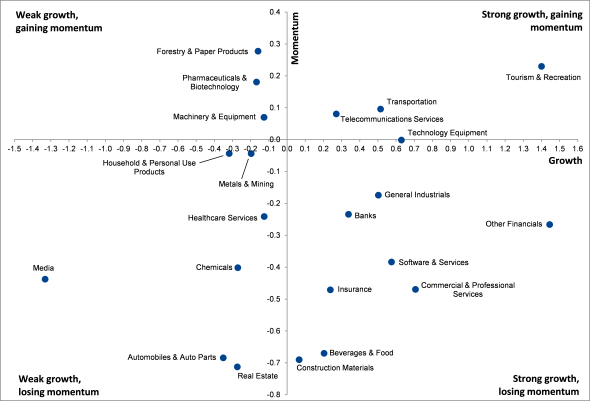

Global Sector PMI data can be usefully analysed according to momentum and relative growth. Momentum is calculated as the difference between the average of the Business Activity Index's month-on-month movement over the latest three-month period and the long-run average of its month-on-month movement (since October 2009), divided by the standard deviation from the mean. A relative growth score is the difference between the Business Activity Index's average over the latest three-month period and its long-run average (since October 2009), divided by the standard deviation from the mean.

In the latest three-month period, from September to November, 12 sectors registered relatively strong growth while ten posted relatively weak expansion. That said, only six sectors gained momentum.

By these measures, the best overall performer in the latest period was tourism & recreation, achieving the second-highest relative growth and momentum scores of all sectors. Other financials posted a fractionally higher growth score, but was losing momentum. Forestry & paper products recorded the highest momentum score, but registered relatively weak overall growth.

The only other sectors to record both positive momentum and relatively strong growth were transportation and telecommunication services. That said, forestry & paper products, pharmaceuticals & biotechnology and machinery & equipment may move into the top-right section of the chart in the coming months.

In line with its current position at the foot of the sector rankings table in November, media registered by far the lowest relative growth of any sector in the latest three-month period. Meanwhile, real estate lost the most momentum, closely followed by construction materials, automobiles & auto parts and beverages & food.

Relative growth and momentum by sector

Trevor Balchin | Economics Director, IHS Markit

Tel: +44 149 1461065

trevor.balchin@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-Global-tech-producers-lead-global-growth-rankings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-Global-tech-producers-lead-global-growth-rankings.html&text=Global+tech+producers+lead+global+growth+rankings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-Global-tech-producers-lead-global-growth-rankings.html","enabled":true},{"name":"email","url":"?subject=Global tech producers lead global growth rankings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-Global-tech-producers-lead-global-growth-rankings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+tech+producers+lead+global+growth+rankings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122014-Economics-Global-tech-producers-lead-global-growth-rankings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}