Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 05, 2015

Eurozone economy shows resilience amid Greek worries, buoyed by Spanish growth spurt

The eurozone economy showed reassuring resilience in the face of the Greek debt crisis in July. Despite a record deterioration in Greek business conditions amid extended bank closures, the overall pace of economic growth across the region barely slowed from June's four-year high.

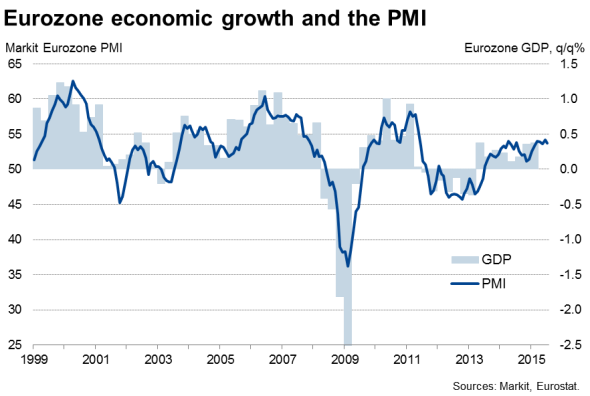

The final Markit Eurozone PMI" posted 53.9 in July, down from 54.2 in June but above the earlier flash estimate of 53.7. Solid expansions of output were signalled in both the manufacturing and service sectors, with the slightly faster rate of growth seen in the latter.

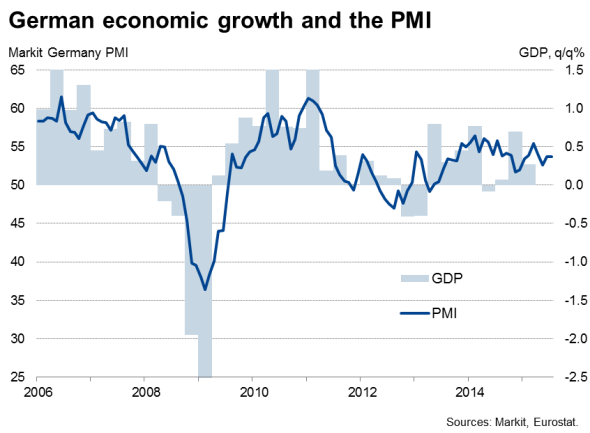

Based on the recent survey data, euro area GDP looks set to have risen by 0.4% in the second quarter, with the same rate of growth evident at the start of the third quarter. Even faster growth could soon be achieved providing the Greek situation remains under control.

As such, the data support the view that the region looks set to grow by at least 1.5% in 2015; a robust albeit unspectacular rate of expansion.

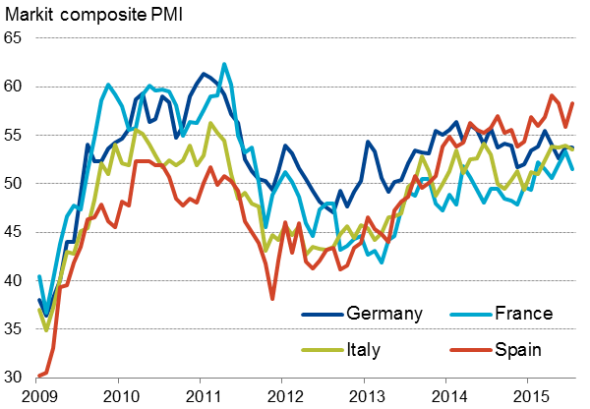

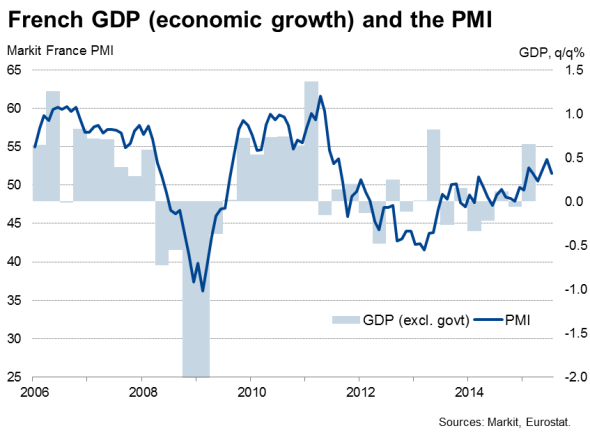

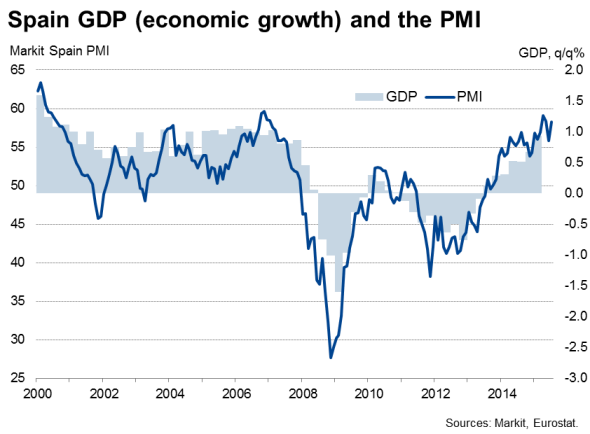

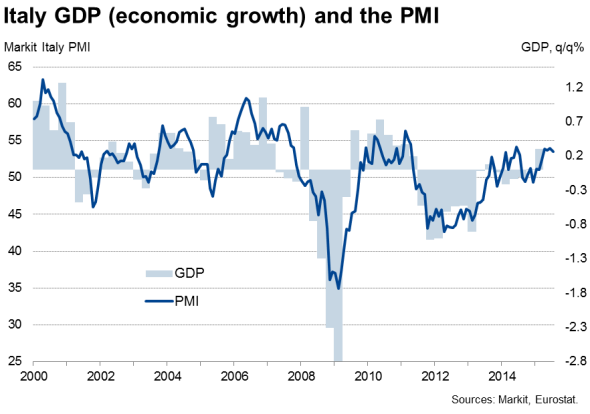

Of the region's largest economies, Spain is the current star performer, with the PMI signalling ongoing economic growth of approximately 1% at the start of the third quarter. Italy and Germany are also showing sustained recoveries, albeit with growth running at more modest 0.3-0.4% rates. France remains a straggler, but is still joining in the recovery, with the PMI signalling a mere 0.2% rate of expansion.

Eurozone "big four'

Broad-based upturn across "big-four'

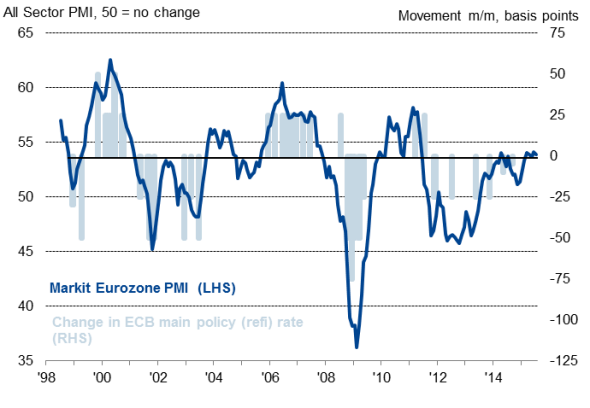

The solid survey results in the face of the escalated Greek crisis in July suggest that the ECB will see the eurozone recovery as remaining firmly "on track', suggesting that the Governing Council will see no need to adjust the ECB's asset purchase programme, currently set at €60bn per month.

PMI signals ECB policy on hold

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Eurozone-economy-shows-resilience-amid-Greek-worries-buoyed-by-Spanish-growth-spurt.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Eurozone-economy-shows-resilience-amid-Greek-worries-buoyed-by-Spanish-growth-spurt.html&text=Eurozone+economy+shows+resilience+amid+Greek+worries%2c+buoyed+by+Spanish+growth+spurt","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Eurozone-economy-shows-resilience-amid-Greek-worries-buoyed-by-Spanish-growth-spurt.html","enabled":true},{"name":"email","url":"?subject=Eurozone economy shows resilience amid Greek worries, buoyed by Spanish growth spurt&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Eurozone-economy-shows-resilience-amid-Greek-worries-buoyed-by-Spanish-growth-spurt.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+economy+shows+resilience+amid+Greek+worries%2c+buoyed+by+Spanish+growth+spurt http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Eurozone-economy-shows-resilience-amid-Greek-worries-buoyed-by-Spanish-growth-spurt.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}