Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 05, 2015

Emerging markets stagnate in July

Markit's worldwide PMI survey data showed emerging market economic growth stagnating in July and employment falling for a fifth successive month.

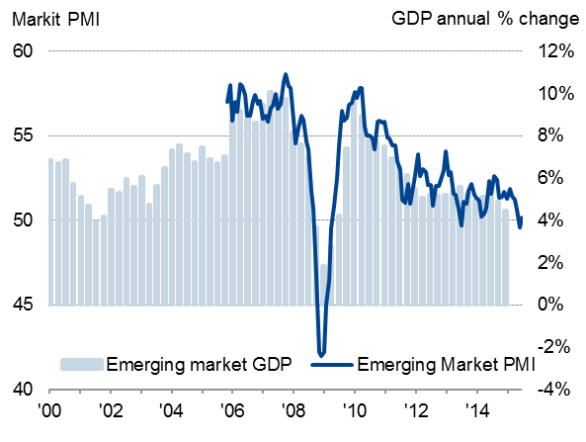

At 50.2, the Markit Emerging Market PMI remained close to the recent low of 49.6 seen in June, suggesting emerging market GDP is growing at a meagre annual rate of around 4%. With the exceptions of the 2008-9 global financial crisis and the 2013 "taper tantrum', the emerging markets have not seen such weak growth since 2002.

Emerging market economic growth

Although services returned to modest growth after slipping into decline in June, manufacturing output fell across the emerging markets as a whole for a third month running, dropping at the fastest rate since November 2011.

The emerging market employment index meanwhile rose slightly, but remained below the no-change level of 50.0 for a fifth successive month to signal an ongoing net drop in staffing levels in the private sector.

The emerging market malaise will be an ongoing topic for policymakers around the world, as the lack of economic growth in these previously-fast-growing markets will act as a drag on the global economy and potentially feed though to lower rates of expansion in developed economies.

Any hiking of US interest rates also poses further downside risks to the emerging market outlook, most notably by raising the cost of servicing dollar-denominated debt in many countries.

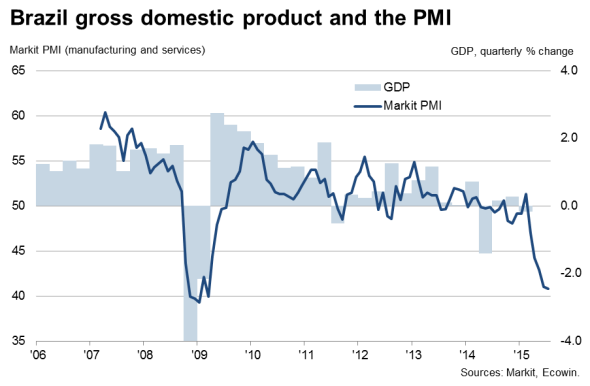

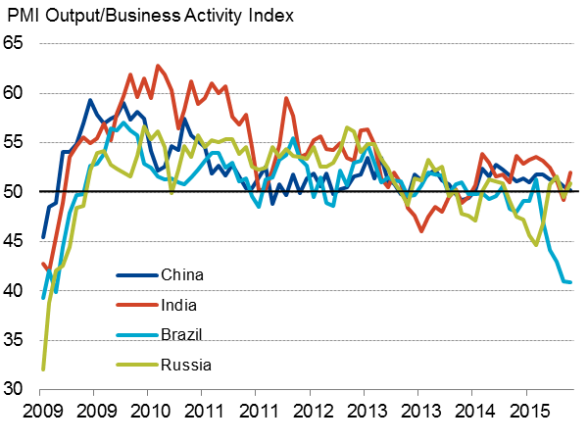

The most striking deterioration was seen in Brazil, where the PMI covering both manufacturing and services fell to 40.8, its lowest since March 2009 and indicative of GDP falling at a quarterly rate in excess of 2%. Service sector activity collapsed at the joint-fastest rate in the survey history.

At 50.2, the all-sector Caixin PMI for China sank to its lowest for 14 months, raising the possibility of GDP failing to meet the government's 7.5% growth target in 2015. The fastest service sector growth for 11 months was offset by the largest drop in manufacturing output for three-and-a-half years, through the divergence at least points to the Chinese economy rebalancing towards service away from export-led manufacturing.

There was better news in Russia and India. Russia's economy showed signs of stabilising after the steep downturn seen in earlier in the year (GDP slumped 1.3% in the first quarter), with an all-sector PMI of 50.9 in July. India also revived from a brief slide into contraction in June, albeit growing at a historically tepid pace, with a PMI of 52.0.

Emerging markets

Sources for charts: Nikkei, Caixin, Markit

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-markets-stagnate-in-July.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-markets-stagnate-in-July.html&text=Emerging+markets+stagnate+in+July","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-markets-stagnate-in-July.html","enabled":true},{"name":"email","url":"?subject=Emerging markets stagnate in July&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-markets-stagnate-in-July.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+stagnate+in+July http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Emerging-markets-stagnate-in-July.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}