Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 04, 2015

Emerging market credit stages comeback

Fears of a sustained global slowdown have alleviated over the past month with emerging market credit quick to react.

- Markit CDX EM index spread is below 300bps for the first time since mid July.

- Russia continues its credit recovery with CDS spreads hitting new 52 week lows.

- Venezuela's 5-yr CDS spread has nearly halved over the last two months.

A looming US interest rate rise, sputtering Chinese growth concerns and dwindling oil prices wreaked havoc on emerging markets (EM) in September, causing investors to hedge against potential losses. But with the Fed delaying lift off, a bounce in commodity prices and positive macro data coming out of China, EM credit have since staged a comeback.

The Markit CDS EM index, which consists of 14 EM sovereign single name CDS, has seen its 5-yr spread dip below 300bps for the first time since mid July as tensions have eased. At its widest this year, the index surpassed 400bps towards the end of September, before marking a 100bps tightening in the last five weeks.

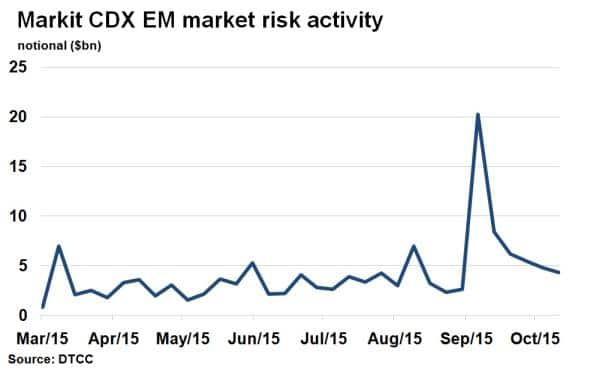

Market risk activity on the Markit CDS EM index remains elevated, however, signalling that investors are still wary of potential future risks. The notional amount traded on the index last week was $4.45bn, compared to $2.65bn seen in mid July, the last time spreads were at current levels. Unsurprisingly at the height of the volatility towards the end of September, investors rushed to hedge against EM risk, sending notional trading volumes to $20bn (four times more than current levels), according to data from DTCC.

BRICs

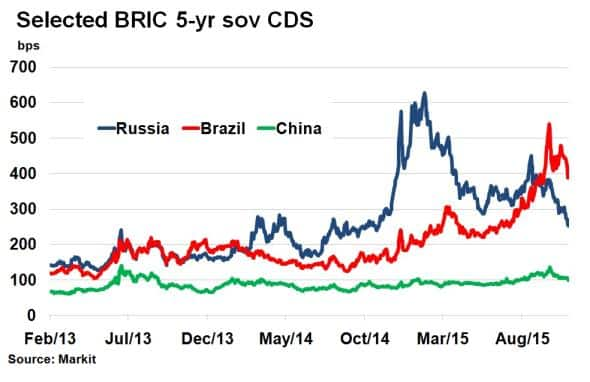

Leading the fall in credit risk among EM countries have been the BRIC nations, traditionally the growth engines of the global economy.

China's 5-yr sovereign CDS spread has tightened below 100bps for the first time in three months. A brighter outlook was affirmed by positive PMI data this week.

At one stage this year Russia's 5-yr CDS spread widened to over 600bps but has since retracted to 254bps, the lowest level since October 2014. Back then, the price of WTI oil was over $80, albeit falling, but significantly higher than it is today, demonstrating Russia's ability to adapt to low oil prices (petroleum is its main export). Brazil on the other hand has been more embroiled in internal politics which has only been exacerbated by the prospect of lower demand for its commodities. 5-yr CDS spreads are, however, 150bps tighter than on September 28th, a 28% move, as EM sentiment turned for the better.

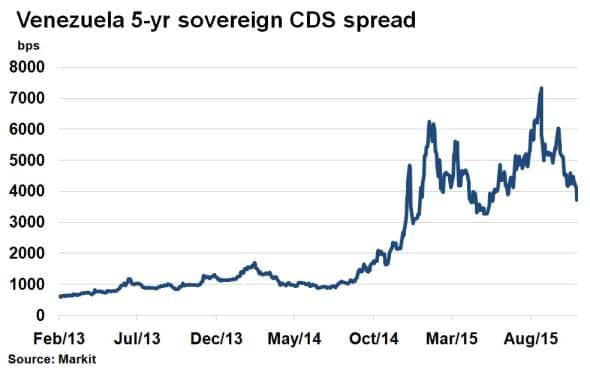

Venezuela risk eases

The widest credit in the Markit CDX EM index is Venezuela, a nation beleaguered by falling oil prices over the past year. Just in August, CDS spreads were implying a 97% probability the nation would default over the next five years. CDS spreads have since halved, but the default probability remains 90%. CDS spreads are however at their lowest level since May, as default fears are set aside for now.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112015-credit-emerging-market-credit-stages-comeback.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112015-credit-emerging-market-credit-stages-comeback.html&text=Emerging+market+credit+stages+comeback","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112015-credit-emerging-market-credit-stages-comeback.html","enabled":true},{"name":"email","url":"?subject=Emerging market credit stages comeback&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112015-credit-emerging-market-credit-stages-comeback.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+credit+stages+comeback http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112015-credit-emerging-market-credit-stages-comeback.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}