Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 03, 2015

Commodities continue to drag down UK miners

Large UK miners continue to suffer as weak commodity prices persist, attracting short sellers. However, PMI data indicates a slowing rate of deterioration in China that may have given hope to optimism, which lifted stocks in October.

- Post restructuring, Glencore short interest remains at highs after stock soars 70%

- Anglo American short interest at an all-time high

- October rally that lifted miners 20% fading as commodity price momentum stalls

Commodities' slide

The collapse in commodity prices continues with the price of zinc falling back down to five year lows after rising 10%. This was after the biggest miner of the metal, Glencore, said it would cut production by a third to support prices.

There are some positive signs, however, as PMI data released this week indicates that weaker demand emanating out of China may be stabilising. Data shows that the rate of deterioration in Chinese manufacturing businesses slowed during October with the largest increase in PMI data seen in 16 months recorded.

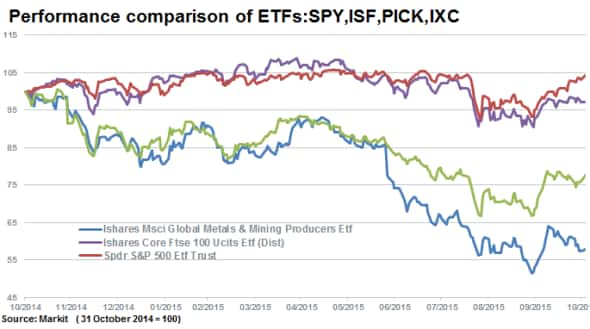

This coincides with an equity markets rally seen during October as the SPDR S&P 500 ETF rose 8.2% and the iShares Core FTSE 100 ETF increased by 4.7%. Year to date, however, miners have dragged down the performance of the FTSE 100 with the worst performing shares year to date being miners: Glencore, Anglo American and Antofagasta.

Meanwhile in the US, underperformers in the S&P 500 have largely been led by Energy names: Consol Energy, Chesapeake Energy and sector outlier Keurig Green Mountain in third position.

FTSE 100's copper counters

Significantly exposed to copper, iron ore, coal and zinc, Glencore is the worst performing stock in the FTSE 100 year to date, down 59%. Short interest currently stands at 3.0% of shares outstanding on loan, the highest level seen in over two years.

Even after receding 10% in recent weeks, Glencore is up 68% from all-time lows after a wave of optimism lifted shares in late September and early October. This was post news of the company restructuring operations in light of sustained lower prices and debt burden.

While Glencore shares are still up significantly from lows, the wave of optimism that also greeted other commodity names seems to have been fleeting.

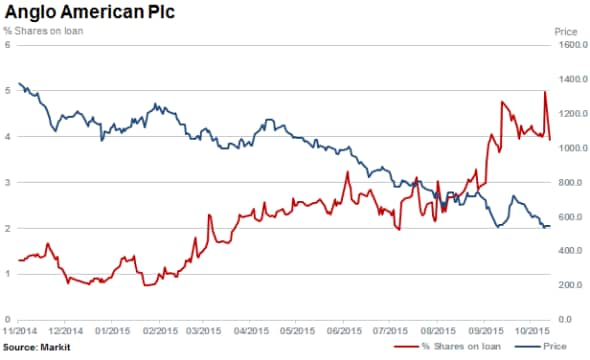

Anglo American shares rallied by 22% over the same period but have since given back more than half of these gains. Short interest breached financial crisis levels with 5.0% of shares outstanding on loan and is currently at 3.9%. Shares are down 52% year to date.

The third worst performer in the FTSE 100 year to date is Chilean based copper producer Antofagasta, down 30%.

With 3.7% of shares outstanding on loan, the copper miner also rallied over 20%, and then subsequently receded 10%. The spike was enough for shorts to cover positions by 10%.

Outside of the FTSE 100, Kazakhstan based copper miner Kaz Minerals with 6.9% of shares outstanding on loan also experienced the September/October rally. The stock is down 53% year to date.

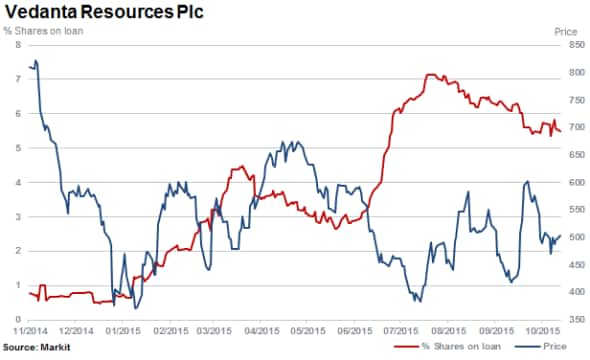

Benefiting from Glenore's cut to zinc production, comparatively outperforming larger peers on a year to date basis is Vedanta Resources with 5.5% of shares outstanding on loan and down 12% year to date. The stock, however, is down 40% over the last 12 months.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112015-Equities-Commodities-continue-to-drag-down-UK-miners.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112015-Equities-Commodities-continue-to-drag-down-UK-miners.html&text=Commodities+continue+to+drag+down+UK+miners","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112015-Equities-Commodities-continue-to-drag-down-UK-miners.html","enabled":true},{"name":"email","url":"?subject=Commodities continue to drag down UK miners&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112015-Equities-Commodities-continue-to-drag-down-UK-miners.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Commodities+continue+to+drag+down+UK+miners http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112015-Equities-Commodities-continue-to-drag-down-UK-miners.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}