Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 04, 2014

Further signs of UK economy cooling as construction PMI hits five-month low

The construction PMI provides another indication that the economy is cooling as we move towards the end of the year, but we should not lose sight of the fact that the rate of expansion remains impressively strong.

Growth merely eases after best quarter for 17 years

The headline index from the Markit/CIPS Construction PMI fell from 64.2 in September to a five-month low of 61.4 in October. The fall in the index is not a major concern, as it merely indicates a cooling of growth from the super-strong pace seen in prior months. The average reading for the third quarter, for example, was the highest for 17 years.

What's more important is the level of the index, which is clearly well above the 50.0 no-change mark and very elevated by historical standards, signalling still strong growth. The average Construction PMI reading since the survey began in 1997 is just 54.5, and even the average in the seven-year lead up to the financial crisis (2000-2007) was only 56.3.

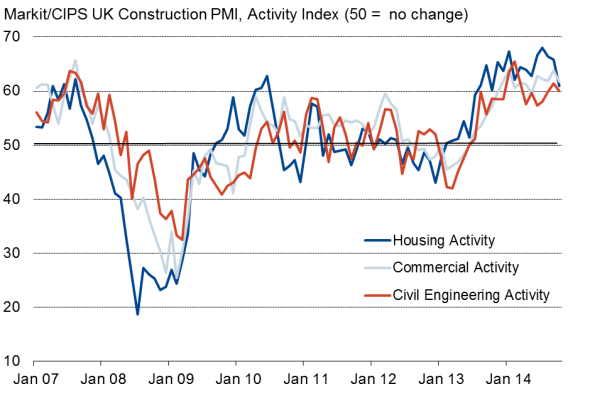

Strong growth persists in all sectors despite signs of cooling

The cooling was most evident in the house building sector, which has seen the strongest growth of all main areas of construction so far this year.

Some easing of growth was also recorded in the civil engineering and commercial construction sectors, but - like house building - all sectors continued to report a pace of expansion well in excess of historical averages.

Growth of employment and inflows of new work likewise moderated compared to the summer months, but both also remained elevated.

Broad-based upturn within construction

Source: Markit.

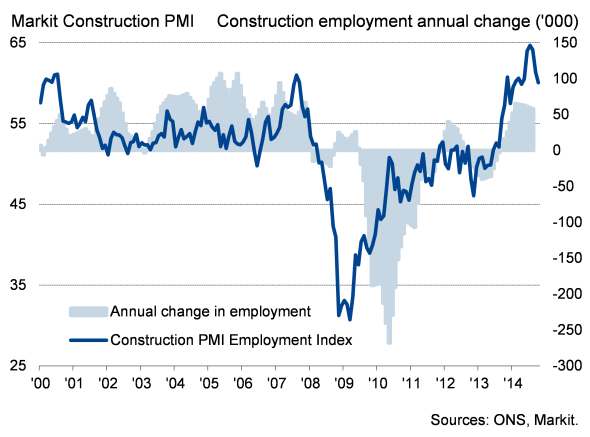

Construction sector employment

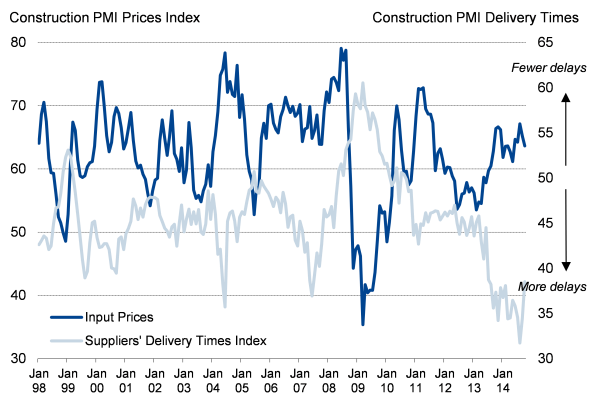

Shortages drive prices higher

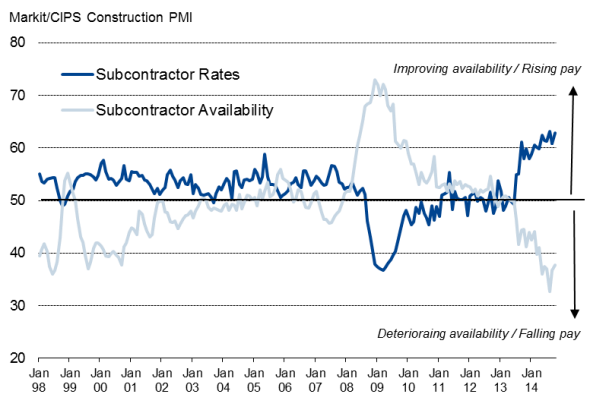

In a reminder of the scale of the ongoing boom being recorded in the construction sector, October saw yet another month of widespread supplier delivery delays for items such as bricks and concrete blocks, as well as shortages of suitable sub-contractors. Prices of both raw materials and subcontractors rose sharply again, on average, the latter closing back in on the all-time high seen in August.

Subcontractor availability and prices

Source: Markit.

Raw material availability and prices

Source: Markit.

Fourth quarter slowdown

Although only representing around 6-7% of GDP, the pace of expansion signalled by the PMI suggests that the construction sector will again provide a strong contribution to the economy in the fourth quarter, both in terms of boosting GDP and generating jobs.

October's services PMI will provide a key ingredient to taking the temperature of the overall economy at the start of the fourth quarter, but with growth having clearly cooled in both manufacturing and construction since earlier in the year, the pace of economic growth looks likely to slow slightly further in the final quarter of the year compared to the 0.7% increase in GDP seen in the third quarter.

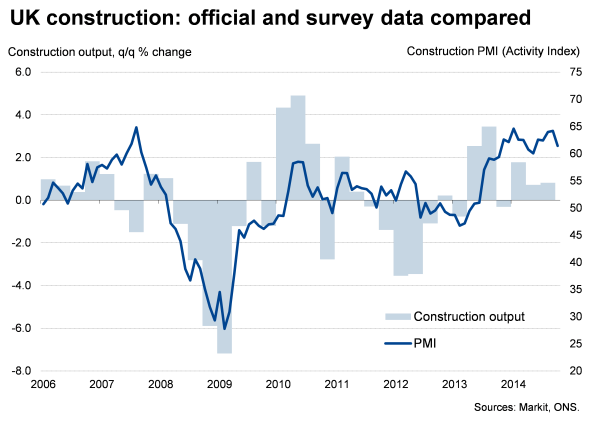

Reconciling the PMI with official data

The solid growth of construction output signalled by the PMI over the summer has been confirmed by data from the Office for National Statistics showing a 0.8% increase in the output of the sector in the third quarter. This rise occurred despite the ONS data showing a 3.9% drop in production in August. The ONS's first estimate of GDP growth in the third quarter, at 0.7%, includes an estimate of construction output rebounding 4.0% in September.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Economics-Further-signs-of-UK-economy-cooling-as-construction-PMI-hits-five-month-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Economics-Further-signs-of-UK-economy-cooling-as-construction-PMI-hits-five-month-low.html&text=Further+signs+of+UK+economy+cooling+as+construction+PMI+hits+five-month+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Economics-Further-signs-of-UK-economy-cooling-as-construction-PMI-hits-five-month-low.html","enabled":true},{"name":"email","url":"?subject=Further signs of UK economy cooling as construction PMI hits five-month low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Economics-Further-signs-of-UK-economy-cooling-as-construction-PMI-hits-five-month-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Further+signs+of+UK+economy+cooling+as+construction+PMI+hits+five-month+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112014-Economics-Further-signs-of-UK-economy-cooling-as-construction-PMI-hits-five-month-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}