Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 04, 2016

Gold rally shines on miners' bonds

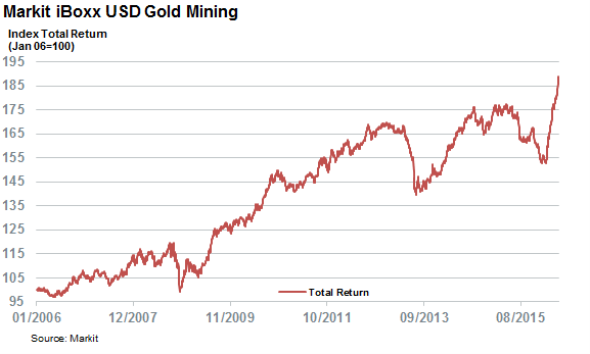

Although gold has surged by over 15% this year, the commodity's price has been outpaced by the bonds issued by gold miners, according to the newly launched Markit iBoxx USD Gold Mining index.

- Gold bonds have returned 23% ytd on a total return basis, driven by a collapse in spreads

- Bonds issued by gold miners have returned 20% since gold's peak in 2011

- Markit iBoxx USD Gold Mining index yield is still above 5%, despite recent performance

Gold's surging popularity has been making waves in the bond market. Bonds issued by gold mining firms have outperformed almost every segment of the bond market since the start of the year, according to the newly launched Markit iBoxx USD Gold Mining index.

The index, which is made up of investment grade bonds issued by firms which mine gold, has returned over 23% since start of the year on a total return basis. These returns are a hefty four times higher than those seen in the wider dollar denominated investment grade universe tracked by the Markit iBoxx $ Corporates index.

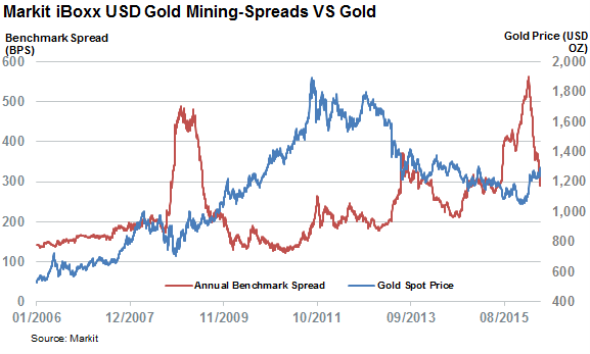

The returns have been almost entirely driven by investors treating bond mining bonds in a better light in the wake of the commodity's surging popularity. The extra yield demanded by investors stood at 552bps at the start of the year. That number has since retreated to less than 300bps, a level not seen since last summer.

This recent rebound brings back parallels of 2008 when gold mining bonds experienced a similar spread collapse.

The warming sentiment towards gold mining bonds means that the asset class has outperformed the physical commodity by over 8% since the start of the year as the price of an ounce of gold has only climbed by 15% in 2016 to date. Should this trend hold out until the end of the year, this would mark the third year out of the last four in which gold mining bonds have outperformed the physical commodity mined by its issuing firms. In fact, gold bonds have returned 22% in the five years since the commodity hit its peaks in 2011 while physical gold is still over 30% off its highs, despite its recent rebound.

These returns are almost entirely driven by the yield portion of the asset class. Even with the recent falling yields, investment grade mining bonds still yield over 5% as opposed to 0% for the physical commodity.

Investors seeking yield have traditionally been attracted to the equity side of gold miner's balance sheet. However bonds have proven a much better alternative for these investors as the largest equity gold mining ETF, Vectors Gold Miners ETF, has a trailing dividend yield of around 50bps, just one tenth of that delivered by the iBoxx USD Gold Mining index. The former has also yet to rebound from gold's retreat from previous highs, as the ETF is still trading over 50% off the highs seen in 2011.

Simon Colvin - Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-credit-gold-rally-shines-on-miners-bonds.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-credit-gold-rally-shines-on-miners-bonds.html&text=Gold+rally+shines+on+miners%27+bonds","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-credit-gold-rally-shines-on-miners-bonds.html","enabled":true},{"name":"email","url":"?subject=Gold rally shines on miners' bonds&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-credit-gold-rally-shines-on-miners-bonds.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gold+rally+shines+on+miners%27+bonds http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-credit-gold-rally-shines-on-miners-bonds.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}