Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 03, 2014

Short sellers leave Norway in the cold

Nordic nation's heavy exposure to energy prices has seen the country's shares become the target of increasingly bearish investor sentiment recently. We review the most shorted sectors.

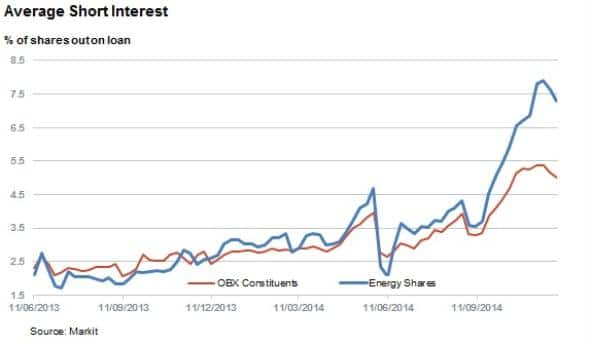

- Average short interest across OBX constituents has surged to 5% of shares outstanding in the last few weeks

- Energy firms have been at the forefront of the recent spike in demand to borrow

- ETF investors have stayed put, but the value of their assets has shrunk in the face of a falling krone and equity value

Norway's management of its oil wealth has long been touted as model for other natural resource rich countries looking to long term wealth over short term profligacy derived from rental income. This long term approach has seen the country's sovereign wealth fund which invests its excess oil reserves surge to over $870bn since its inception in 1990.

Despite the country's active efforts to diversify away from oil and energy production, the Norway is still heavily exposed to energy, with over 37% of the current market cap of the OBX index coming from the sector. This has seen both the county's equities and currency lose ground in the last week as oil prices retreated to five year lows.

Investor sentiment in the country has also tracked oil's recent slide with short interest climbing over the last few months.

Short interest on the up

The foremost gauge of negative sentiment across Norwegian shares has been the surging short interest seen across the constituents of the OBX index. Current average demand to borrow across the 24 constituents now stands at 5% of shares outstanding. This is represents an 80% jump of the average demand to borrow from the start of the year.

This increase in demand to borrow comes in heels of a 13% average price retreat across the index's constituents. Energy shares have been at the forefront of this fall as all 12 energy firms have seen their shares fall since the start of the year with a massive 47% average price slump.

Energy firms most targeted

The underperforming energy shares have also been at the forefront of the shorting activity as these firms have seen their short interest more than double to 7.3% of shares outstanding since the start of the year.

Short sellers have been focusing their attention in oil rig contractors and firms which offer geophysical surveys to the oil industry. This focuses on the theme that oil firms will cut back exploration in the coming years in reaction to oil's recent slip.

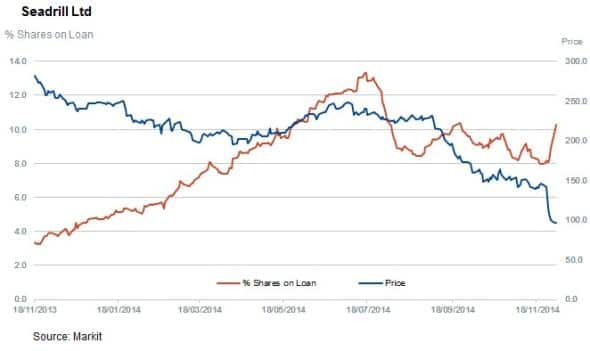

The key firms in this trend are Seadrill which has 10% of shares out on loan, a number that has jumped to a new recent high in the last weeks after the firm announced that it was discontinuing its dividend to save cash and deleverage.

In the geophysical space short sellers have been very active in Petroleum Geo Services and Tgs Nopec Geophysical Company Asa, with over 20% of both firms' shares currently out on loan.

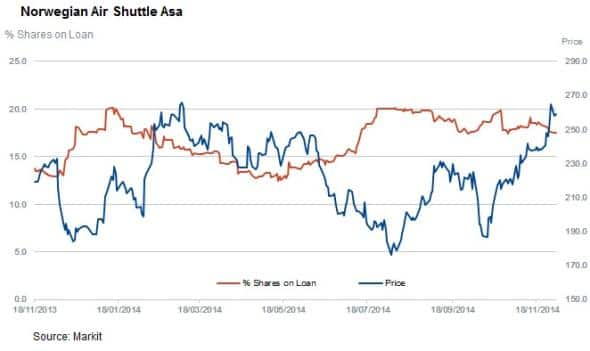

Not all shorts in the region have been successful as Norwegian Air Shuttle, the third most shorted company, has seen its shares surge in the wake of falling oil prices. This has seen short sellers retreat in over the last few weeks.

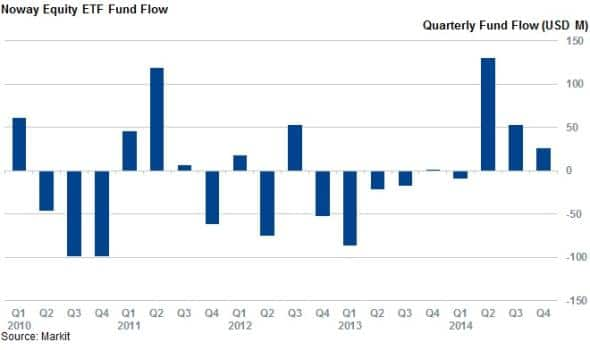

ETF investors stay the course

Interestingly, ETF investors have stayed the course in their Norwegian exposure despite the recent headwinds as the eight Norwegian equity focused products have seen over $200m of inflows since the start of the year putting them on track for their best ever year in terms of inflows. The largest fund, the Global X MSCI Norway 30, is listed in the US and the falling krone and equities value have seen the fund fall by more than 10% in the last week.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Equities-Short-sellers-leave-Norway-in-the-cold.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Equities-Short-sellers-leave-Norway-in-the-cold.html&text=Short+sellers+leave+Norway+in+the+cold","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Equities-Short-sellers-leave-Norway-in-the-cold.html","enabled":true},{"name":"email","url":"?subject=Short sellers leave Norway in the cold&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Equities-Short-sellers-leave-Norway-in-the-cold.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+leave+Norway+in+the+cold http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Equities-Short-sellers-leave-Norway-in-the-cold.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}