Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 03, 2014

US and UK continue to drive global economic expansion

Markit's worldwide PMI surveys, designed to accurately measure the pace of economic growth in advance of official data such as gross domestic product, signalled the weakest rate of global economic expansion for seven months in November.

However, divergent growth trends persisted. The US and UK markedly outperformed all other major economies, the rest of the world largely stagnating on average. Such growth divergences look set to drive exchange rate and interest rate differentials in coming months.

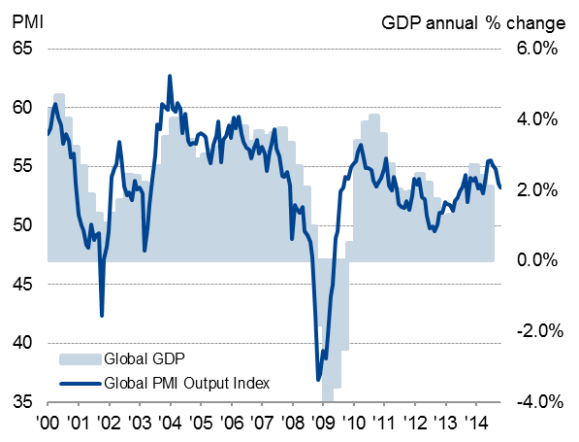

Global gross domestic product

Global growth at seven-month low

The JPMorgan Global PMI", compiled by Markit, fell for a fourth month running in November, down from 53.5 in October to 53.2, its lowest since April. So far, the fourth quarter of 2014 has seen the slowest average global economic growth since the final quarter of 2013, with the PMI data roughly consistent with the global economy growing at an annual rate of just over 2%.

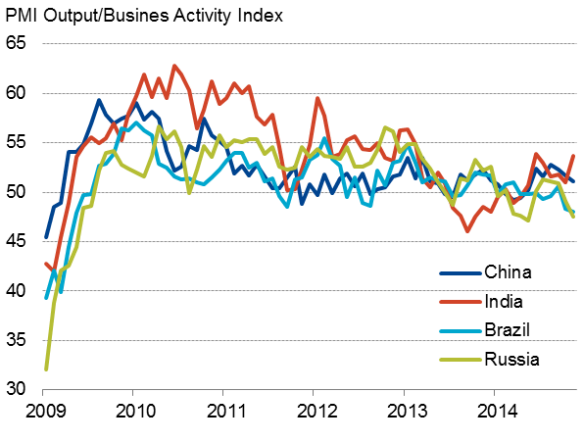

Growth slowed closer to stagnation in China and the eurozone, business confidence in the latter being again dented by concerns over the strained relations with Russia, whose downturn deepened in November.

Japan meanwhile struggled to expand amid weakened domestic spending since the country's sales tax rise, and manufacturing conditions in many other Asian countries remained subdued.

The main bright lights in the global economy remained the US and the UK, though even in these countries growth has slowed compared to earlier in the year.

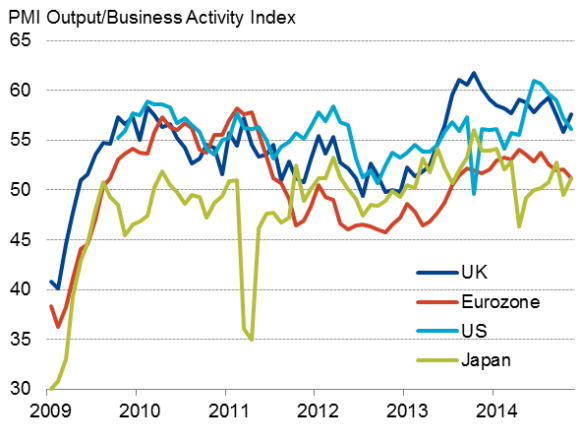

Developed world (manufacturing & services)

Emerging markets (manufacturing & services)

US and UK remain brightest lights

Growth therefore continues to be led by the US and the UK, with both seeing strong expansion persisting into the fourth quarter of 2014. However, in both cases growth has slowed compared to earlier in the year as the adverse global economic environment has weighed on business conditions.

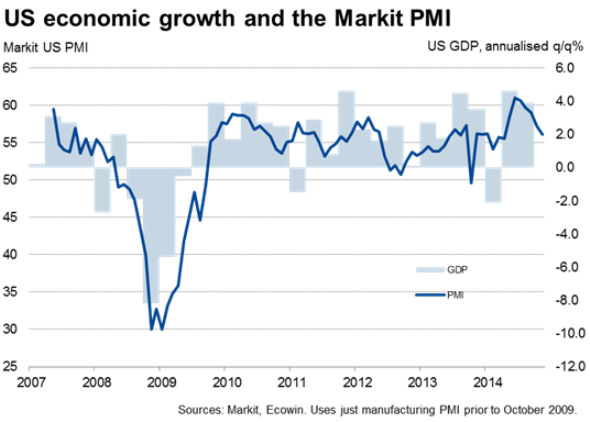

After enjoying especially strong economic growth over the second and third quarters, the PMI data suggest the US economy has slowed towards the end of the year. Markit's weighted manufacturing and services PMI fell to 56.1, its lowest since April, suggesting annualised economic growth is likely to have slowed from 3.9% in the third quarter to around 2.5% in the fourth quarter. The theory that the US, with its vast domestic market and self-sufficiency on energy, has "decoupled' from weak demand in the rest of the world is being challenged by the surveys.

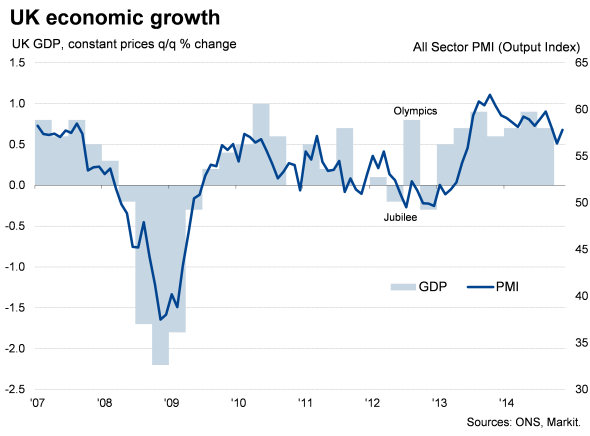

In the UK, the "all-sector' PMI rose to 57.8 after it had slumped to a 16-month low of 56.4 in October. So far, the PMI data are pointing to UK quarterly GDP growth of 0.6% in the fourth quarter (similar to the US's 2.5% annualised pace), down from 0.7% in the third quarter.

Policy divergence

Although slowing, growth in the US and UK remains robust by historical standards, meaning speculation will continue to intensify about the timing of interest rate hikes in both countries. That said, the slowdowns and recent falls in oil prices point to any initial tightening being delayed until the second half of 2015.

In contrast, the ongoing travails in the eurozone, Japan, China and other emerging markets suggest policymakers there will need to continue to seek ways to revive growth in these economies.

Such policy divergences will no doubt continue to drive exchange rate differentials, the US dollar having already strengthened sharply against the euro and yen in particular (the dollar index has risen 11% since July, climbing to its highest since March 2009). That is unless, off course, growth continues to wane in the US and UK, as these two bright lights succumb to the headwinds of weakened demand elsewhere in the world and geopolitical risks.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-US-and-UK-continue-to-drive-global-economic-expansion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-US-and-UK-continue-to-drive-global-economic-expansion.html&text=US+and+UK+continue+to+drive+global+economic+expansion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-US-and-UK-continue-to-drive-global-economic-expansion.html","enabled":true},{"name":"email","url":"?subject=US and UK continue to drive global economic expansion&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-US-and-UK-continue-to-drive-global-economic-expansion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+and+UK+continue+to+drive+global+economic+expansion http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122014-Economics-US-and-UK-continue-to-drive-global-economic-expansion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}