Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 03, 2017

Week Ahead Economic Preview

A number of central banks across Asia will decide on monetary policy, while IHS Markit Services PMI" data for the eurozone, Japan and Brazil will provide further clues as to the health of these major economies at the start of the fourth quarter. Other key data highlights include China trade and inflation figures as well as UK housing and industrial output statistics. Elsewhere, Indonesia and Hong Kong will publish third quarter GDP figures.

The release of detailed global and regional sector PMI data and eurozone retail PMI surveys by IHS Markit will offer more nuanced insights into recent economic trends.

Eurozone Composite PMI

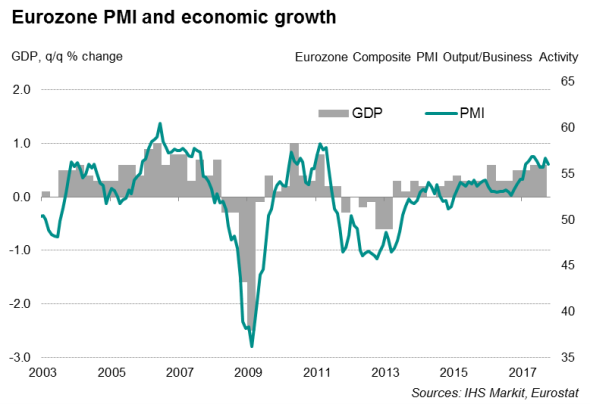

Final eurozone PMI data next week will give further insights into economic and price trends in the final quarter 2017. The flash data has signalled a strong start to the quarter, but perhaps more important is the extent to which inflationary pressures will continue to develop in coming months, which will in turn have a strong bearing on future central bank policy. The European Central Bank recently announced its decision to cut back on stimulus next year, and further tightening rhetoric may follow if the PMI surveys continue to show a strong set of data with rising price pressures.

*October data = Flash Eurozone Composite PMI

Japan service sector

In Japan, an updated Nikkei Service PMI will be gleaned for clues as to how the Japanese economy fared at the start of the closing quarter of 2017, to gauge future Bank of Japan policy. The latest BoJ meeting minutes, released on Monday, will likewise be scoured for indications of how robust the authorities see the current economic climate.

Survey data earlier indicated that Japanese manufacturing sector growth remained robust, accompanied by rising cost pressures. Both represent welcome news for the central bank.

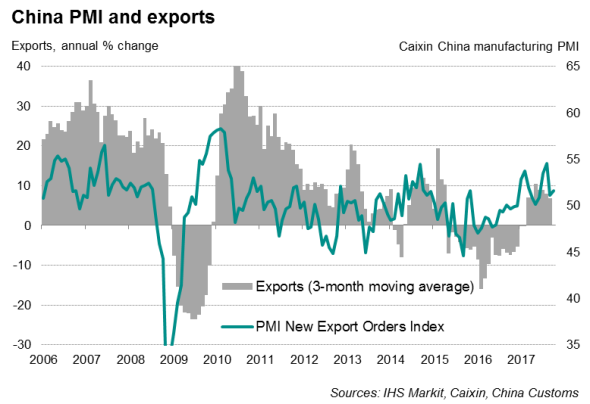

Chinese trade and inflation

China analysts will be eyeing trade and inflation data, which will give indications of demand in the Chinese economy. The Caixin China Manufacturing PMI signalled a marginal improvement in the health of the sector in October amid a modest expansion in sales. Growth in new export orders was noticeably lower compared to the third quarter average, posing some downside risk to the official export figures.

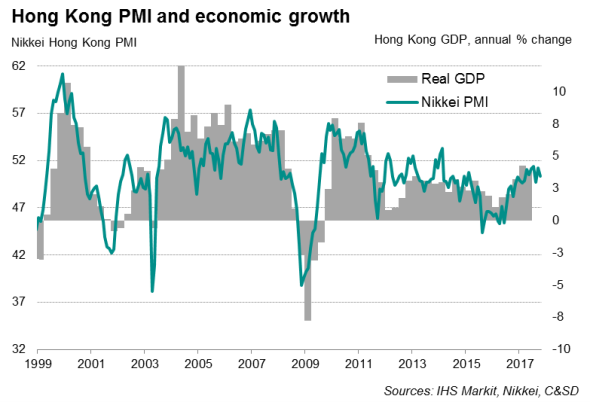

Hong Kong and Indonesia GDP

Third quarter GDP numbers for Hong Kong and Indonesia will be released next week. The Nikkei Hong Kong PMI showed that the pace of economic expansion during the three months to September was similar to the previous quarter, when annual GDP growth of 3.8% was recorded. Meanwhile, market expectations are for the Indonesian economy to grow by an annual rate of 5.1% during the third quarter.

Meanwhile, the Reserve Bank of Australia is widely tipped to keep rates on hold, though signs of stronger growth from recent PMI surveys suggest a tightening bias may lead to higher rates next year.

UK data to help guide future policy

After the Bank of England raised interest rates for the first time in a decade, analysts will be eyeing the incoming data flow for the timing of the next rise. Official industrial production, construction output and trade data for September will therefore add to the picture of the economy's health in the lead up to the next rate decision (and also indicate if any revision to the current estimate of 0.4% third quarter GDP growth is likely). Recent PMI data showed manufacturing continuing to fare well up to October, but construction continues to struggle, with business hit by weak business confidence in the economic outlook.

Download the full report for a diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-economics-week-ahead-economic-preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-economics-week-ahead-economic-preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112017-economics-week-ahead-economic-preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}