Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2015

Week Ahead Economic Overview

Industrial output and trade data are released in a number of countries across Europe during the week, with China seeing the publication of latest inflation figures. Meanwhile, the Bank of England's Monetary Policy Committee announces its latest interest rate decision.

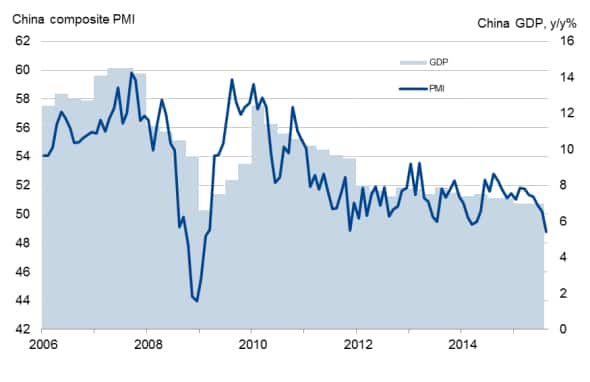

China is likely to remain in focus, and sees the release of trade and inflation data during the week. The numbers will be watched closely by data watchers around the world for more insights into the health of Asia's largest economy. Business survey evidence signalled the steepest contraction in private sector output since the height of the financial crisis in August, putting further pressure on policy makers to boost the economy and help cool recent financial market volatility.

In the UK, the Bank of England's Monetary Policy Committee announces its latest interest rate decision on Thursday, followed by the release of the meeting's minutes. It is widely expected that the Bank will leave policy unchanged. While an upturn in employment growth could put further upward pressure on wages and therefore favour a rate hike, subdued PMI results and a benign inflation outlook are clearly arguments against an imminent tightening of policy. Business survey data for the third quarter so far are consistent with GDP growth slowing to 0.5%, down from 0.7% in the three months to June, with employment growth also slowing and inflationary pressures waning.

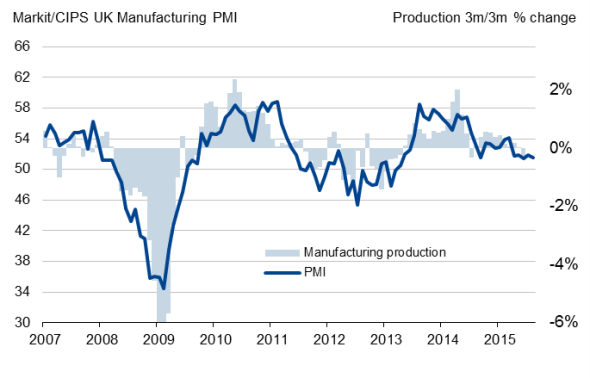

A day before the UK monetary policy announcement, official trade and industrial production data are published. Output of the manufacturing sector fell 0.3% in the second quarter, and survey data signal that the sector still struggles to show any growth. August's manufacturing PMI was consistent with only a subdued expansion, with the strength of sterling continuing to act as a drag on exports.

A question mark meanwhile hangs over the quality of UK trade data. Although official data showed that a surge in overseas trade boosted the UK economy in the second quarter, survey data suggest that exporters are enduring a far tougher time in the battle to win overseas sales than indicated by the official data.

UK manufacturing production and the PMI

Elsewhere in Europe, a number of countries see the release of industrial production data, including France, Germany, Greece and Spain.

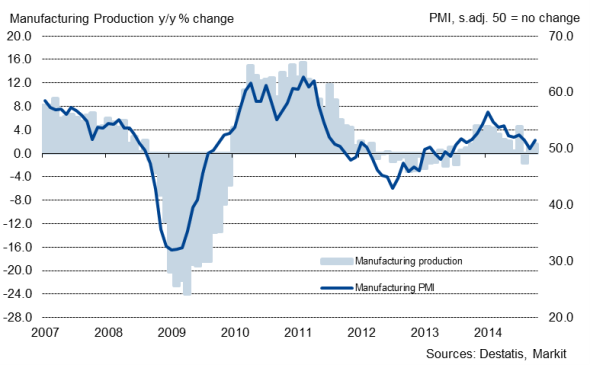

According to business survey data, the eurozone manufacturing sector continued to expand at a healthy, although unspectacular, pace in August. Encouragingly, growth picked up in Germany, with the PMI hitting a 16-month high in the light of rising demand from both domestic and foreign markets. However, industrial production fell 1.4% in June and rose only fractionally in the second quarter as a whole. Data watchers are therefore hoping for a rebound of industrial output in July.

German manufacturing production and the PMI

In France, production was down 0.1% in June, with the second quarter as a whole showing a decline of 0.7%. Further disappointment looks likely, as the manufacturing PMI Output Index remained in contraction territory in August.

Outside of the two "core" Eurozone nations, production is expected to rise further in Spain. In June, industrial output increased 0.3%, rising 4.4% higher than a year ago and its steepest increase since March 2010. PMI data point to ongoing growth in the sector. However, things look different in Greece, with business survey data for July pointing to the steepest drop in manufacturing output in the survey's history. It is therefore expected that the official data will show a steep decline in industrial production.

China GDP and the PMI

Monday 7 September

The latest KPMG/REC UK & English Regions Report on Jobs is out.

Meanwhile, global sector PMI data are released by Markit.

The AIG Construction Index is released in Australia.

In India, current account data are published.

The latest Eurozone Sentix Index is out.

Meanwhile, industrial output numbers are issued in Germany.

Tuesday 8 September

Business confidence numbers are issued by the National Australia Bank.

Revised second quarter GDP figures are published in Japan and Russia.

Meanwhile, trade data are out in China, France and Germany.

The British Retail Consortium releases its latest Shop Price Index.

The NFIB Business Optimism Index and employment trends data are published in the US.

Wednesday 9 September

In Australia and Japan, consumer sentiment data are published.

The latest Dubai Economy Tracker and Dubai Real Estate Tracker are released by Emirates NBD.

Greece sees the release of industrial output and inflation numbers.

Meanwhile, trade data and industrial production figures are issued in the UK.

Housing starts and building permit data are released in Canada. Moreover, Canada's Central Bank announces its latest monetary policy decision.

Consumer credit data are out in the US.

Thursday 10 September

The Reserve Bank of New Zealand announces its latest monetary policy decision.

A labour market update is released in Australia, while China sees the publication of inflation numbers.

In Russia, trade data are issued.

Manufacturing and mining production figures are meanwhile released in South Africa.

Industrial output numbers are out in France and Spain with the former also seeing the publication of non-farm payrolls figures.

Meanwhile, unemployment data are released in Greece.

The Bank of England announces its latest monetary policy decision and publishes minutes from the meeting simultaneously.

Savills publishes the latest UK Commercial Development Activity Report.

Brazil sees the releases of inflation numbers.

In Canada, the latest New Housing Price Index is published.

Import and export price numbers plus initial jobless claims data are out in the US.

Friday 11 September

In Japan, the latest MOF Business Confidence Index is published.

The Bank of Russia Board of Directors announces its latest monetary policy decision.

Inflation data are out in Germany and Spain, while France sees the release of current account numbers.

Meanwhile, industrial output figures are issued in Italy.

The Office for National Statistics releases construction output numbers for the UK.

The US sees the release of producer price data and the latest Reuters/Michigan Consumer Sentiment Index.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03092015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}