South Korean shipbuilders run aground

Short sellers have flocked to South Korean shipbuilders faced with declining demand as low oil prices persist, creating increased competition and discounting as firms struggle to stay afloat.

- Largest three builders' stocks fall by a third in recent months while short sellers circle

- Aggressive project pricing by top three to grab market share now impacting earnings

- Recent oil price weakness starts to take toll as offshore oil & gas projects curtailed

Ship owners better off, for now

The recent rise in the Baltic Dry Index (BDI) and lower oil prices should bode well for shipping firms. The BDI measures the charter rate for large ships carrying iron ore, coal and grain.

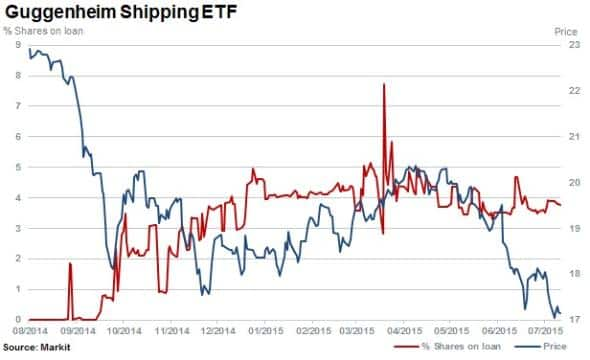

However investors are not convinced on shipping's improving prospects, with the Guggenheim shipping ETF (SEA) down 15% in the last three months. This ETF tracks the Dow Jones Global Shipping Index and constituents of SEA are affected by shipping rates as well as the energy and commodities markets.

The ETF has seen anaemic fund flows for the last 24 months but sees strong demand to borrow from short sellers, with a cost to borrow above 5% and 3.8% of shares outstanding on loan currently.

Korean sinking demand

Demand for new super oil tankers and large container ships had somewhat buoyed the South Korean builders earlier in the year as the industry faced its worst slump in decades. The lack of exposure to dry bulk vessel manufacturing present in China shielded the Koreans earlier in the year when the BDI hit an all-time low in February 2015.

Since then the BDI has rallied however, sending mixed signals to the market as Brent crude flirts with $50 a barrel once again.

Total global orders for new vessels halved in the first quarter of 2015 but oil tanker order growth was still strong, with Korean shipbuilders grabbing the bulk of orders. However aggressive pricing to secure these contracts has eroded current earnings and stubbornly low oil prices have seen new orders postponed or cancelled.

Korean shipyards

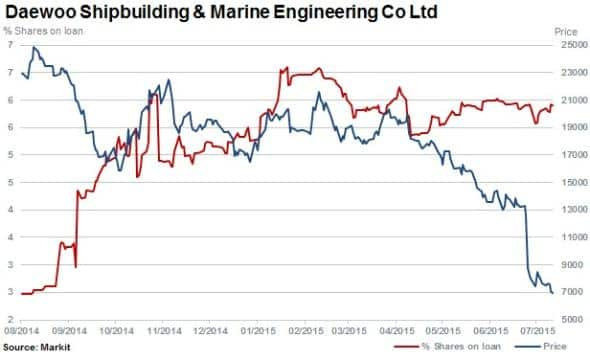

Daewoo posted its first quarterly loss in almost eight years this year. The smallest of the three large Korean shipbuilders by market cap, Daewoo is the most in demand shipbuilder to short currently in South Korea.

Short sellers are prepared to pay above 6% to short the name. Shares out on loan in Daewoo have increased to 6% while the stock has capsized, falling some 62% in the last three months.

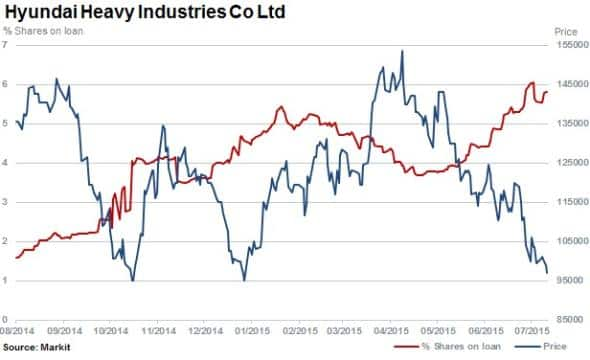

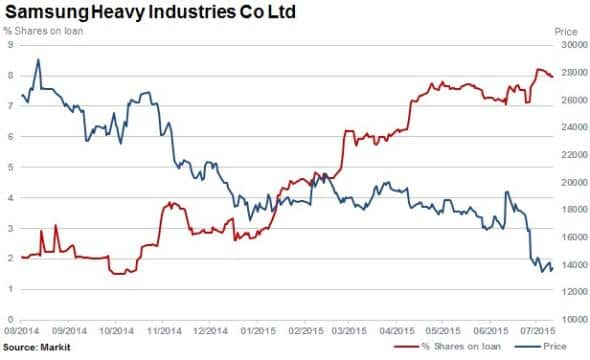

The other two large shipbuilders in South Korea are Hyundai Heavy industries and Samsung Heavy Industries which have seen similar trends with short interest rising to 5.8% and 8% while stock in the companies has fallen by 32% and 25 % respectively.

After the financial crisis, these shipbuilders generally derived more earnings from profitable projects in offshore oil and gas vessels, which have been particularly hard hit recently. Expanding Japanese industry, a weaker yen and increased competition from Chinese shipyards pose further threats to the Korean shipbuilders.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.