Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Aug 03, 2015

Periphery bonds rejoin European fold

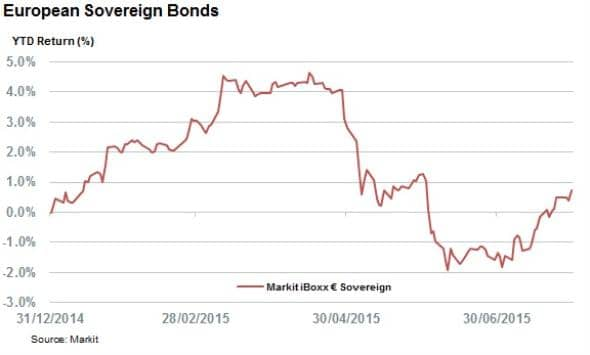

Investor appetite for periphery European debt in July has helped push European sovereign bonds back into the black for the year after enjoying their best performance since January.

- European sovereigns delivered 2% total returns in July, according to Markit iBoxx € Sovereign

- Periphery bonds have driven this trend, but spreads are still off the yearly lows

- CDS spreads have also been coming down across the periphery sovereign space

July started pretty badly for European bond investors, but the resolution (for now) of the Greek crisis has actually seen the asset class bounce up from the recent lows. This return to form means that European sovereign bonds delivered their best month in terms of total return since January. This is gauged by the Markit iBoxx € Sovereign index which returned 2.13% in July.

This strong performance means that European sovereign bonds are now in positive total returns for the year after falling by over 4% over the course of the Greek crisis.

Periphery drives returns

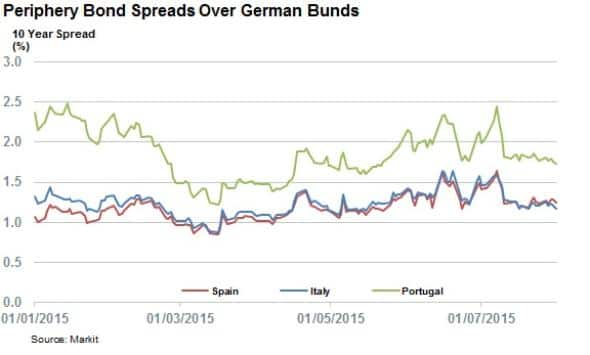

This trend was largely riven by improving investor sentiment towards periphery debt; gauged by the fact that Italian and Spanish 10 year bonds have seen their yield differential over 10 year German bunds fall significantly over July.

Italian bonds experienced the largest amount of tightening over July with the 10 year spread falling 40bps to 1.17%, while Spanish bonds fell by 24pbs over the month.

Spanish and Italian bonds make up over 36% of the Markit iBoxx € Sovereign index so any shifts in investor sentiment in periphery bonds have a material impact for European sovereign bond investors.

Note that the spreads are still off the lows seen before the recent Greek crisis, which shows that investors are still wary of political risks seen in the European periphery. But these fears may well be abated in the coming months, should the anti-austerity parties continue to lose momentum in the wake of Greece's failed bid to play hardball with international creditor.

Portugal, which is not a constituent of the iBoxx € Sovereign index, has also exhibited a trend similar to Spain and Italy with its 10 year sovereign spread over German bunds falling by 40bps in July.

CDS spreads also reflect the tend

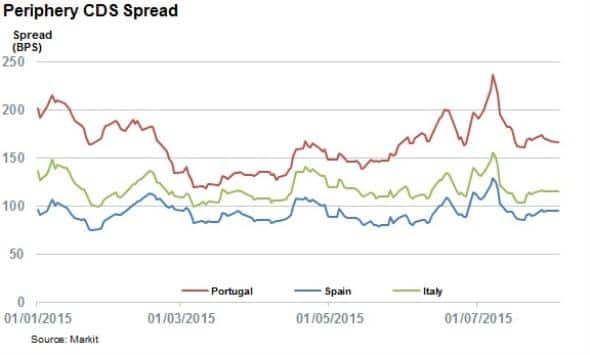

The improving investor sentiment is also reflected in CDS spreads with periphery spreads falling significantly from their early July highs.

Spain and Portugal have led the trend with a 22bps and 27bps tightening over the month.

However, much like the bond yields current CDS spreads indicate that there is some lingering damage from the Greek crisis. Investors are still treating periphery sovereign bonds with a higher level of risk than at the recent lows seen earlier in the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-Credit-Periphery-bonds-rejoin-European-fold.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-Credit-Periphery-bonds-rejoin-European-fold.html&text=Periphery+bonds+rejoin+European+fold","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-Credit-Periphery-bonds-rejoin-European-fold.html","enabled":true},{"name":"email","url":"?subject=Periphery bonds rejoin European fold&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-Credit-Periphery-bonds-rejoin-European-fold.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Periphery+bonds+rejoin+European+fold http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082015-Credit-Periphery-bonds-rejoin-European-fold.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}