Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 03, 2017

Global price pressures wane as manufacturing growth shows signs of cooling

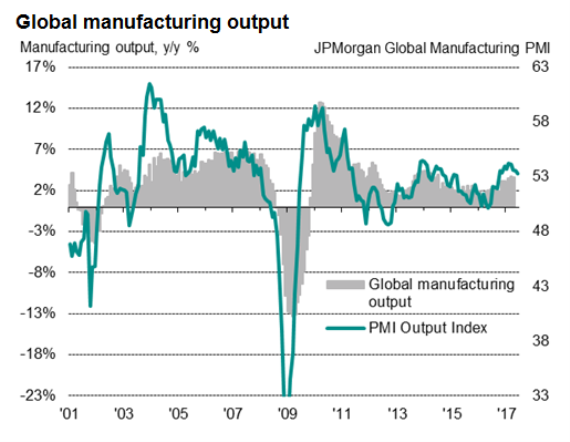

The global manufacturing economy saw sustained improvement in June, albeit with output growth slipping to the weakest since last September. The headline JPMorgan PMI, compiled by IHS Markit, was unchanged at 52.6 in June, rounding off a solid second quarter.

The latest survey incorporates the new CBA Australia PMI data, launched this month, taking the total number of countries covered to some 29.

The global survey's output index fell, however, down slightly for a third successive month, to suggest that production growth has cooled slightly across the world's factories. The rate of increase of new orders likewise moderated for a third month.

Helping keep the PMI steady was a modest upturn in the employment index and a steadying of inventories; though both indices are backward-looking indicators.

Looking at more forward-facing indicators, there were mixed signals. A drop in the survey's new orders to inventory ratio to a six-month low hints at production growth cooling further as we move into the third quarter. On the other hand, firms' expectations about the coming year regained some poise after sliding to a five-month low in May, lending support to the view that the upturn has further to run and that any slowdown could be temporary.

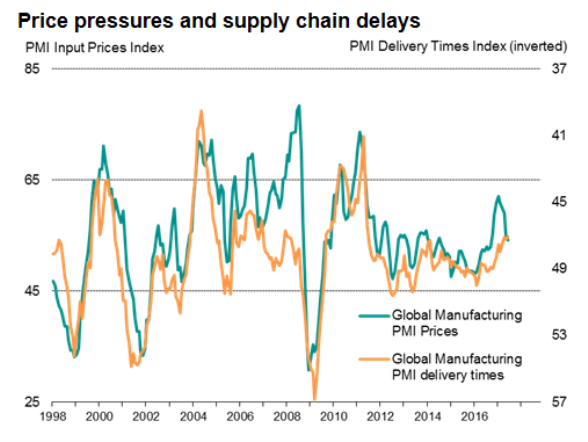

Cooling price pressures

Manufacturing input cost inflation meanwhile eased for a fifth straight month from January's five-and-a-half year peak, mainly reflecting lower global commodity prices (notably oil). Output price inflation picked up slightly as many firms sought to rebuild profit margins, though the rate of increase was up only marginally on May's eight-month low.

While supplier lead times continued to lengthen, suggesting many firms are enjoying an increase in pricing power as demand exceeded supply, delivery delays remained relatively moderate on the whole and indicative of only modest inflationary pressures.

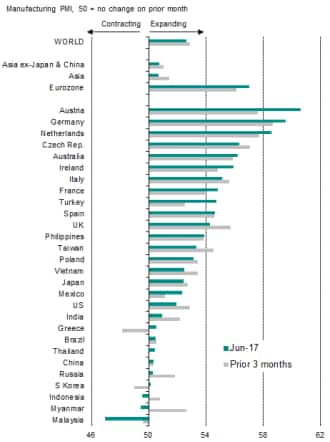

European countries still dominate

European countries continued to dominate the manufacturing PMI rankings in June, led by Austria and Germany. All of the top 11 fastest growing manufacturing economies were located in Europe, with the exceptions of neighbouring Turkey (albeit part-European) and Australia.

In contrast, Asia nations generally struggled. Six of the bottom seven countries in the global ranking were all Asian, including China.

Only three countries (Malaysia, Myanmar and Indonesia) reported a deterioration in business conditions during June, but some 14 of the 27 countries surveyed saw the PMI lose momentum in June compared to the average reading seen over the prior three months, including the US, Japan and the UK. The Eurozone as a whole meanwhile saw a marked upturn in growth momentum.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-global-price-pressures-wane-as-manufacturing-growth-shows-signs-of-cooling.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-global-price-pressures-wane-as-manufacturing-growth-shows-signs-of-cooling.html&text=Global+price+pressures+wane+as+manufacturing+growth+shows+signs+of+cooling","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-global-price-pressures-wane-as-manufacturing-growth-shows-signs-of-cooling.html","enabled":true},{"name":"email","url":"?subject=Global price pressures wane as manufacturing growth shows signs of cooling&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-global-price-pressures-wane-as-manufacturing-growth-shows-signs-of-cooling.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+price+pressures+wane+as+manufacturing+growth+shows+signs+of+cooling http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072017-economics-global-price-pressures-wane-as-manufacturing-growth-shows-signs-of-cooling.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}