Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 03, 2015

UK PMI surveys point to post-election economic rebound

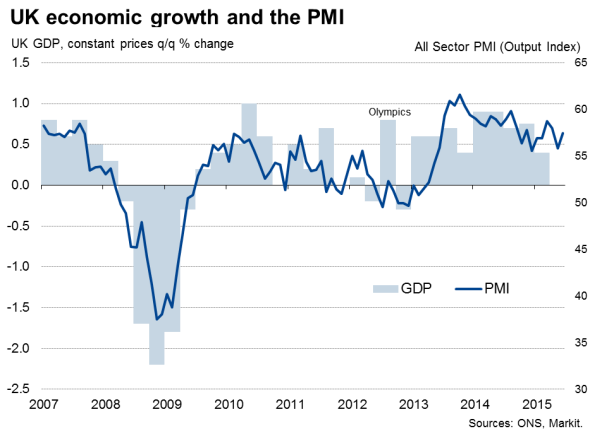

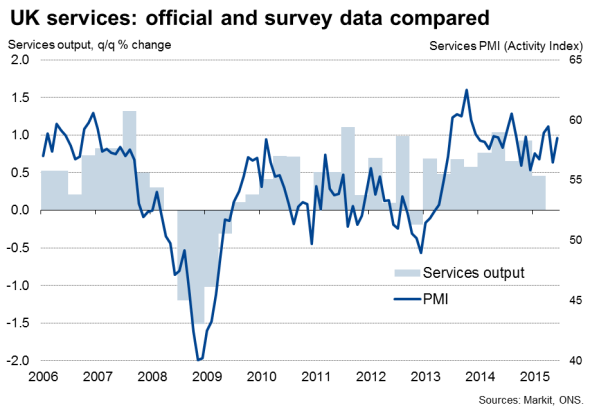

The UK PMI surveys indicate that the pace of economic growth rebounded in June, recovering from what appears to have been a brief lull caused by the general election. Slower growth in a manufacturing sector that continues to be hurt by the strength of sterling was offset by faster rates of expansion in services and construction, suggesting GDP growth will accelerate from 0.4% in the first quarter of the year to 0.5% in the three months to June.

The buoyancy of the service sector PMI survey data in particular increases the possibility of interest rates rising later this year, especially when viewed alongside the recent upturn in wage growth to the highest since early-2009.

A rate hike isn't imminent, however, not least because policymakers will want to avoid adding further stress and uncertainty while the Greek debt crisis rolls on. The Bank of England will inevitably also need more time to be sure that pay growth will continue to build and that the economy can maintain robust momentum. In respect of the latter, the weakness of the manufacturing economy will be a major concern, especially as it's looking like the economy may undershoot the Bank's 2015 growth forecast.

Post-election rebound

The combined Output Index of the three Markit/CIPS PMI surveys rose from 55.8 in May to 57.4 in June, taking the second quarter average to 57.1, broadly consistent with a 0.5% quarterly rise in GDP. Although faster than the 0.4% expansion seen in the first quarter, it means growth will have to accelerate further in the second half of the year to meet official forecasts.

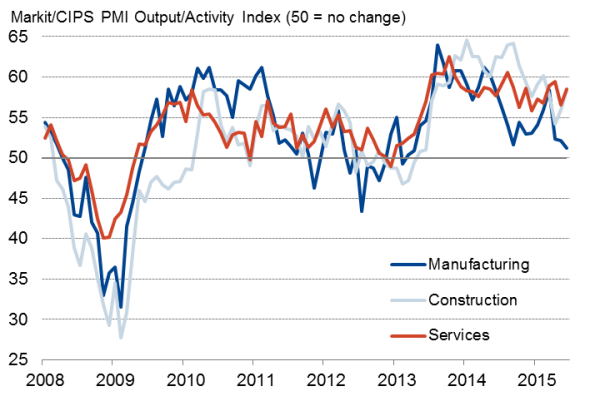

Business activity by sector

Both the Bank of England and Office for Budget Responsibility have forecast GDP to rise by 2.5% in 2015, a target which would require economic growth of close to 0.7% in each of the final two quarters (assuming 0.5% growth in the second quarter).

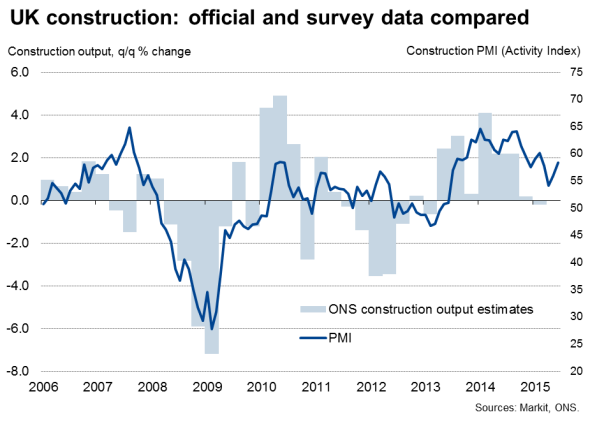

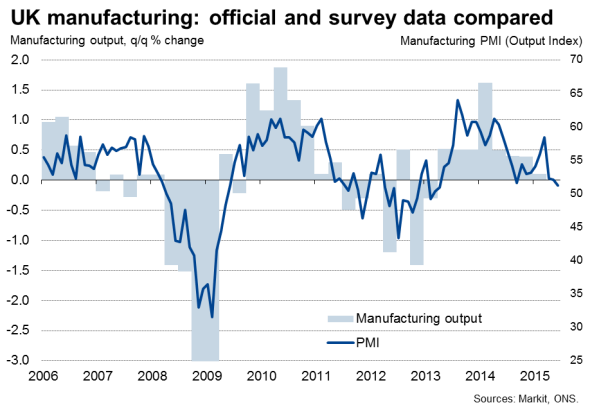

Manufacturing lags behind

Looking further into the details of the June PMI reports, growth accelerated in the service sector after having slumped to a five-month low in May, though remained below the rates seen in March and April. The rate of expansion meanwhile picked up in the construction sector for a second successive month, reaching the fastest since February. Increased service sector and, in particular, construction activity was in part related to a rebound after May's general election, which many companies reported having led to a temporary lull in demand and activity.

In contrast, June saw manufacturing output rise at the slowest pace since April 2013, attributable in part to a faster rate of decline in export orders, which was in turn commonly linked by companies to the pound's recent appreciation. Sterling has risen to its highest since 2008 on a trade-weighted basis.

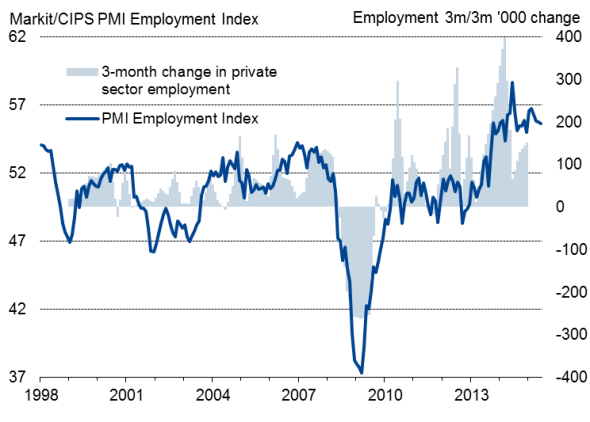

Robust job creation

The rate of job creation failed to pick up from May's five-month low but employment nevertheless continued to rise at a robust pace, reflecting buoyant business optimism about the need to boost capacity to meet future demand. The three surveys are consistent with employment rising by 200,000 in the second quarter. Marked job gains in services and construction contrasted, however, with only a modest rise in factory employment.

Employment

Prices rise

On the price front, input costs showed the largest monthly rise since last September, driven higher largely by rising oil prices - up just over one-third on average in June compared to the low seen earlier in the year - as well as higher wage rates. However, average prices charged for goods and services rose only modestly, reflecting intense competition.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-economics-uk-pmi-surveys-point-to-post-election-economic-rebound.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-economics-uk-pmi-surveys-point-to-post-election-economic-rebound.html&text=UK+PMI+surveys+point+to+post-election+economic+rebound","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-economics-uk-pmi-surveys-point-to-post-election-economic-rebound.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys point to post-election economic rebound&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-economics-uk-pmi-surveys-point-to-post-election-economic-rebound.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+point+to+post-election+economic+rebound http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-economics-uk-pmi-surveys-point-to-post-election-economic-rebound.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}