Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2015

Hong Kong economy deteriorates as exports to China fall at fastest rate since 2008

Business conditions in Hong Kong deteriorated at an increased rate in May, linked to weaker demand from China. The worsening of conditions puts the economy on course for its weakest quarter for six years and raises the possibility of a renewed downturn.

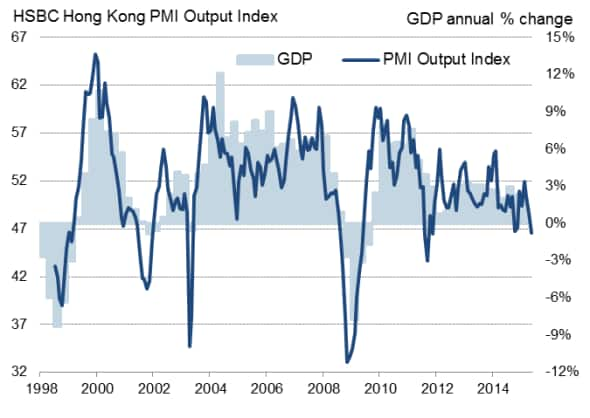

The HSBC PMI, which covers all private sectors of the economy, fell from 48.6 in April to 47.6 in May. The latest reading was the lowest since September 2011 and the second-weakest since the height of the global recession in mid-2009. The average PMI reading for the second quarter so far is the weakest since the second quarter of 2009 and broadly consistent with the economy stagnating in year-on-year terms.

Hong Kong PMI and economic growth

Sources: Markit, Census and Statistics Department.

The PMI exhibits an 83% correlation with the annual rate of change of GDP, with the PMI exhibiting a two-month lead. The annual rate of GDP growth slowed to 2.1% in the first quarter, down from 2.4% in the final quarter of 2014.

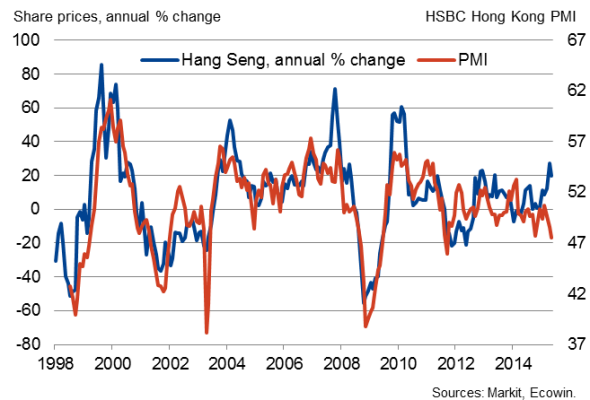

The Hong Kong government is forecasting growth of 1-3% this year, with the PMI suggesting that the lower end of this range looks the most likely. The deterioration in corporate health indicated by the survey also raises a warning flag over the recent rally in the Hong Kong stock market. The data suggest that the record highs hit by the Hang Seng Index in recent sessions may not be justified by current economic fundamentals, having pushed the price-earnings ratio up to 12.8% from just over 10% at the start of April.

Hong Kong PMI and share prices

Steep downturn in orders from China

Both the PMI survey's Output and New Orders Indexes fell in May, the declines being among the sharpest seen over the past six years. Key to the renewed weakness was a marked acceleration in the rate of contraction of new business from mainland China.

New work from China fell at the steepest rate since December 2008, down for a tenth successive month, reflecting slower economic growth on the mainland. China is set to record its weakest economic growth for a quarter of a century in 2015.

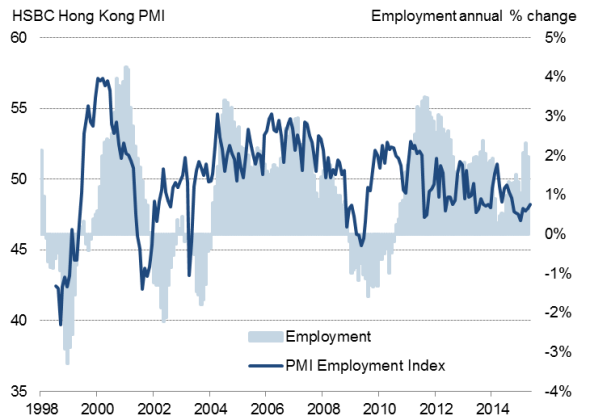

Hiring under pressure, while costs fall

Employment continued to fall as a result, albeit with the rate of job shedding easing slightly. However, with backlogs of work falling sharply for a second month in a row, falling workloads are likely to exert further downward pressure on payroll numbers in coming months.

Hong Kong PMI and employment

Input costs fell for a second successive month, marking the first back-to-back monthly falls since 2009, driven down primarily by lower energy costs. Average selling prices also fell, highlighting current weak inflationary pressures.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-hong-kong-economy-deteriorates-as-exports-to-china-fall-at-fastest-rate-since-2008.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-hong-kong-economy-deteriorates-as-exports-to-china-fall-at-fastest-rate-since-2008.html&text=Hong+Kong+economy+deteriorates+as+exports+to+China+fall+at+fastest+rate+since+2008","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-hong-kong-economy-deteriorates-as-exports-to-china-fall-at-fastest-rate-since-2008.html","enabled":true},{"name":"email","url":"?subject=Hong Kong economy deteriorates as exports to China fall at fastest rate since 2008&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-hong-kong-economy-deteriorates-as-exports-to-china-fall-at-fastest-rate-since-2008.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hong+Kong+economy+deteriorates+as+exports+to+China+fall+at+fastest+rate+since+2008 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-economics-hong-kong-economy-deteriorates-as-exports-to-china-fall-at-fastest-rate-since-2008.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}